Donald Trump’s 2024 presidential campaign has seen a notable influx of cryptocurrency donations. A political action committee (PAC) supporting Trump pulled in $7.5 million during the third quarter, underscoring a growing interest from the crypto community. Trump Campaign Receives $7.5 Million in Cryptocurrency Donations Trump’s campaign contributions came in via various cryptocurrencies, including bitcoin (BTC), […] Original

Day: October 16, 2024

Crypto Turns Up Nose at Trump Token Sale, ‘Gold Paper’

Finally, last week, official details of what the project actually is, or aims to be, began to emerge: Still to be developed and launched, it’s a “best-in-class consumer application,” distinguished by “simple onboarding and familiar UI/UX via one-click social login and wallet creation,” according to a blog post. (UI/UX is shorthand for user interface and user experience.) Under the hood, the project plans to operate an instance of the decentralized-finance (DeFi) project Aave atop the Ethereum blockchain, with plans to eventually deploy on the layer-2 network Scroll, according to the…

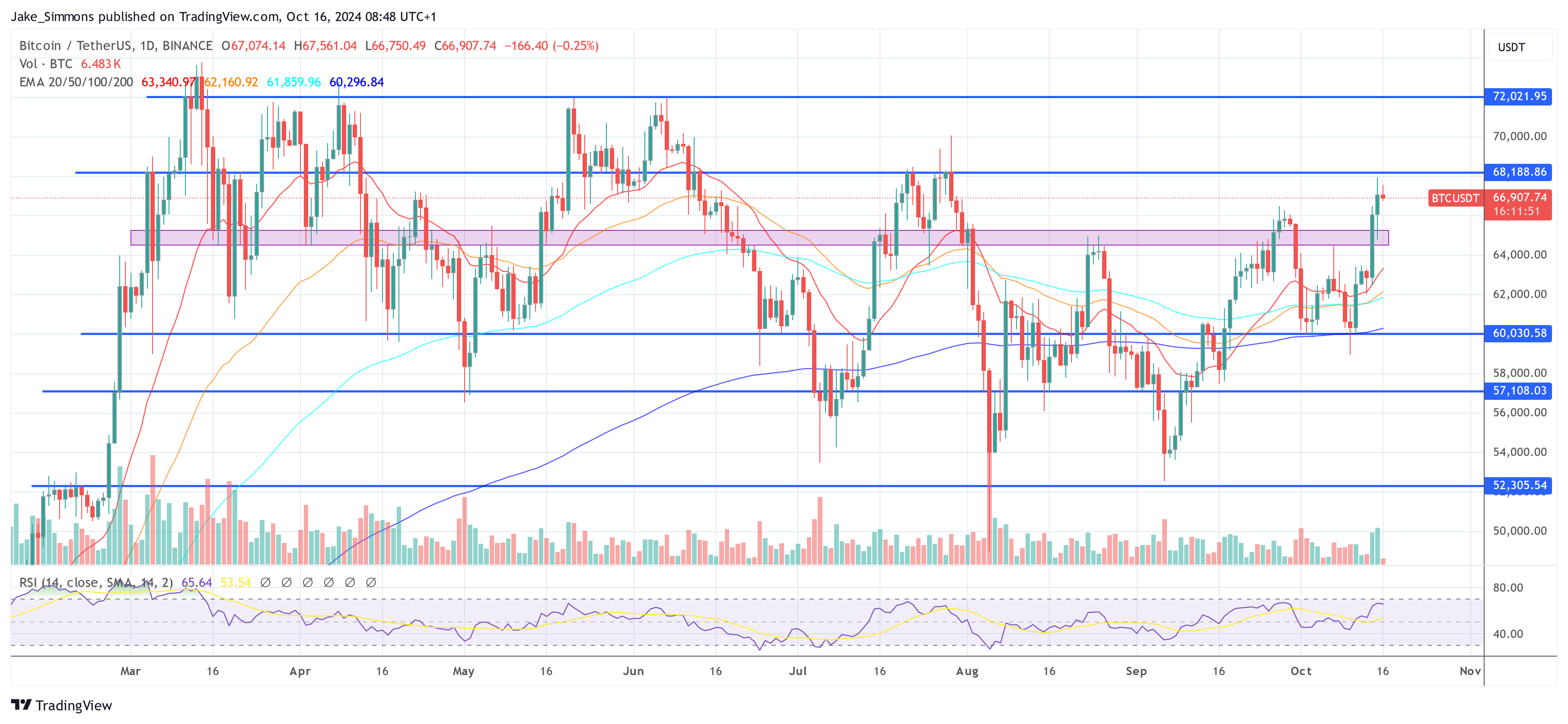

Crypto Analyst Says Bitcoin Price Can Port To $86,600 If It Breaks This Level

Este artículo también está disponible en español. Crypto analyst Ali Martinez has revealed how the Bitcoin price can rise to as high as $86,600, which would mark a new all-time high (ATH) for the flagship crypto. This comes amid BTC’s impressive price rebound, which has brought renewed optimism that the next leg of the bull run is almost here. Bitcoin Price Could Rise To $86,600 If It Breaks This Level Martinez mentioned in an X post that the Bitcoin price could rise to around $86,600 if it can break past…

Crypto Venture Capital Market is Tepid

Some sectors of the crypto ecosystem saw more interest than others. Crypto exchanges, lending, investing and trading platforms raised 18% of VC capital, over $460 million. Layer 1 projects came in next, at roughly $440 million, then Web3/Metaverse projects, at about $360 million, then infrastructure projects at $340 million. Meanwhile, projects combining crypto and artificial intelligence (AI) took in about $270 million – five times more than in the previous quarter, Galaxy said. Source

Binance Labs invests in Bitcoin liquid staking project Lombard

Binance’s venture capital and incubation arm has invested in Lombard, the crypto project behind the Bitcoin liquid staking token LBTC. The investment will help Lombard expand LBTC onto new chains. Jacob Phillips, Lombard’s co-founder and head of strategy, said in an announcement that the goal is to grow the decentralized finance landscape on Bitcoin (BTC) by unlocking new opportunities for BTC holders. Lombard launched its liquid staked token in August and is one of the projects looking to bring the benefits of decentralized finance to Bitcoin holders. The platform’s DeFi…

AI-Designed Meme Coin GOAT Sees Explosive Growth in Just 72 Hours

Based on market data, goatseus maximus (GOAT), a meme coin generated by an artificial intelligence (AI) bot, has been steadily increasing in value since its introduction. Over the past 24 hours, it has appreciated by 132% against the U.S. dollar. From AI Bot to Major Crypto Exchanges: GOAT Climbs 546% in a Week It’s hard […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Bitcoin’s (BTC) Bullish Momentum Should Continue Into the U.S. Presidential Election and Afterwards

Using an implied performance against a theoretical value, ETC Group found bitcoin could move up to 10% in either direction based on the election. Given the current spot price just shy of $68,000, a 10% upside move would mean a new record high, surpassing March’s $73,697. The team also found that the impact of the election would likely have the greatest effect on Cardano (ADA) and Dogecoin (DOGE), with a 18% and 20% moves, respectively. Original

How The Israel-Iran War Could Shake Crypto Prices: Arthur Hayes

Este artículo también está disponible en español. Arthur Hayes, the co-founder and former CEO of BitMEX, published an essay titled “Persistent Weak Layer” on October 16, where he examines the potential impact of escalating tensions between Israel and Iran on the crypto markets. Drawing an analogy from avalanche science, Hayes explores how the geopolitical situation in the Middle East could act as a “persistent weak layer” (PWL) that might trigger significant financial market upheavals, affecting Bitcoin and crypto prices. How Will The Crypto Market React? Hayes begins the essay by…

Investor Strategies for a Shifting Landscape

This uncertainty is creating opportunity as well as risk, as traditional financial (TradFi) institutions ramp up their entry into digital assets. TradFi firm’s sophisticated regulatory strategies, honed over decades of navigating complex compliance environments, are better positioned than smaller crypto-native companies. As major players launch products like Bitcoin ETFs and tokenized funds, innovators without regulatory expertise may be squeezed out unless they adapt to emerging frameworks such as those proposed by the Stablecoin Standard, which offers voluntary requirements for transparency, operational resilience, and reserve-backing. This model could offer a path…

Tap-to-Earn Games Are Realizing Satoshi’s Dream

Love or hate games like Hamster Kombat, they’re onboarding millions of users to crypto, says Ryan Gorman. Source