Cryptocurrencies, stocks, and other risky assets received another catalyst on Friday, Sept. 27, after the U.S. government published encouraging inflation data. US PCE inflation dropped in August Bitcoin (BTC) held steady above $65,000 while altcoins like Wormhole (W), Floki (FLOKI), Pepe (PEPE), and Shiba Inu (SHIB) jumped by over 15%. Futures tied to the Dow Jones, S&P 500, and Nasdaq 100 rose by over 25 basis points. Data from the statistics agency showed that personal consumption expenditure dropped from 0.2% in July to 0.1% in August, lower than the expected…

Month: September 2024

Bitcoin Price (BTC) Rose 0.9% While Ether Price (ETH) Gained 0.2%

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Bitcoin Prices Show Positive 30-Day Correlation With China's Central Bank Balance Sheet

“The new inflow of cash could indirectly push up the price of bitcoin, particularly in the long term perspective,” one analyst said. Original

MicroStrategy’s Bitcoin Bet Pays Off In Multiple Ways As Stock Surges 317%

Este artículo también está disponible en español. MicroStrategy was shot into the limelight when it began publicly buying Bitcoin back in 2020. While it is not the only publicly listed company to do this, the company’s aggressive Bitcoin strategy set it apart from the rest. Four years later, MicroStrategy is now the public company with the largest BTC holdings in the world, recording over $5 billion in profit so far. However, the profit on the BTC holdings is not the only positive that has come from the company’s Bitcoin investment…

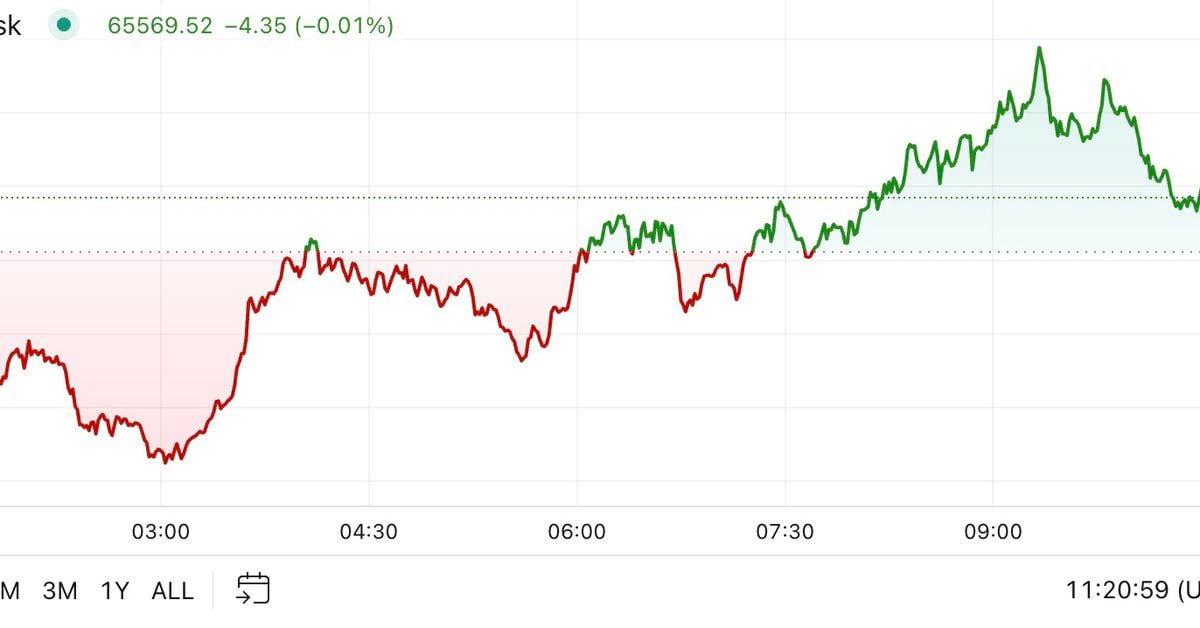

First Mover Americas: Bitcoin Nears $66K After Monster ETF Day

The latest price moves in bitcoin (BTC) and crypto markets in context for Sept. 27, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Original

Render (RENDER) Shows 23% Surge As Sharks & Whales Continue To Buy

Render has shown a sharp jump of more than 23% during the last week as on-chain data shows the large hands have continued to buy. Render Has Enjoyed Bullish Momentum Over The Past Week The cryptocurrency sector as a whole has witnessed an uplift recently, but Render has been among the altcoins that have really stood out from the rest. Whereas Bitcoin (BTC) and Ethereum (ETH) have only seen weekly profits of around 3% and 9%, respectively, RENDER has shown an impressive 23% jump. The below chart shows how the…

A memecoin frenzy is coming to BNB Chain, and FLOKI tokens are at the centre of it

With the bonding curve model, anyone can deploy a memecoin or a launchpad that supports this model for next to nothing (e.g., anyone can create a memecoin with GraFun with a few dollars or less), with zero developer experience and without having to make any form of commitment (liquidity, expensive token deployment costs, etc). Source

Analyst Sets $2,820 As ETH’s Next Key Level to Watch

Este artículo también está disponible en español. Following the market’s recent pump, the leading cryptocurrencies have seen a remarkable performance. Bitcoin is trading above the $64,000 mark, while Ethereum (ETH) has surged 9% in the last week to consolidate above a key support level. Despite the bullish sentiment, some crypto investors remain cautious about ETH’s performance as the second-largest cryptocurrency faces the next crucial resistance level. Related Reading Ethereum Consolidates Above $2,600 Ethereum recorded a 13% price jump in the last seven days after the US Federal Reserve (Fed) announced…

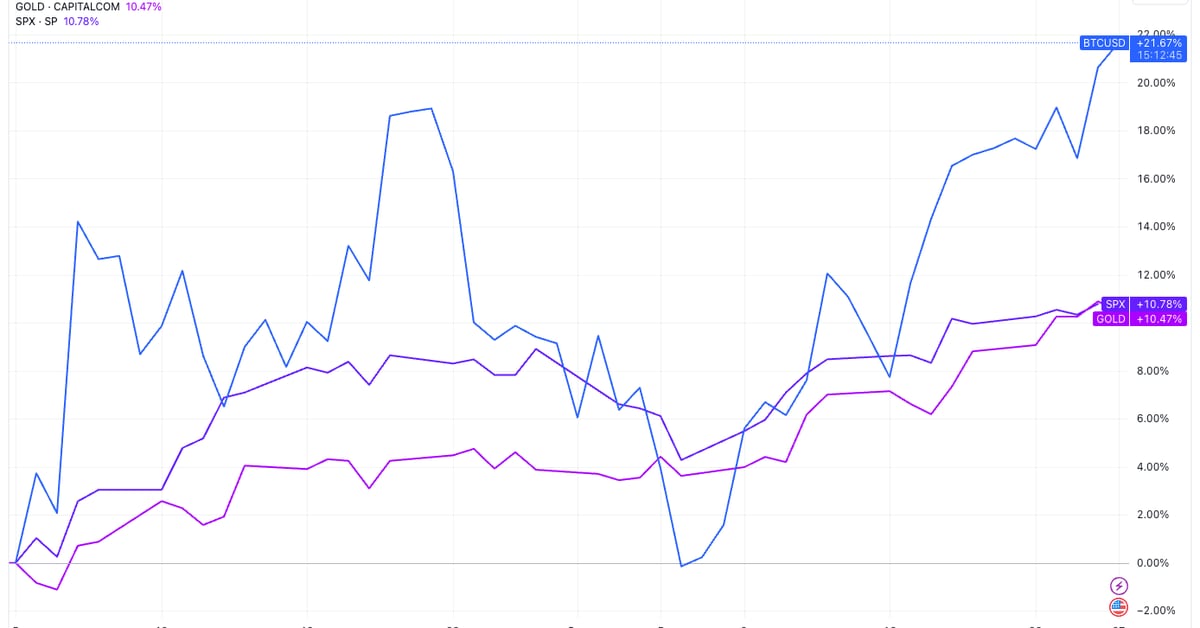

BlackRock Highlights Bitcoin’s Risk-Off Status in the Long Term

Second, bitcoin’s high volatility can be perceived as a “risky” asset, which contributes to the discussion that whether it is a “risk-on” or “risk-off” asset. The token could be considered a flight-to-safety option because it is scarce, non-sovereign, and decentralized. Lastly, BlackRock pointed out that the long-term adoption of bitcoin may come from global instability. Original

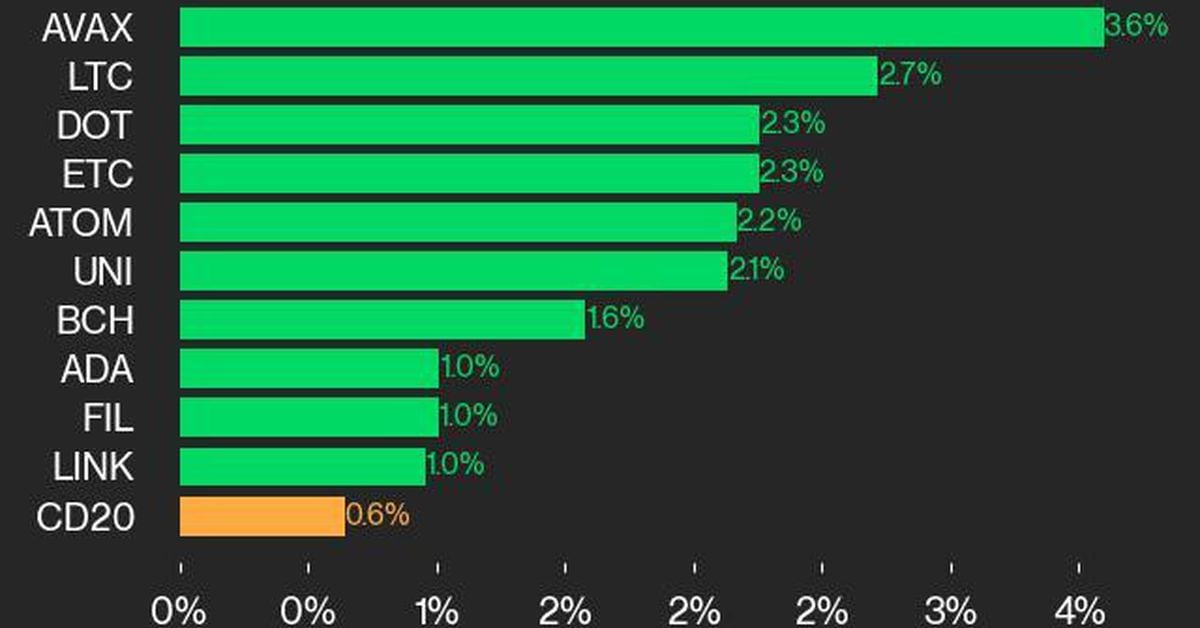

Bitcoin (BTC)’s ‘Outside Day’ Sets Stage for $70K Price, Altcoins Break Out: Technical Analysis

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…