Vice President Kamala Harris has unveiled a plan focused on supporting Black men, with cryptocurrency playing a significant role. Her “Opportunity Agenda for Black Men” includes ensuring that those holding digital assets “benefit from financial innovation.” Noting that over 20% of Black Americans have owned cryptocurrency, Harris promises regulatory protections to help safeguard their participation […] Source CryptoX Portal

Day: October 14, 2024

Kamala Harris to Back Crypto Reg Framework in Speech Today, Campaign Says

“Vice President Harris knows that more than 20% of Black Americans own or have owned cryptocurrency assets, which is why her plans will make sure owners of and investors in digital assets benefit from a regulatory framework so that Black men and others who participate in this market are protected,” a press release said. Source

Analysts React to China’s Lackluster Stimulus Measures: Will a ‘Big Move’ Follow?

Chinese investors have been left wanting more from the latest stimulus measures announced by authorities. Analysts are attempting to explain the reasons behind China’s lack of deeper action to stimulate its economy and how this might affect the Asian giant’s commercial partners. China’s Weak Stimulus Measures Stifle Markets, Analysts Try to Explain the Reasons Behind […] Source CryptoX Portal

Does World Liberty Financial Count as Trump ‘Launching a Coin’? Polymarket Bettors Are Divided

Another No holder by the name of Lawyered.eth points to language from the white paper, first reported by CoinDesk, which reads: “World Liberty Financial is not owned, managed, operated, or sold by Donald J. Trump, the Trump Organization, or any of their respective family members, affiliates, or principals… World Liberty Financial and $WLFI are not political and have no affiliation with any political campaign.” Source

What’s Behind Bitcoin And Ethereum’s Exchange Exodus?

Este artículo también está disponible en español. Crypto investors are not keen on dealing with cryptocurrency trading platforms, which has resulted in the dwindling exchange reserves of Bitcoin and Ethereum. Centralized exchanges on Bitcoin and Ethereum hit a historic low after investors and crypto enthusiasts opted for self-custody solutions for their virtual assets. Related Reading Staying Away From Cryptocurrency Trading A recent trend showed that traders and other enthusiasts choose to hold on to their crypto assets rather than sell them on Bitcoin and Ethereum exchange platforms. They preferred direct ownership…

Man Who Accidentally Sent $527M in Bitcoins to Dump Sues Local Council to Retrieve Them: Report

Over the last decade, Howells had made requests to Newport Council – proprietors of the landfill where the hard drive ended up – to retrieve it, but he claims he has been “largely ignored.” He is now suing the council for damages of 495 million pounds ($646 million), representing the peak valuation that 8,000 BTC reached earlier this year. Source

Pro-Palestine protestors cause disturbance outside New York Stock Exchange

The New York Stock Exchange. Getty Images A pro-Palestinian protest erupted outside of the New York Stock Exchange on Monday. There was no disruption to trading and none of the protestors appeared to make it to the historic trading floor. NYSE security fences off a perimeter area outside of the exterior of the building on Broad Street in lower Manhattan. According to video shared on social media, the group, called Jewish Voice for Peace, broke into that area and protestors were chaining themselves to the security fence and some exterior…

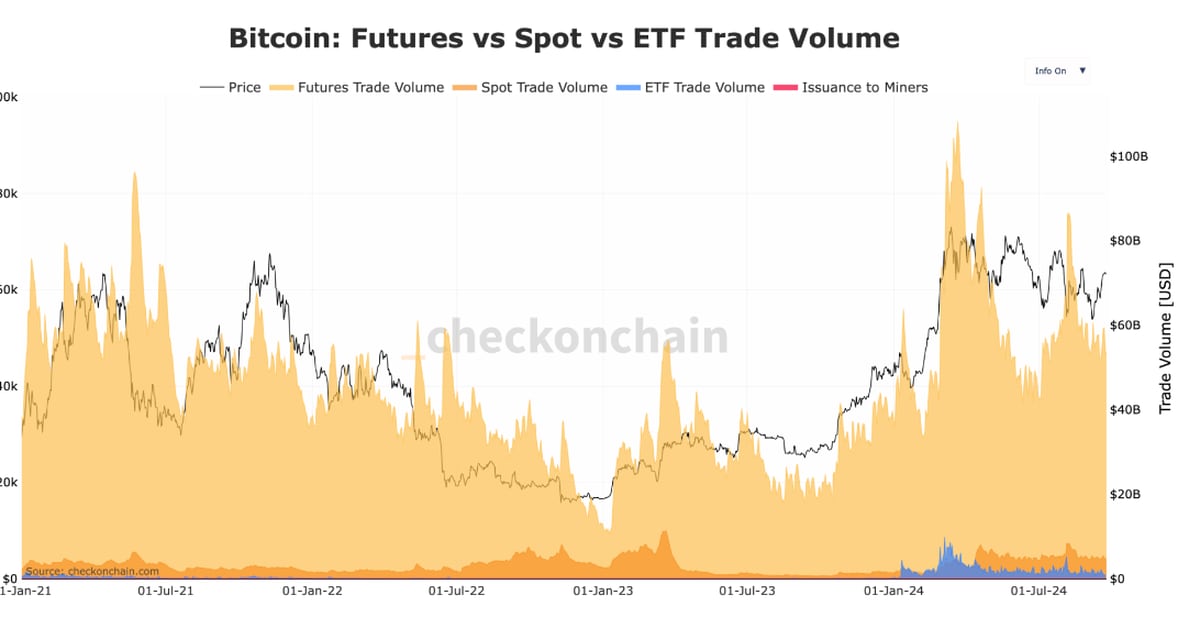

Liquidity and Options Pave the Way for Bitcoin ETF Market Expansion

As liquidity grows, institutional investors and options strategies could fuel the long-term expansion of the bitcoin ETF market. Original

Bitcoin Breaks $65K, as Price Action Compared to Prior U.S. Election Cycles

Trading firm QCP Capital said the move was similar to BTC’s price action in 2016 and 2020 before the U.S. elections. Source

Bitcoin ‘Uptober’ in play ahead of US election

Bitcoin’s leap toward $65,000 after a lackluster start to October could catalyze gains historically experienced during this month, according to QCP Capital. Analysts from the crypto trading firm said in its Telegram channel Bitcoin’s (BTC) 4% price jump on Oct. 14 might signal a rally for the leading cryptocurrency during the second half of the month. A total crypto market uptick liquidated nearly $80 million in BTC and Ethereum (ETH) leveraged short positions, easing the bearish overhang on these two market leaders and the broader digital asset space. QCP experts…