“Trump has been reaching out to the crypto community, and it seems to have paid off,” said Dan Cassino, professor of Government and Politics at Fairleigh Dickinson and executive director of the poll, in a Friday press release. “It might be easy to dismiss them as insignificant, but I don’t think people realize exactly how widespread crypto ownership is.” Source

Day: August 30, 2024

Bitcoin Slides Below $58K as Market Plunge Wipes Out $178M

After lingering around the $59,000 mark, bitcoin’s value has faced downward pressure, dipping to an intraday low of $57,775 on Friday. Over the past 24 hours, bitcoin (BTC) has slipped by 4.6%, while ether (ETH) saw a 5.4% decline. Friday Crypto Slide: Bitcoin Falls, Ether Sinks, and Liquidations Jump The crypto market is in the […] Original

Bitcoin Price (BTC) Falls to $58.2K; Solana Tumbles 9%

Headlining the data next week will be the Friday Sept. 6 Nonfarm Payrolls Report for August. The July jobs report was a weak one and likely was the final straw forcing the Fed’s hand in promising a September rate cut. Currently, however, market expectations are for only a meek 25 basis point cut in mid-September. A second consecutive weak jobs print, though, might have investors quickly pricing in a 50 basis point move by the central bank, delivering a strong positive jolt to risk markets, bitcoin among them. Original

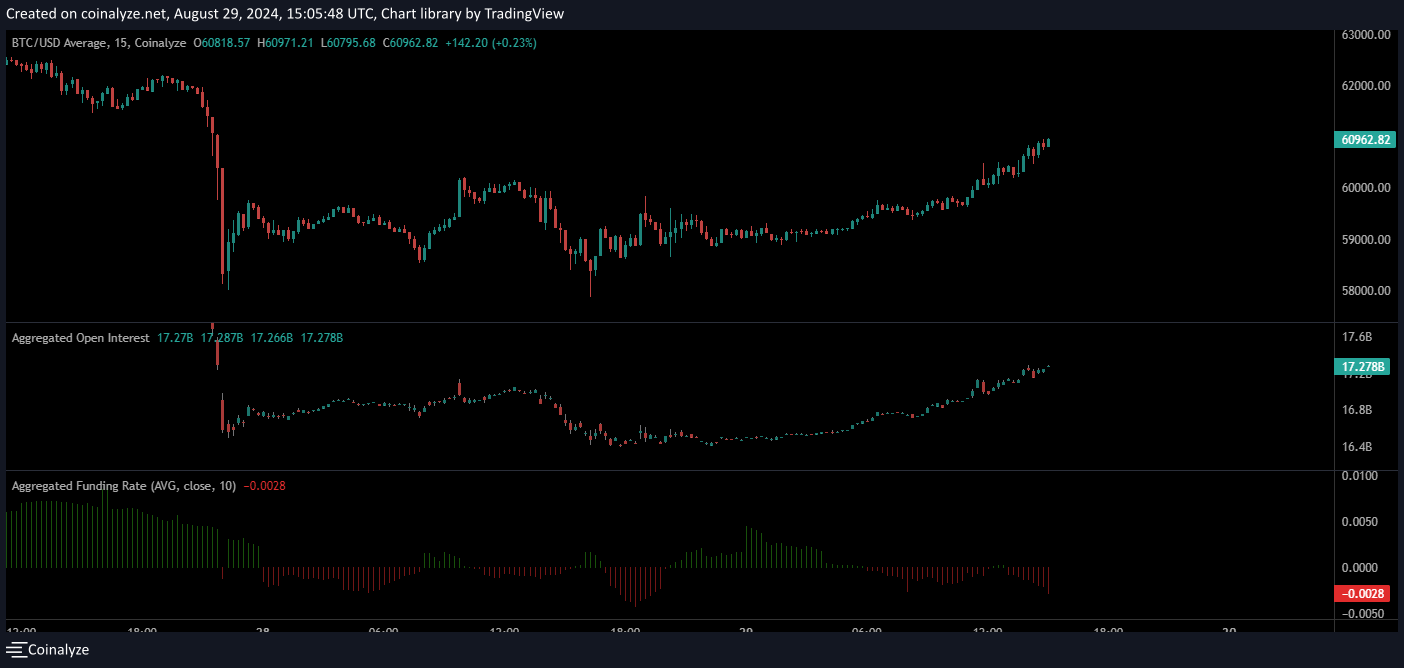

Will Shorts Be Rekt This Time?

Data shows the Bitcoin Open Interest on exchanges has been heading up while the Funding Rate has turned negative recently. Bitcoin Open Interest Trend Suggests Speculators Are Back As pointed out by CryptoQuant community manager Maartunn in a new post on X, things appear to be heating up on the derivatives side of the market. There are two indicators of relevance here: Open Interest and Funding Rate. Related Reading The first of these, the Open Interest, keeps track of the total amount of derivatives contracts related to Bitcoin, whether short…

Here’s why Bitcoin price dropped in August

Bitcoin price is on track for a monthly decline even as major stock indices like the Dow Jones, Nasdaq 100, and Nifty 50 jumped to record highs. Bitcoin (BTC) dropped by almost 10% in August, while the Nasdaq 100 index rose by over 2% and gold peaked at an all-time high of $2,530. This performance occurred despite the US dollar index plunging to $100.1, down by over 6% from its highest point this year. Typically, Bitcoin performs better when the greenback is falling. Notably, it fell even as spot Bitcoin…

Pepecoin Investors See Massive Benefits In Adding Their Rival To Their Portfolio

The world of meme coins is buzzing with excitement, and Pepecoin (PEPE) continues to capture the attention of investors. Recently, Pepecoin (PEPE) experienced a remarkable surge, with its value increasing by more than 10% in just a week. As the broader meme coin market flourishes, Pepecoin (PEPE) investors are diversifying their portfolios to capitalize on emerging opportunities. One token that has caught their eye is Mpeppe (MPEPE), a rising star in the meme coin space that promises significant potential for explosive growth. Pepecoin (PEPE) has shown incredible momentum over the…

A New Era for Decentralized Gambling?

The cryptocurrency world is no stranger to dramatic trends, but the recent surge of interest in Mpeppe (MPEPE) has truly captivated the market, particularly among investors in Fetch AI (FET). As decentralized gambling gains traction, Mpeppe (MPEPE) is emerging as a potential game-changer, promising returns that are hard to ignore. Meanwhile, FET and other AI tokens are experiencing a remarkable performance, outperforming the broader crypto market. This convergence of trends is creating a new wave of excitement and speculation among investors. The AI Token Rally: FET Leads the Charge Fetch…

FET Holder Influx Boosts Mpeppe: Is This a Bullish Signal for the Future of Blockchain and AI?

Recently, the Mpeppe (MPEPE) token has caught the attention of Fetch AI (FET) holders, sparking a wave of interest that could be a bullish signal for both blockchain technology and artificial intelligence (AI) in the decentralized finance (DeFi) space. But what does this influx of Fetch AI (FET) holders into Mpeppe mean for the future of these technologies? The Current State of Fetch AI: A Downturn with Potential Fetch AI (FET) has been a significant player in the AI-driven cryptocurrency market, known for its innovative approach to integrating AI and…

Ethena’s USDE Sees Market Cap Shrink by $770M in Less Than 2 Months

Based on the latest data, Ethena’s yield-generating stablecoin, USDE, has experienced a dramatic contraction in supply since July 4, 2024. Over the span of less than two months, its market capitalization has decreased by $770 million. Ethena’s USDE Supply Plummets as Competition Heats Up From Aug. 23 to Aug. 30, the stablecoin economy expanded from […] Source CryptoX Portal

History and evolution of Bitcoin ATMs

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Bitcoin ATMs mark a key moment in digital finance history, reflecting on their evolution and future potential. Bitcoin ATMS are landmarks for the digital writing and public view of a standout amongst the most extraordinary worldwide fiscal designs in sitting memory. A brief background on the historical evolution of Bitcoin ATMs can be helpful in better assessing where we are today and what possibilities lay ahead. This article explores…