Though the Trump family appears deeply involved in World Liberty Financial and Donald Trump will be officially unveiling it on Monday evening, the project’s white paper claims that the platform has no political affiliation, stating: “World Liberty Financial is not owned, managed, operated, or sold by Donald J. Trump, the Trump Organization, or any of their respective family members, affiliates, or principals.” Source

Day: September 16, 2024

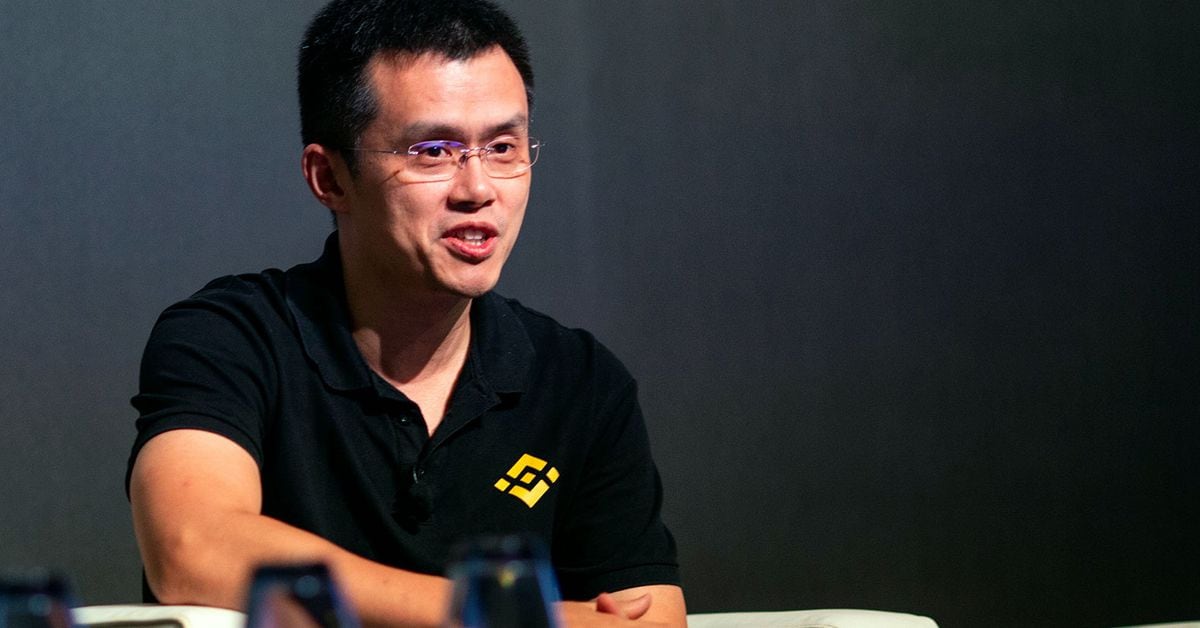

CZ Set to Be Released From Prison on September 29

Zhao was sentenced to four months in prison in April, five months after he pleaded guilty to violating the Bank Secrecy Act by failing to set up an adequate know-your-customer (KYC) program at Binance. As part of his guilty plea, Zhao also agreed to pay a $50 million fine and step down as CEO of the crypto exchange. Source

DeFi protocol Euler Finance announces launch of new stablecoin Maxi

Decentralized finance lending platform Euler Finance has introduced a new hybrid token called Maxi. Euler Labs, the team behind the decentralized finance lending protocol on Ethereum (ETH), announced the development on Sept. 16. Maxi, as the platform explained in a post on X, is a bespoke lending product designed to offer its users greater capital efficiency. A stablecoin backed with range of assets Maxi is a stablecoin whose key features include a blend of assets and cross-collateralization for both capital efficiency and risk mitigation, Euler Finance posted. In terms of…

Bhutan’s Bitcoin mining stash exceeds $750m: Arkham

Bhutan, a country with a population of under one million, ranks as the world’s fourth-largest sovereign Bitcoin owner. According to Arkham, the Kingdom of Bhutan holds over 13,000 Bitcoin (BTC) tokens valued at over $750 million as of Sept. 16. Only the U.S., China, and the U.K. have larger BTC holdings. Bhutan overtook El Salvador to claim fourth place and joined world governments that cumulatively control over 2.2% of BTC’s total supply, per CoinGecko. BREAKING: BHUTAN GOVERNMENT’S $750M BTC NOW ON ARKHAM Bhutan’s Bitcoin holdings are now labeled on Arkham.…

Avalanche Revenue Down Over 40% In Q2

Este artículo también está disponible en español. Avalanche (AVAX) has had a terrible Q2 2024 by several standards, going by a significant decline in market capitalization coupled with low revenue generation. Related Reading Messari’s recent report indicated that AVAX faced a fierce correction after two quarters of growth on the trot. Market capitalization dipped by 40% within the last quarter to stand at $11.6 billion. Well, despite this slump, the ecosystem is still sound as AVAX still has a market cap of $4.5 billion — that’s a 157% surge compared…

How to potentially earn $10,000 with CryptocoinMiner

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. CrytocoinMiner’s user-friendly platform has attracted over 3.7M global members for easy mining access. Freelancing pays more than your main job? I’m going to reveal some of them here. So, who are these people? Stick around because this article will reveal the two recommendations from people with different careers. The first is Charlotte, who specializes in photovoltaic panel installation. Five years ago, he was still working part-time, although he also…

Analyst Details 10 Reasons That Could Lead To Massive Q4 Gains

Este artículo también está disponible en español. As the crypto market grapples with significant volatility and uncertainty, expert analyst Miles Deutscher has outlined ten reasons to be optimistic about the year’s fourth quarter (Q4). With Q4 fast approaching, Deutscher emphasizes that a monumental market shift could catch many investors off guard. Trends And Factors That Could Impact The Crypto Market In a recent social media post, Deutscher broke down his analysis into seasonality, macroeconomic factors, and crypto-specific elements. Deutscher begins by discussing the concept of seasonality, noting that market movements…

Bitcoin Accumulation In Full Swing As $1.3 Billion Exits Exchanges, $75,000 Next?

Este artículo también está disponible en español. Investors are once again accumulating Bitcoin (BTC) despite previous price declines. Reports indicate that approximately $1.3 billion worth of Bitcoin has been withdrawn from various crypto exchanges, signaling a renewed interest and confidence in the leading cryptocurrency. Bitcoin Accumulation Frenzy Resumes Data from IntoTheBlock has revealed a new accumulation trend amongst Bitcoin investors. According to the financial service platform, roughly $1.29 billion worth of BTC has exited various Centralized Exchanges (CEXs) in the last week. Related Reading This development signals a shift in…

Is EigenLayer Ready For Institutional Adoption?

Firstly, the majority of institutions hold their assets with a qualified custodian or trusted institutionally-focused wallet provider. However the primary delegation flow for restaking with EigenLayer is via their user interface and requires a connection to DeFi wallets such as Metamask, Trust or Rainbow. Institutions therefore require their custodian or wallet provider to build the necessary integrations into the Eigenlayer ecosystem in such a way that their institution’s staking provider of choice, such as Twinstake, can also be integrated in the flow. However to date, most institutionally focussed custodians have…

Nervos Network (CKB) Price Prediction 2024, 2025 & 2026, CKB Whales Add Mpeppe To Crypto Bags

Este artículo también está disponible en español. Nervos Network (CKB) has caught the attention of the broader crypto community, with its price soaring by 55% in the last 24 hours. This bullish sentiment, driven by strong market fundamentals and increased interest from institutional investors, suggests that Nervos Network (CKB) could be poised for even more significant gains in the coming years. In this article, we will dive into Nervos Network (CKB)’s price prediction for 2024, 2025, and 2026, and explore why CKB whales are adding Mpeppe (MPEPE) to their portfolios.…