Based on the latest data, U.S. spot bitcoin exchange-traded funds (ETFs) ended the day with net losses, while spot ethereum ETFs also experienced a decline. $18.66M Flows Out of Bitcoin ETFs as Ethereum Funds Also Falter On Tuesday, the 12 spot bitcoin ETFs saw $18.66 million flow out, with a trading volume hitting $1.35 billion. […] Original

Day: October 9, 2024

Whale Insider Tips Pepe, New Frog Meme Coin Pepe Unchained as Best Cryptos to Watch

One of the biggest names in crypto is stirring up talk about frog meme coins. Whale Insider, a popular Twitter account, just named Pepe (PEPE) and other frog-themed tokens as the best cryptos to watch right now. Whale Insider Announces Top Frog Meme Coin Picks Whale Insider is a big name in the industry and […] Source CryptoX Portal

The Shopification of Wealth

Just as Shopify democratized e-commerce, enabling millions to open online stores, on-chain rails are poised to lower the barriers to entry in the financial advisory business, says Miguel Kudry. Source

The Wealth-Building Alternative to Real Estate for Millennials and Gen Z

In Hong Kong, for instance, parents who fully own their property are likely to be millionaires already, even if it’s just a tiny one-bedroom apartment. However, for younger generations, including millennials and Gen Z, the ultra-high property prices aren’t just a challenge — they’re a significant financial burden. Many of these owners are weighed down with long-term mortgages that have high interest rates, and are thus struggling to ascend the social ladder. In other words, rapid urbanization means that younger individuals are unlikely to build the same level of wealth…

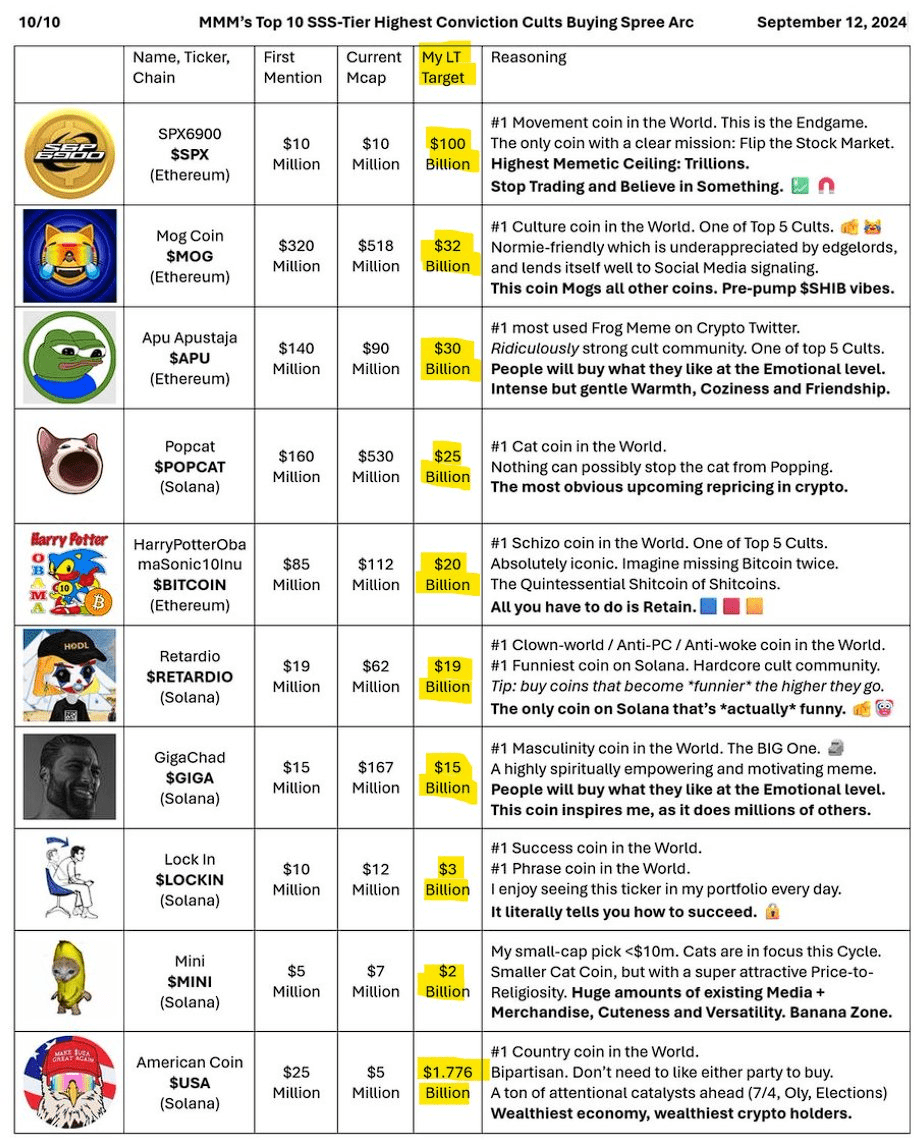

Crypto Whale Turns $2 Into Over $100 Million: Here’s How

Este artículo también está disponible en español. Murad Mahmudov has (once again) garnered major attention in recent weeks, establishing himself as one of the leading crypto analysts—analogous to Keith Gill, also known as “Roaring Kitty,” in the stock market. Mahmudov has reportedly transformed an initial investment of just $2 into a fortune exceeding $100 million over the past five years. This astounding feat was detailed by Pix (@PixOnChain), an advisor to Mintify and researcher at Jirasan, and further analyzed by crypto analyst Rekt Fencer (@rektfencer) on X. This is Murad…

State Street Works on Tokenized Bonds and Money Market Funds, Has No ‘Current Plans’ of Stablecoin Project: Report

Traditional finance heavyweights and global banks are getting increasingly involved in the tokenization of traditional financial instruments, or real-world assets (RWA), placing bonds, funds, credit or commodities onto blockchain rails. The process promises operational benefits such as increased efficiency, faster and around-the-clock settlements and lower administrative costs. Source

Peter Brandt’s Bullish Bitcoin Forecast: $135K by 2025, but $48K Is the Line in the Sand

On Wednesday, seasoned trader Peter Brandt shared his long-term perspective on bitcoin, predicting it could reach $135,000 by August or September 2025. This forecast comes with a key caveat: for the projection to hold, bitcoin must stay above a crucial support level of $48,000. Should it drop below this mark, Brandt suggests his current chart […] Original

VanEck launches $30m fund for crypto and AI startups

VanEck has announced the launch of VanEck Ventures, a $30 million early-stage fund focused on fintech, digital assets, and artificial intelligence. The fund will support pre-seed and seed-stage startups, with investment amounts ranging from $500,000 to $1 million per project. VanEck is a global investment firm managing $115 billion in assets. Led by former Circle Ventures heads Wyatt Lonergan and Juan Lopez, the fund aims to identify and back 25 to 35 startups that offer both financial and strategic upside. Lonergan and Lopez bring a wealth of experience from Circle,…

$6 Million ETH Sale: Ethereum Foundation Joins Whale Liquidation Frenzy

The Ethereum Foundation was at the center of attention recently concerning a liquidation plan it has set in place to sell parts of its Ether balance. According to the on-chain tracker Lookonchain, a wallet linked to the foundation moved 2,500 ETH, valued around $6 million, to the exchange Bitstamp on October 8, 2024. This is part of an increasing trend in which large holders, colloquially known as “whales,” are selling their holdings in the face of this volatile market environment. A whale deposited 11,456 $ETH($27.8M) to #Binance in the past…

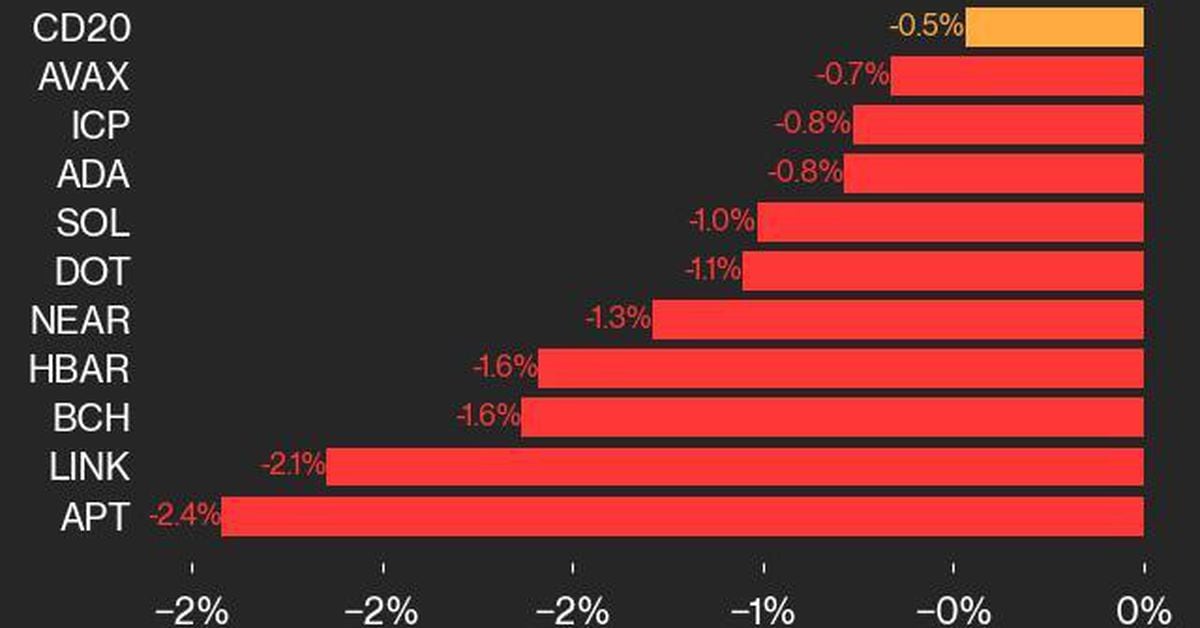

CoinDesk 20 Performance Update: APT Drops 2.4%, Leading Index Lower

Chainlink also underperformed, falling 2.1%. Source