Open Interest (OI) refers to the total number of outstanding derivative contracts not settled for an asset. An increase in OI and a price increase typically indicate that new money is coming into the market. On the other hand, if the price rises but OI falls, the rally might be driven by short covering rather than new buying, potentially signaling a weaker trend. Source

Day: October 1, 2024

Judge Sides With U.S. SEC in Case Alleging Defunct Mobile Wallet Platform Rivetz Sold Unregistered Securities

“The SEC shall confer with Sprague [Steven Sprague, CEO of Rivetz] and file a proposed judgment for injunctive and monetary relief on or before October 22, 2024,” Mastroianni said. “Sprague shall file any objections to the proposed judgment on or before November 5, 2024.” Source

Bitcoin (BTC) Retail Inflows Hold Steady as Whales Pile In at Start of Historically Bullish Month

In recent months, fewer than 40,000 wallets have been active each day on the two exchanges. That’s less even than during the bear market when the BTC was below $10,000 and active wallets numbered around 50,000 a day. The data is in line with other indicators such as popularity of the Coinbase mobile application and on-chain usage, as reported. Original

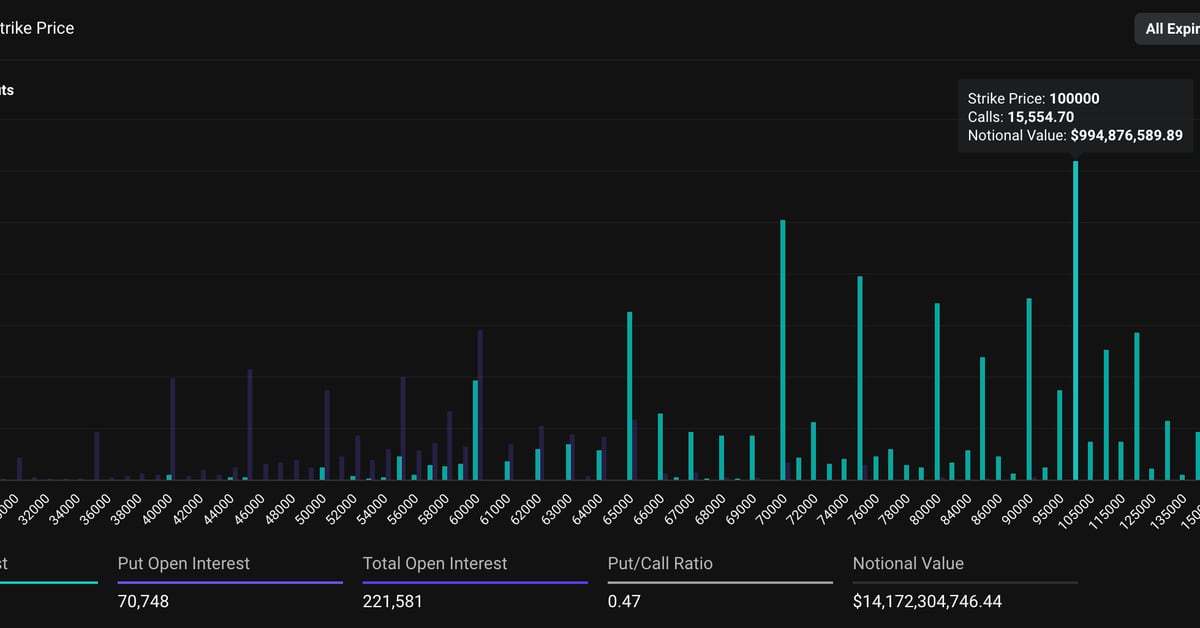

Bitcoin (BTC) $100K Call Option Draws Nearly $1B in Open Interest on Deribit

As of writing, the dollar value of the number of active call options contracts at the $100,000 strike price was over $993 million, the highest among all other BTC options listed on the exchange, according to data source Deribit Metrics. On Deribit, one options contract represents one BTC. Original

Metaplanet pushes Bitcoin holdings past 500 BTC with latest buy

Japan’s Metaplanet, the budget hotel operator turned investment firm, has added $6.94 million worth of Bitcoin to its growing holdings. According to its Oct. 1 disclosure, Metaplanet has purchased an additional 107.913 Bitcoin (BTC) for a total investment of ¥1 billion ($6.94 million), marking one of its biggest single purchases. This brings the company’s Bitcoin holdings to 506.745, with the stash currently valued at $32.45 million. Metplanet has invested 4.75 billion yen since announcing its adoption of Bitcoin as a reserve asset, picking up BTC at an average price of…

Dogecoin Leaps 20%, Co-Creator Says He Doesn’t Know Why

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn. Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer…

Japan’s new PM Shigeru Ishiba champions blockchain and NFT in policy document

Newly appointed Japanese Prime Minister Shigeru Ishiba aims to use blockchain technology and non-fungible tokens to revalue local assets like food and tourism on a global scale. Policy documents from Shigeru Ishiba’s office indicate that Japan‘s PM is pro-blockchain and in favor of developing web3 technology to boost the country’s regional economies. His vision resonates with those of various crypto industry groups that wish for more incorporation of NFTs and Decentralized Autonomous Organizations in augmenting rural economies to promote sustainability and innovation. “Using blockchain technology, NFTs, and more, we will…

Metaplanet Buys Another 107 Bitcoin, Pushing Stock-BTC Ratio to 20%

The firm now holds over 500 bitcoin after a first tranche of purchases in April. Original

Cryptocurrencies Continue to Outperform the Stock Market: Canaccord

If bitcoin follows historical patterns post halving a rally could start between now and April, the broker said. Source

Japan to Review Crypto Regulations, Potentially Easing Tax Burden

Japan is reportedly set to review its cryptocurrency regulations, potentially reducing taxes on digital assets. The Financial Services Agency (FSA) plans to assess whether current crypto regulations under the payments act provide sufficient investor protection. The review may lead to reclassifying crypto as financial instruments under Japan’s investment law, which could enhance safeguards and bring […] Source CryptoX Portal