Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…

Day: October 19, 2024

Decentralized Money Market Protocol Loses $4.3M in Social Engineering Attack

Tapioca DAO, has been the victim of a social engineering attack in which criminals exploited a vulnerability to compromise the ownership of the TAP token vesting contract. The breach led to the sale of 30 million vested tokens. A blockchain security firm detected suspicious activity involving Tapioca DAO. The attacker withdrew millions of TAP tokens, […] Source CryptoX Portal

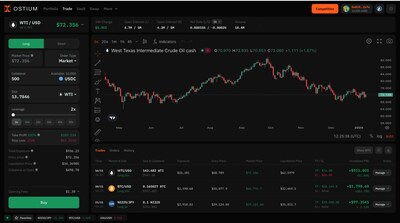

Ostium Launches Novel Macro Trading Platform Amidst Growth in Global Events-Based Trading

Enables Real-Time Trading of Traditional Assets During Historic Event-Driven Market Volatility and Adoption of Prediction Markets LONDON, Oct. 18, 2024 /PRNewswire/ — Ostium Labs today announced the public mainnet launch of its onchain trading platform, offering traders unprecedented access to global macro markets during a period of global event-driven volatility, marked by speculation around the U.S. Presidential election. Ostium enables perpetuals trading on traditional market currencies, commodities, and indices in real time, markets uniquely affected by events like interest rate changes and geopolitical outcomes. The trading platform meets the needs…

BlackRock in Talks With Crypto Exchanges About Using Its BUIDL Token As Derivatives Collateral: Report

Asset management titan BlackRock is reportedly in talks with numerous crypto exchange platforms about using its proprietary token BUIDL as collateral for derivatives contracts. According to a new report by Bloomberg, anonymous people familiar with the matter say the world’s largest asset manager is exploring the idea of utilizing BUIDL – the crypto asset related to the firm’s tokenized mutual fund – as collateral for trading derivatives contracts. BUIDL, which launched in March of this year and stands for BlackRock USD Institutional Digital Liquidity Fund, is a tokenized money-market fund…

Friday’s Big Moves: Bitcoin ETFs Dominate With Fresh Inflows – Here’s What You Missed

Spot bitcoin and ether exchange-traded funds (ETFs) in the U.S. had another winning day, with both categories seeing a steady flow of fresh investments. On Friday, the 12 bitcoin ETFs pulled in a combined $273.71 million, led by ARKB and IBIT at the front of the pack. Bitcoin ETFs Secure Inflows on Friday, Ether Funds […] Original

Ecosystem growth fuels Ethena rally, analysts eye 65% upside

Ethena has broken out of a rare bullish pattern on the one-day charts and could see gains of over 65% from the current price. Over the last seven days, Ethena (ENA) — best known for the USDe stablecoin — rose 24.4%. The crypto asset’s market cap surpassed the $1 billion mark on Oct. 14. It is now up 200% from its lowest point in September, and sits at $1.14 billion. Its daily trading volume hovers over $318 million. According to analysts, Ethena has broken out of multiple patterns on the…

NYSE, CBOE to list Bitcoin ETF options after SEC approval

The U.S. Securities and Exchange Commission has granted “accelerated approval” for listing Bitcoin options exchange-traded funds on the New York Stock Exchange and the Chicago Board Options Exchange. According to Oct. 18 filings, the SEC has greenlighted the NYSE and CBOE to list and trade options for Bitcoin ETFs. Options give investors the right to buy or sell an asset—referred to as “call” or “put” options—at a specific price before an agreed date. This move is expected to open up new opportunities for investors seeking to manage risk or capitalize…

Bitcoin Ordinal Sales Surge by 1,816%—And It’s Just Part of This Week’s NFT Shakeup

Amid the broad uptick in crypto asset markets, non-fungible token (NFT) sales saw a 22.38% increase this past week. NFT sales managed to rake in $92.95 million this week and Ethereum and Bitcoin NFT sales led the way. Digital Collectibles Spike in Activity as Ethereum and Bitcoin Top the NFT Charts NFTs enjoyed an increase […] Original

Bitcoin ETFs surpass $2.1b weekly inflows, whale accumulation mirrors 2020 rally

Spot Bitcoin exchange-traded fund inflows shot up more than 580% this week, as one analyst pointed out that whales were loading up on Bitcoin at a pace akin to the lead-up to the 2020 rally. Over the past week, inflows into the 12 spot Bitcoin ETFs reached $2.13 billion, following six consecutive days of positive inflows. This marks the first time weekly inflows into Bitcoin ETFs have surpassed the $2 billion mark since March 2024. Total net inflows across Bitcoin ETFs have hit a record $20.94 billion. That’s a milestone…

Post-mortem reveals stealthy malware injection led to $50m Radiant Capital exploit

Radiant Capital attackers used malware to hijack developer wallets and swipe over $50 million in assets. According to Radiant Capital’s post-mortem report, the attack on Oct. 16, 2024, which led to losses upwards of $50 million, was “one of the most sophisticated hacks ever recorded in DeFi.” The attackers compromised the hardware wallets of at least three Radiant developers through a sophisticated malware injection, though it is believed that more devices may have been targeted. The malware manipulated the front-end interface of Safe{Wallet} (formerly known as Gnosis Safe), displaying legitimate…