On September 2, 2024, ethereum was priced at $2,517, with a 24-hour intraday range of $2,407 to $2,531. Over the past week, its price fluctuated between $2,409 and $2,740, reflecting ongoing volatility. With a 24-hour trading volume of $14 billion and a market capitalization of $302.85 billion, ether’s market dynamics remain under pressure as it […] Source CryptoX Portal

Day: September 2, 2024

Bitcoin’s August Slump: Dormant Wallets Stirred, But Vintage BTC Spending Slowed

Bitcoin faced a challenging August, with its price dipping by 8.6%. Data shows that although 84 previously inactive bitcoin wallets became active last month, the total amount of vintage BTC spent was lower in August than in July. Specifically, dormant wallets spent around 2,291 BTC from addresses that hadn’t been touched between 2011 and 2017. […] Original

Beware of a bitcoin backslide to $50,000 as it enters worst month

Bitcoin’s poor trading action could go on for another month as traders wait for a sense of direction to emerge about U.S. interest rate cuts and the looming presidential election. August was a tough month for the leading cryptocurrency. Bitcoin slid 10.25% for its worst month since April, while ether dropped 23.66% in its third monthly drawdown and worst month since June 2022. The discrepancy supports the feeling in the market that although bitcoin has had isolated success thanks to ETFs in 2024, the rest of crypto has not followed…

Bitcoin At Risk Of Continued Selling Pressure Amid Market Volatility, Here’s Why

Este artículo también está disponible en español. As September, often seen as a negative month for Bitcoin, kicks off, a crypto expert has pointed out that the digital asset is at risk of experiencing extended selling pressure amid recent market volatility and uncertainty. Recent data suggests that negative sentiment is growing, as more investors may want to sell their BTC in response to the turbulent market conditions. Will Bitcoin Undergo An Extended Selling Pressure? In a pessimistic research, Ali Martinez, a popular market analyst and trader, underscored a trend of…

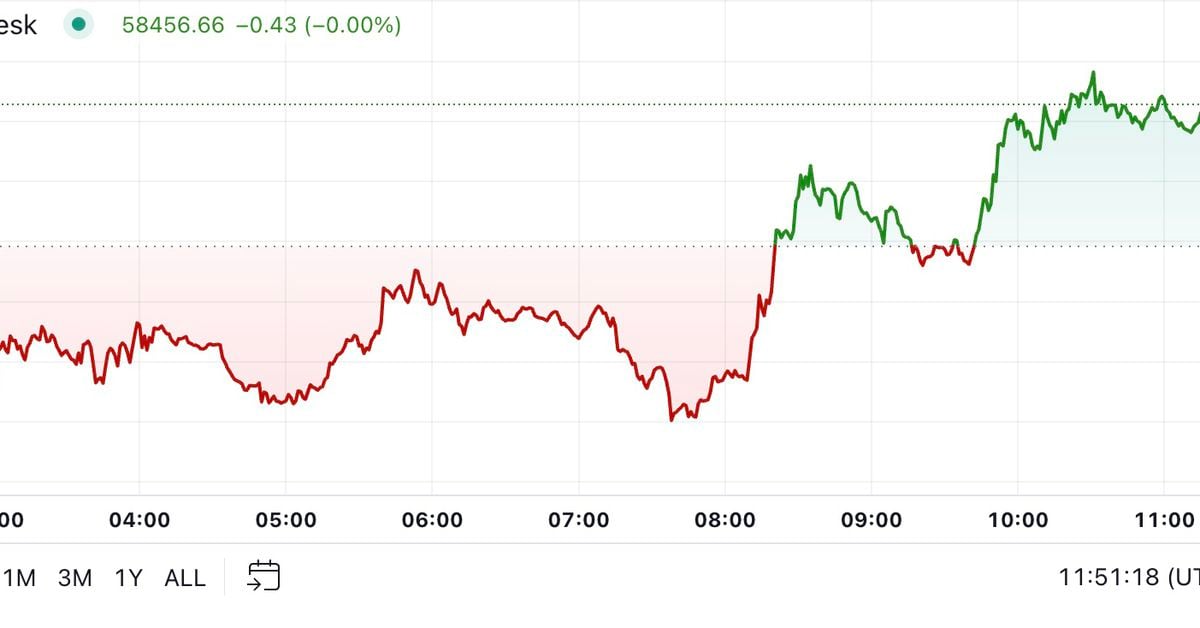

Bitcoin Sits Around $58.5K at Start of Historically Bearish September

Bitcoin fluctuated around the $58,000 mark amid a generally sedate market on Labor Day in the U.S. The largest cryptocurrency was trading around $58,600 at the time of writing, about 1% higher in 24 hours. The broader digital asset market has risen 0.9%%, according to CoinDesk Indices data, with ETH and SOL gaining around 1.9% and 0.5%, respectively. U.S.-listed exchange-traded funds (ETFs) tracking BTC posted total net outflows of $175 million on Friday, extending a losing streak to four days. Ether ETFs had zero net inflows or outflows despite $173…

Bitcoin Technical Analysis: BTC Fails to Break Key Resistance Levels

On September 2, 2024, at 7:30 a.m. EDT, bitcoin’s price stood at $58,388, fluctuating within an intraday range of $57,257 to $58,698. With a trading volume of $29.57 billion and a market capitalization of $1.15 trillion, the leading crypto asset demonstrated significant volatility. Technical indicators reveal persistent downward momentum, suggesting that traders should remain cautious […] Original

Bilateral Settlement Between China and Russia Worsens Due to New Sanctions

The payment flow between China and Russia is being disrupted once again due to the enactment of a new package of sanctions that includes 46 Chinese companies allegedly assisting the Russian war effort. This has affected imports of dual-use products, which can be used for both military and civilian purposes, as well as other merchandise. […] Source CryptoX Portal

Key Week for Bitcoin (BTC) and the Dollar Index (DXY)

That said, July’s weaker-than-expected ISM PMI, released Aug. 1, triggered recession fears, weighing on risk assets even as the dollar dropped. BTC fell 3.7% to $62,300 that day. Traders, therefore, should watch out for a “growth scare” should the PMI come in worse than expected. Source

Lone Survivor: Helium (HNT) Soars 18% As Most Cryptos Collapse

September started weak for the broader crypto market as it burned down 3% in favor of the bears. Despite this, Helium (HNT) continues to shrug off the fear, uncertainty, and doubt that plague the market environment. According to CoinGecko, HNT went against the market consensus, rising over 16% since last week — and outperforming the top 100 cryptocurrencies on Monday. The Helium ecosystem boasts astonishing gains as it experiences continued and strong on-chain developments, several of which contributed to HNT’s short-term squeeze. The question is whether the token will continue…

Brevan Howard-Backed Real-World Asset (RWA) Tokenization Firm Libre Arrives on NEAR Blockchain

Libre, a startup focused on tokenizing financial assets in partnership with Nomura’s Laser Digital, Brevan Howard’s WebN group and private markets giant Hamilton Lane, is adding several digitized funds to the NEAR blockchain, enabling tokenized real-world assets (RWA) to be transferred across multiple blockchains. Source