Japanese investment firm Metaplanet has bought $6.7 million worth of Bitcoin, adding 108.99 BTC to their expanding cryptocurrency reserves. On Oct. 11, Metaplanet invested ¥1 billion or equal to $6.7 million in Bitcoin(BTC) reserves. This brings the company’s holdings in cryptocurrency to 748.50 BTC, which is currently valued at $45.65 million. This marks the Tokyo-based hotel operator turned investment firm’s third ¥1 billion investment into their Bitcoin holdings since the start of this month. Previously, the firm purchased 108.786 BTC on Oct. 7, which brought their total Bitcoin reserves to…

Day: October 11, 2024

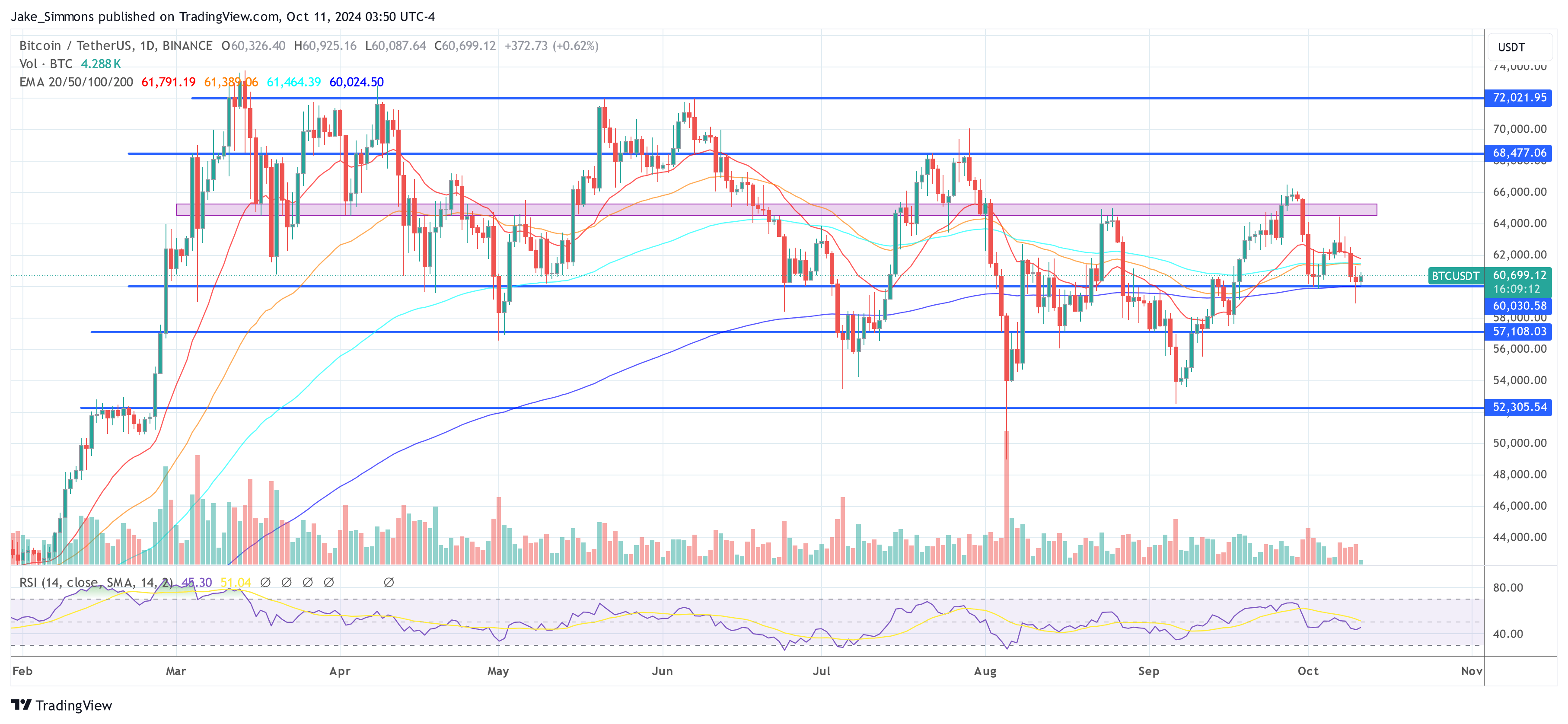

Bitcoin on Track For Record Sideways Action, With Eyes on November Elections as Bullish Catalyst

Prices tend to rise with fewer new bitcoin in the open market as long as demand remains constant or increases. BTC jumped above $73,000 to new lifetime highs ahead of the April 14 halving – with some targeting a continued rally to as high as $160,000 by the end of this year. However, prices have largely fluctuated in the $59,000 to $65,000 range since then, nearing a 300-day sideways action record from 2016. Source

Uniswap Labs Introduces Scalability-Focused Ethereum L2

Uniswap Labs has announced Unichain, its Ethereum Layer-2 solution aimed at streamlining the user experience for those leveraging its services. The organization specified that Unichain would be built as part of Optimism’s Superchain, designed specifically with decentralized finance in mind. Unichain aims to lower costs by 95% compared to using the Ethereum blockchain and to […] Source CryptoX Portal

Bitnomial Exchange Sues U.S. SEC, Alleging Regulatory Overreach

Bitnomial’s action follows a similar suit filed by Crypto.com on Tuesday. Source

Dogecoin Targets $0.11 As Short-Term Traders Fuel DOGE Price – Details

Este artículo también está disponible en español. Dogecoin is now at a crucial demand level after a 4% rise from local lows, stirring serious speculation in the market. The meme coin has caught the attention of analysts and traders, with mixed opinions about its next move. Some believe Dogecoin is preparing for a rally, while others suggest further declines could be ahead. Key data from IntoTheBlock highlights the importance of short-term traders in driving liquidity for meme coins like DOGE. This cohort of traders remains a significant source of activity,…

Binance Executive Tigran Gambaryan Was Denied Bail in Nigeria

During his time in prison Gambaryan has developed malaria, pneumonia and tonsillitis and suffers from complications tied to a herniated disc in his back, which left him in need of a wheelchair – though in a video from his last court appearance, Gambaryan did not have a wheelchair, and instead had to struggle on a single crutch. Source

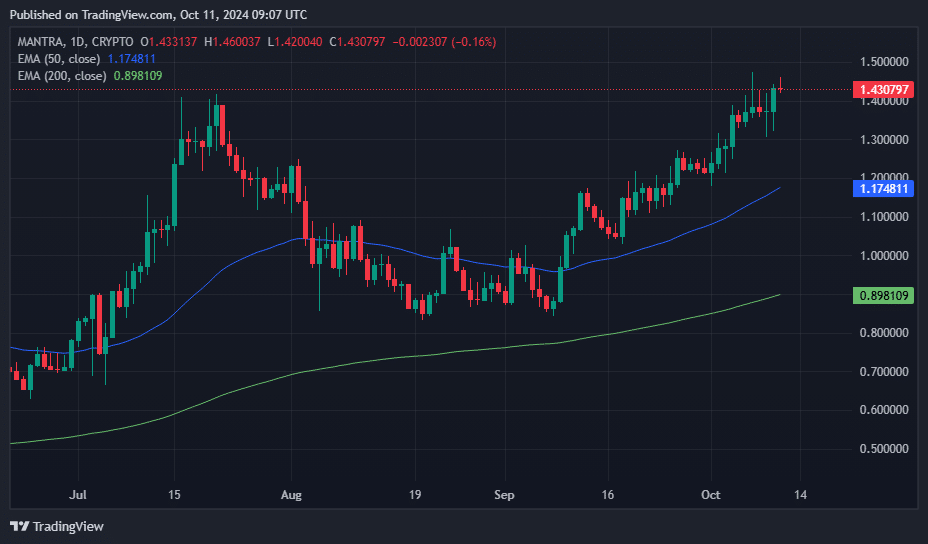

Mantra retests all-time high amid OM airdrop hype and mainnet launch anticipation

Mantra (OM), a blockchain network focused on real-world asset tokenization, retested its all-time high on Oct. 10, surging 9.2% to reach $1.46. The altcoin’s market capitalization crossed $1.2 billion, with daily trading volumes around $56 million, predominantly concentrated on Binance and XT.COM. In the past 30 days, Mantra (OM) has risen 42%, outperforming key RWA tokens such as Ondo (ONDO) and Pendle (PENDLE). When writing it was up over 2400% since the start of 2024. OM’s price action has aligned with a rebound in its futures open interest, which has…

Christie’s sells it’s first Bitcoin Ordinal made by Ryan Koopmans and Alice Wexell

A digital art piece inscribed on Bitcoin’s Ordinals protocol titled “Ascend” has been sold for $57,450 at Christie’s Post-War and Contemporary Art Day, beating it’s low estimate of $39,000. Ryan Koopmans and Alice Wexell’s Bitcoin Ordinal “Ascend” was sold at a £44,100 or equal to $57,450 on Oct. 10 at Christie’s Post-War and Contemporary Art Day sale. The piece was initially estimated to sell at a price of £30,000 or $39,222. This is the first time that a Bitcoin Ordinal has been featured in a live auction at Christie’s, one…

Former Customer of Crypto Exchange FTX Sues Olympus Peak, Says It Reneged on Bankruptcy Payout Deal

In documents filed with the U.S. District Court Southern District Of New York, Alexander Nikolas Gierczyk says he agreed to sell a $1.59 million FTX bankruptcy claim at a 42% discount to Olympus Peak Trade Claims Opportunities Fund with an “excess claim provision.” Source

Is The Bitcoin Bull Run Over? Top Analyst Predicts What’s Next

Este artículo también está disponible en español. Crypto analyst Bob Loukas has released a new video analysis titled “No Bull.” In the video, Loukas delves into the current state of the Bitcoin market, addressing growing concerns about the possibility of a canceled bull run. Loukas begins by acknowledging the prolonged period of consolidation for the Bitcoin price. He senses that “there is now some fear creeping into the market,” partly due to factors such as the Bitcoin ETF being “out for quite some time” and the halving having “come and…