U.S. Bitcoin exchange-traded funds have captured institutional demand after legacy firms initially expressed skepticism toward Wall Street’s new crypto asset class. American institutions have acquired $13 billion worth of spot Bitcoin (BTC) ETF shares since trading opened in January, CryptoQuant CEO Ki Young Ju said on Oct. 22 via X. Citing Form 13F filings, a quarterly document wealth managers use to disclose U.S. equity holdings, Young Ju noted that 1,179 institutions have amassed 193,064 BTC in 10 months. Traditional finance juggernauts like Millennium Management and Jane Street control 20% of…

Day: October 22, 2024

New Cryptocurrency ICO FreeDum Fighters Raises $225,000 In Opening Weekend

The 2024 US Election is almost here, and it’s shaking up the market. Traders are speculating on what the outcome will mean for the economy and crypto regulation. But one project encapsulates this, providing a means of speculation while offering hilarious satirical escapades and captivating blockchain innovations. The project is called FreeDum Fighters ($DUM), and […] Source

Here’s Why The Bitcoin Price Saw Sharp Crash Below $67,000

Este artículo también está disponible en español. The Bitcoin price briefly crashed below $67,000 on October 21, although it quickly reclaimed this level as support before the daily close. This price decline is believed to be due to its correlation with the stock market, which also experienced a drop of its own. Why The Bitcoin Price Dropped Below $67,000 The Bitcoin price dropped below $67,000 primarily thanks to its correlation to the US stock market. IntoTheBlock data shows that the correlation between the flagship crypto and the S&P 500 is…

Massive Inflows Push Bitcoin ETFs Higher as Ether Funds Falter

On Monday, U.S. spot bitcoin exchange-traded funds (ETFs) marked another day of gains, pulling in $294.29 million in positive inflows. In contrast, ether ETFs saw a different story, losing $20.8 million across nine funds during the trading day. As Bitcoin ETFs Surge Again, Ether Funds See $20.8M in Outflows According to sosovalue.xyz metrics, the 12 […] Original

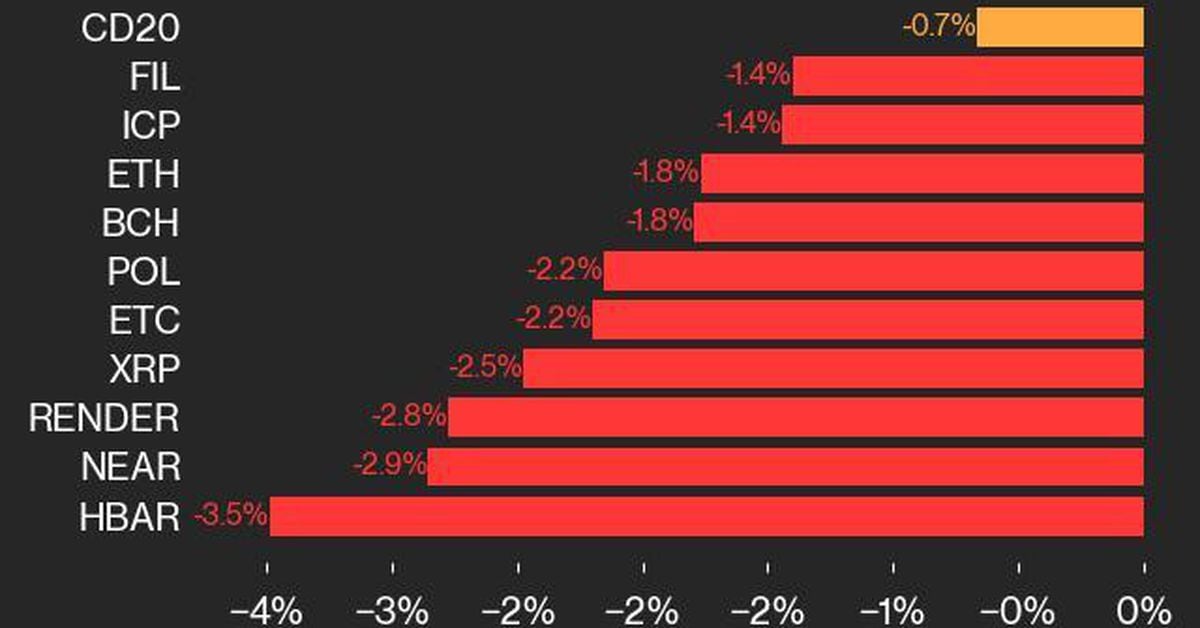

CoinDesk 20 Performance Update: HBAR Drops 3.5%, Leading Index Lower From Monday

NEAR Protocol was also among the underperformers, falling 2.9%. Source

Tudor Jones is long gold and bitcoin as hedge fund titan believes ‘all roads lead to inflation’

Billionaire hedge fund manager Paul Tudor Jones said Tuesday he is long gold and bitcoin as he expects that the path forward will be inflationary regardless of who lands in the White House — though he has started positioning for a Trump victory. “I think all roads lead to inflation,” Jones told CNBC’s “Squawk Box” on Tuesday. “I’m long gold. I’m long Bitcoin. I think commodities are so ridiculously under-owned, so I’m long commodities. I think most young people find their inflation hedges via the Nasdaq, that’s also been great.”…

Bitcoin Market Update: Traders Question Whether There’s a Breakout or Breakdown Looming

As of Oct. 22, 2024, bitcoin (BTC) is priced at $67,058.95, fluctuating within a 24-hour range of $66,669 to $68,268. With a market cap of $1.32 trillion and a daily trading volume hitting $44.03 billion, the digital currency appears to be in a consolidation phase, according to technical indicators. These indicators suggest that while things […] Original

Shiba Inu Soars: Analyst Predicts 71% Rally In ‘Meme Super Cycle’ – Details

Rising as one of the best-performing meme coins, Shiba Inu (SHIB) keeps making headlines in the crypto scene. The meme coin has jumped by over 30% during the past month, drawing both retail and analytical interest. Some analysts think SHIB may soon overcome a major resistance level with a community-driven rally bringing its market capitalization over $11 billion, therefore enabling even further gains. This thrill is driven mostly by a prediction from a pseudonymous analyst called FOUR. Fueled by what he describes as a “hyper meme coin cycle,” FOUR claims…

Scroll's SCR Token Debuts at $212M Market Cap in Volatile Trading Session

Layer-2 network Scroll released its long-awaited native governance token on Tuesday. Traders have priced SCR at around $1.10, or a $212 million market cap, based on the circulating supply figure of 190 million. Source

SOL’s Realms Is Under New Management

Realms isn’t the first piece of the Solana ecosystem to emerge from Solana Labs, the blockchain’s main developer company. Metaplex, the entity underpinning Solana’s non-fungible token (NFT) technology also did, said Matty Taylor, himself a Labs veteran who went on to independently run hackathons for the entire ecosystem. Source