Crypto derivatives exchange Bitnomial is set to launch its U.S. perpetual futures trading platform, Botanical, backed by a $25 million round led by Ripple. The platform, integrating Ripple’s stablecoin RLUSD, aims to challenge decentralized exchanges and offshore models. Bitnomial’s approach to bringing offshore trading models into the U.S. derivatives industry presents a significant market opportunity, […] Source CryptoX Portal

Day: October 16, 2024

Bitcoin Breaks Through $65,000, Is “Uptober” Rally Just Getting Started?

Este artículo también está disponible en español. Bitcoin (BTC) has surged past the $65,000 mark, renewing traders’ optimism for an “Uptober” rally that could extend the digital asset’s bullish momentum. Is The Bitcoin “Uptober” Rally Finally Here? In the early hours of October 15, Bitcoin briefly crossed $66,000 before retracing to $65,964 at the time of writing. Over the past 24 hours, BTC has gained 1.4%. According to a report by crypto exchange Bitfinex, Bitcoin’s decisive move past the crucial $63,000 resistance level, combined with encouraging on-chain metrics, points toward…

Tesla quietly moves $769m in Bitcoin to multiple unknown wallets

Cybertruck manufacturer Tesla has moved its Bitcoin holdings across multiple unidentified wallets after two years of dormancy. According to data from Arkham Intelligence, Tesla-labeled wallets started moving the funds on Oct. 15 at around 20:41 UTC, after conducting several test transactions for small amounts of Bitcoin. Subsequently, 11,500 Bitcoin (BTC) worth over $769 million were distributed across seven different wallets. The transfers marked the first time the funds had been moved since June 17, 2022. At press time, there had been no official announcement from the electric vehicle maker on…

Blockchain Data Reveals Lackluster Response To Trump New Crypto Token Launch

Este artículo también está disponible en español. Donald Trump new cryptocurrency initiative, World Liberty Financial (WLF), has encountered significant challenges since its launch. According to a report by CNBC, the project aims to establish a crypto bank and was expected to attract considerable investor interest. However, the token sale, which began on Tuesday, was marred by website outages and technical issues, severely limiting participation. Trump Crypto Venture Faces Setbacks Zachary Folkman, co-founder of WLF, had previously indicated that over 100,000 individuals were on the whitelist for the investment opportunity. Despite…

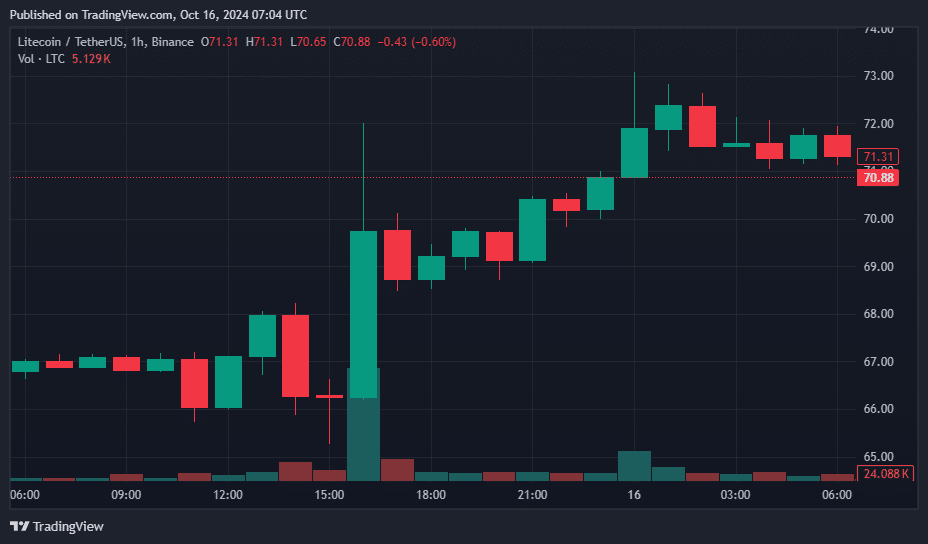

Litecoin rallies 11% amid spot ETF application and improving market sentiment

Litecoin surged to its two-month highs following the news of a spot Litecoin ETF filing with the U.S. Securities and Exchange Commission. Litecoin (LTC) rose 7.2% over the last day, exchanging hands at $71.52 on Wednesday, Oct. 16, its highest price seen since the end of July. LTC 24-hour price chart – Oct. 16 | Source: crypto.news This recent rally reflects a 15% increase from its monthly low, with Litecoin’s market capitalization growing from $4.6 billion on Oct. 3 to over $5.36 billion at the time of writing. The upward…

Bitcoin’s (BTC) Inverse Ties With Dollar Index (DXY) Challenged as U.S. Election Looms

“The upside convexity on a Trump win is worth being long, and we are seeing market participants building positions in the lead-up. In the absence of an escalating crisis, we see BTCUSD at 70,000 in the coming weeks, continuing off current downside support, with equities breaking further highs,” crypto liquidity provider Zerocap’s Chief Investment Officer Jonathan de Wet said in an email. Source

Malta-Based Investment Company to Follow Microstrategy’s Bitcoin Playbook

Samara Asset Group, a Malta-based investment company focused on seeding tech and crypto startups, aims to follow the Microstrategy playbook by announcing a bond whose proceeds will grow its bitcoin portfolio. Co-founded by cryptocurrency proponent Mike Novogratz, the company’s mission is to empower its shareholders “to participate in the performance of their strategies and disruptive […] Original

Institutions Pile Into Bitcoin As Retail Sells—A Bullish Signal For The Market?

Este artículo también está disponible en español. As Bitcoin continues its journey toward recovery, recent market activity has revealed an interesting shift in investor behaviour. According to a CryptoQuant analyst known as caueconomy, institutional investors are quietly accumulating Bitcoin as retail traders reduce their positions. This observation was shared in a post on the CryptoQuant QuickTake platform, highlighting a growing trend where whales—large investors—are buying up Bitcoin from smaller, more “impatient investors.” Related Reading Retail Traders Exit While Whales Accumulate The analyst explained in the post disclosing that, in the…

Trump’s World Liberty Financial Token Sale Kicks Off: 644M Tokens Sold

On Tuesday, former President Donald Trump announced on X that the “World Liberty Financial token sale is now live.” He added that “crypto is the future” and urged everyone to adopt “this incredible technology.” At the moment, the price for one WLFI token stands at $0.015, and as of 8:36 p.m. Eastern Time, a total […] Source CryptoX Portal

Dubai’s VARA Has Struck Correct Balance in Licensing Time Frame, Says Senior Official

“The interest in the ecosystem suggests that in two or three years time there will be more people in suits at such events, executives from the likes of BlackRock, Goldman Sachs and JP Morgan, resulting in the institutionalization of the space,” he said. McHugh has previously held roles at Goldman Sachs, Citibank, Fidelity Investments and Citadel. Source