Este artículo también está disponible en español. SUI showed a remarkable performance on Friday amid the market retrace. Following Bitcoin’s drop to the $55,000 mark, the cryptocurrency was among the few tokens showing green numbers with an 8% surge. The token’s performance, alongside the network’s developments, has fueled a bullish sentiment among investors. However, some analysts remain cautious of the cryptocurrency, warning that the joy could be short-lived. Related Reading SUI Surges As Top 100’s Largest Daily Gainer SUI was among the best performers throughout August, registering 50% surges amid…

Month: September 2024

Zambia’s Dedollarization Plan Aims to Strengthen Kwacha Stability

Zambia’s latest move to restrict foreign currency use in domestic transactions is aimed at stabilizing its currency, the kwacha, according to central bank Governor Denny Kalyalya. The Bank of Zambia announced this initiative in June and is still consulting market participants, with no set implementation date. Kalyalya highlighted that foreign currency use hinders effective monetary […] Source CryptoX Portal

Ethereum Enters Oversold Territory, Can The Pump Send It To $6,000?

Este artículo también está disponible en español. Recent developments show that Ethereum has entered oversold territory. This is undoubtedly a bullish development for the second-largest crypto by market cap, as it looks set for a price rally that could send it as high as $6,000. ETH Ready For Liftoff Having Entered Oversold Territory Crypto analyst Titan of Crypto suggested in an X (formerly Twitter) post that Ethereum is ready for liftoff, having entered oversold territory. He noted that historically, ETH sees a rally or a short-term pump whenever the relative…

Binance Kazakhstan Receives Formal Consent for Regulatory License

Binance Kazakhstan received formal consent from the Astana Financial Services Authority (AFSA) for a full regulatory license, marking a major step toward becoming Kazakhstan’s first fully regulated Digital Asset Trading Facility (DATF). The approval followed rigorous evaluations, including financial audits and ISO certifications. Once licensed, Binance will manage virtual assets, offer custody services, and conduct […] Source CryptoX Portal

Massive Rally Just Around the Corner?

Este artículo también está disponible en español. Solana (SOL) has been holding above the $120 mark since experiencing a significant 24% retrace from its local highs. As the crypto market faces growing fear and uncertainty, Solana has remained one of the strongest performers this cycle, attracting attention from analysts and investors looking for opportunities. This current price zone is critical, as it will likely determine the asset’s next big move. Related Reading Traders are closely monitoring whether SOL can maintain support around $120, as holding this level could set the…

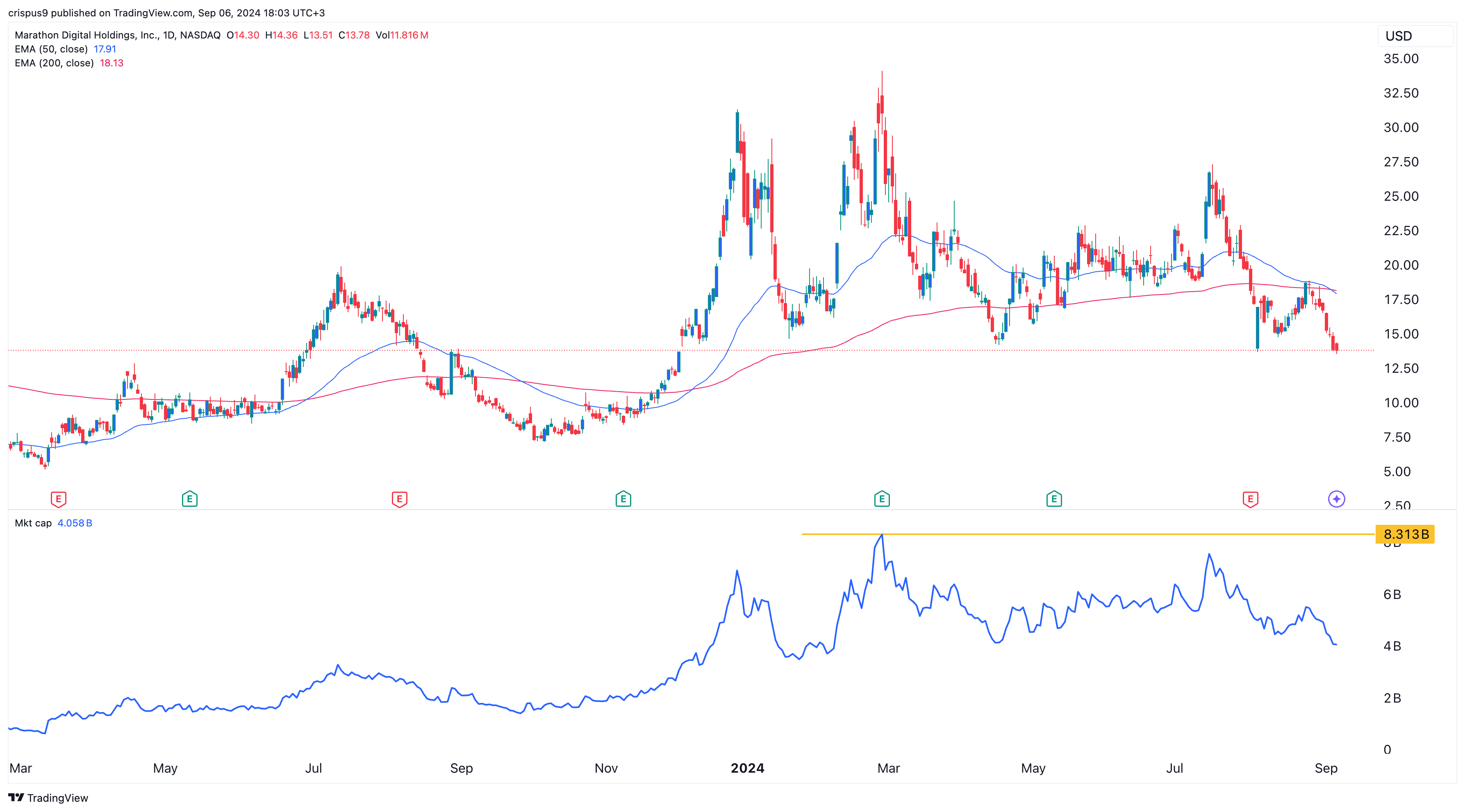

CleanSpark and MARA stocks form rare pattern as BTC hits 54k

Popular Bitcoin mining stocks have formed the rare death cross pattern, pointing to more pain ahead. CleanSpark and Marathon Digital have formed a death cross Marathon Digital, the largest mining company in the industry, dropped to $13.75 on Sep. 6, its lowest swing since December of last year. It has fallen by 60% from its highest point this year, erasing over $4 billion in value. Similarly, CleanSpark shares crashed to $8.39, the lowest point since February, and are 66% below their highest level this year. Its market cap dropped from…

Vaneck Reveals Plans to Close Ethereum Futures ETF

On Sept. 6, Vaneck announced its decision to close and liquidate the Vaneck Ethereum Strategy exchange-traded fund (EFUT). The liquidation comes after evaluating key factors, including performance and investor interest. The firm noted that shareholders will have until September 16, 2024, to sell their shares before delisting. Vaneck to Wind Down Ethereum Futures ETF According […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Bitcoin 200-Day Average Signals Waning Bullish Momentum, Here’s What It Means For BTC Price

Este artículo también está disponible en español. A key long-term price indicator for Bitcoin, the 200-day simple moving average (SMA) appears to be losing its bullish momentum as the US economy added fewer jobs in August 2024. Bitcoin Must Overcome The 200-Day SMA To Reverse Trend The 200-day SMA is considered one of the more reliable long-term indicators to gauge an asset’s upcoming price action. Bitcoin’s 200-day SMA shows a weakening bullish momentum, giving short-term traders little joy. Related Reading Notably, this is the first time since October 2023 that…

Kalshi Cleared to Offer Congressional Prediction Markets in Victory Against CFTC

“For the reasons stated in the Court’s forthcoming memorandum opinion, the Court GRANTS Plaintiff’s motion for summary judgment … and DENIES Defendant’s cross motion for summary judgment,” Cobb wrote. “Defendant’s September 22, 2023 order prohibiting Plaintiff from listing its congressional control contracts for trading is hereby VACATED.” Source

Russia to Prioritize Supplying Energy for Social Development Over Bitcoin Mining

Russia will prioritize using its energy for social development instead of Bitcoin mining, according to the Ministry of Energy. Energy Minister Sergei Tsivilev stressed that if there is a surplus in certain areas, this power can be supplied to legal and registered energy miners operating outside the “gray” zone. Russia Will Not Prioritize Supplying Energy […] Original