Two meme coins, Playdoge (PLAY) and Mpeppe (MPEPE), have captured significant attention, each with its own unique appeal and potential to become the next Dogecoin (DOGE). With the Playdoge (PLAY) presale nearing its end and Mpeppe’s rise in the decentralized gambling space, the question on every investor’s mind is: which of these meme coins will be the next to explode? Playdoge: The Nostalgic Tamagotchi Meets Doge Playdoge (PLAY) has taken the concept of nostalgia to a new level by combining the beloved Tamagotchi game with the iconic Doge meme. The…

Day: August 30, 2024

Mpeppe’s 100x Potential Gains Traction From Playdoge Investors

In recent times certain crypto projects stand out not just for their innovative concepts but for the fervent community that rallies behind them. This year, two names have risen to prominence, catching the eye of seasoned investors and crypto enthusiasts alike: Mpeppe (MPEPE) and Playdoge (PLAY). Both projects are riding the wave of meme coin popularity, but what happens when these two forces converge? The result could be nothing short of explosive. The Rise of Mpeppe: A New Player in the Crypto Arena Mpeppe (MPEPE), a relatively new entrant in…

Injective Down 16% Despite Ongoing Developments

With the market resuming its bearishness today, August 30th, Injective continues to slip and slide. According to CoinGecko, INJ took a nose dive by 16% which slashed any hopes of a short-term recovery. Related Reading Although the token’s performance leaves much to be desired, developments on-chain continue to unfold, cementing Injective’s position within the community. Several developments hold the bay against the bears, but the question of when will INJ and the market recover remains. Injective Announces Release Of Web-Based IDE: Remix Web In a recent X post, Injective announced…

Bridge Fundraising for Stablecoin-Based Payments Network Totals $58M: Report

Bridge, founded by Square and Coinbase alumni, recently raised $40 million in a round led by Sequoia and Ribbit. Source

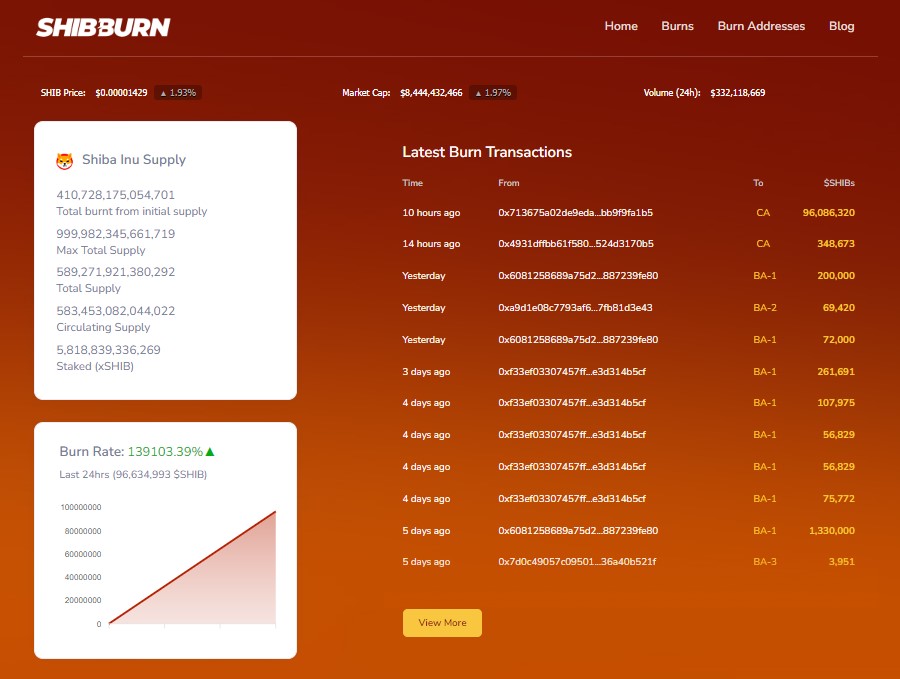

Shiba Inu Burn Rate Skyrockets 13,900% as SHIB Price Eyes Rebound

CoinspeakerShiba Inu Burn Rate Skyrockets 13,900% as SHIB Price Eyes Rebound Shiba Inu (SHIB) has seen a huge spike in its burn rate, suggesting a possible price rebound. According to the Shibburn tracker, the platform that monitors the rate and amount of SHIB burnt, the burn rate has spiked by more than 13,900% in the last 24 hours. As a result, 96,634,993 SHIB tokens have been sent to dead wallets. This notably aligns with the community’s effort to reduce the token’s circulating supply. New Burn Mechanism Facilitate SHIB Burn This…

Washington State Probes Alleged Crypto Fraud Linked to Fake Nasdaq Exchange

The financial watchdog in Washington State is currently probing a complaint regarding a cryptocurrency platform that allegedly purports to be associated with the Nasdaq Stock Exchange. This inquiry began after an investor reportedly put in $200,000 following a solicitation on Facebook that transitioned to communication over Whatsapp. The regulator has flagged this as a potential […] Source

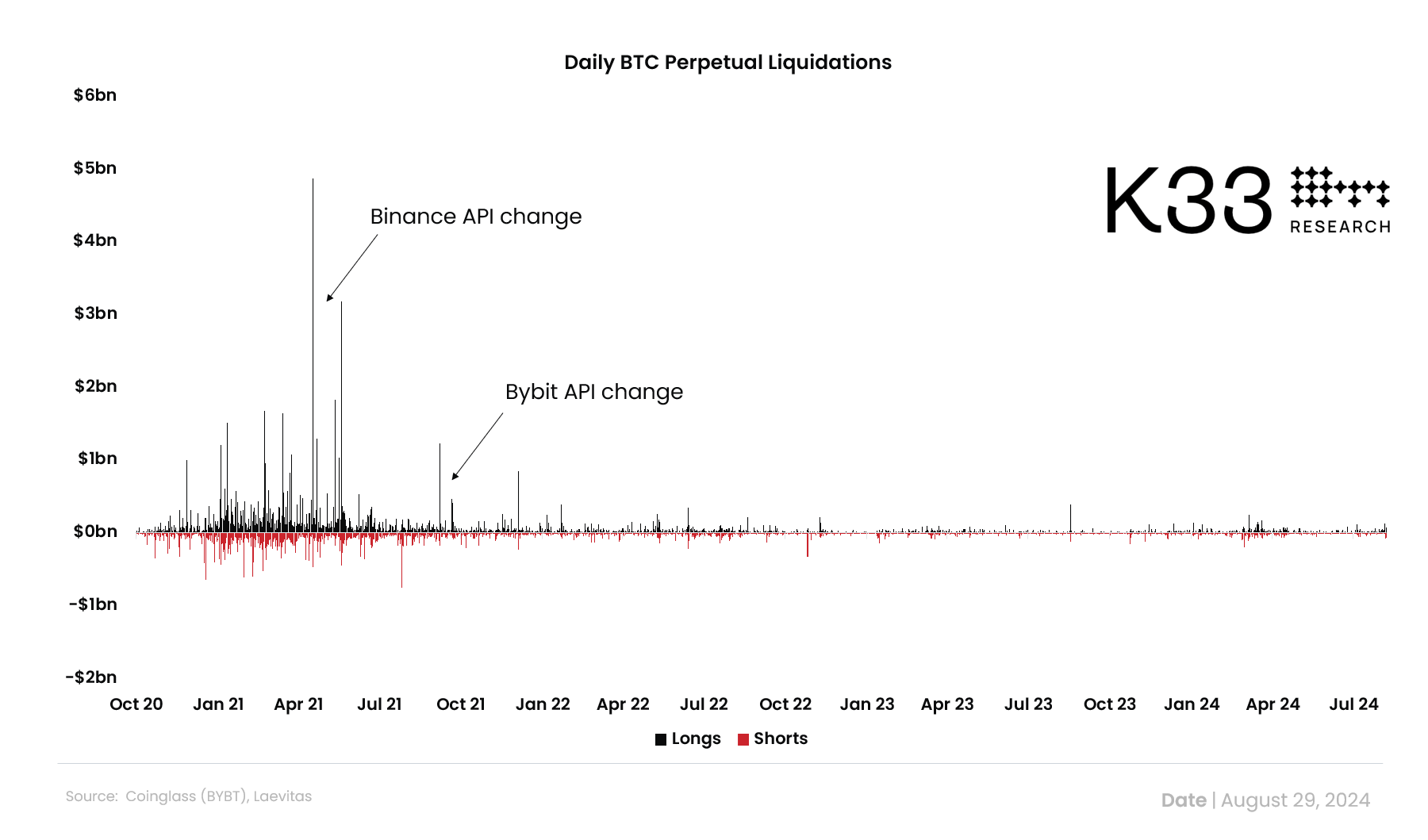

Crypto Liquidation Data Rigged By Exchanges, Researcher Finds

Vetle Lunde, a senior analyst at K33 Research, has issued a stark warning regarding the practices of prominent crypto exchanges concerning the authenticity of liquidation data. In a post on X, Lunde outlines how exchanges such as Binance, Bybit, and OKX have systematically modified their data reporting processes in a way that he claims significantly distorts the true scale of market liquidations. Why Crypto Liquidation Data Is Bogus The core of Lunde’s argument revolves around changes implemented by these exchanges around mid-2021. For example, both Binance and Bybit adjusted their…

Elon Musk, Tesla Win Dismissal of Lawsuit Alleging Dogecoin Market Manipulation

In 2022, a group of investors alleged that Elon Musk and his company had manipulated the price of dogecoin using their X (then Twitter) accounts. Source

Fidelity’s FBTC lead $71.73m Bitcoin ETF outflows, Ether ETFs also slide

Spot Bitcoin exchange-traded funds in the United States experienced their third consecutive day of net outflows, while spot Ethereum ETFs also saw a return to negative flows. According to data from SoSoValue, the 12 spot bitcoin exchange-traded funds recorded $71.73 million in net outflows on Aug. 29, marking the third consecutive day of outflows. FIdelity’s FBTC led the lot, logging $31.1 million in outflows on the day — its highest recorded outflows since Aug. 6. Grayscale’s GBTC continued its outflow streak, with $22.7 million leaving the fund, pushing its total…

Traders Position for Volatility as BTC ETFs See Outflows

“Risk reversals until Oct are still skewed towards puts in both BTC and ETH, indicating that the market remains cautious about the downside,” QCP said. “In the lead-up to next week’s non-farm payroll report, we expect market volatility to continue its downtrend as the market positions itself for potential rate cuts by the Fed.” Source