Variational, a protocol enabling leveraged peer-to-peer trading for customizable crypto derivatives, announced Wednesday it has secured $10.3 million in seed funding. The round was co-led by Bain Capital Crypto and Peak XV Partners (FKA Sequoia India) with support from Coinbase Ventures, Dragonfly Capital, North Island Ventures, HackVC, Brevan Howard, and many other VCs, angel investors, and industry leaders. Source

Day: October 23, 2024

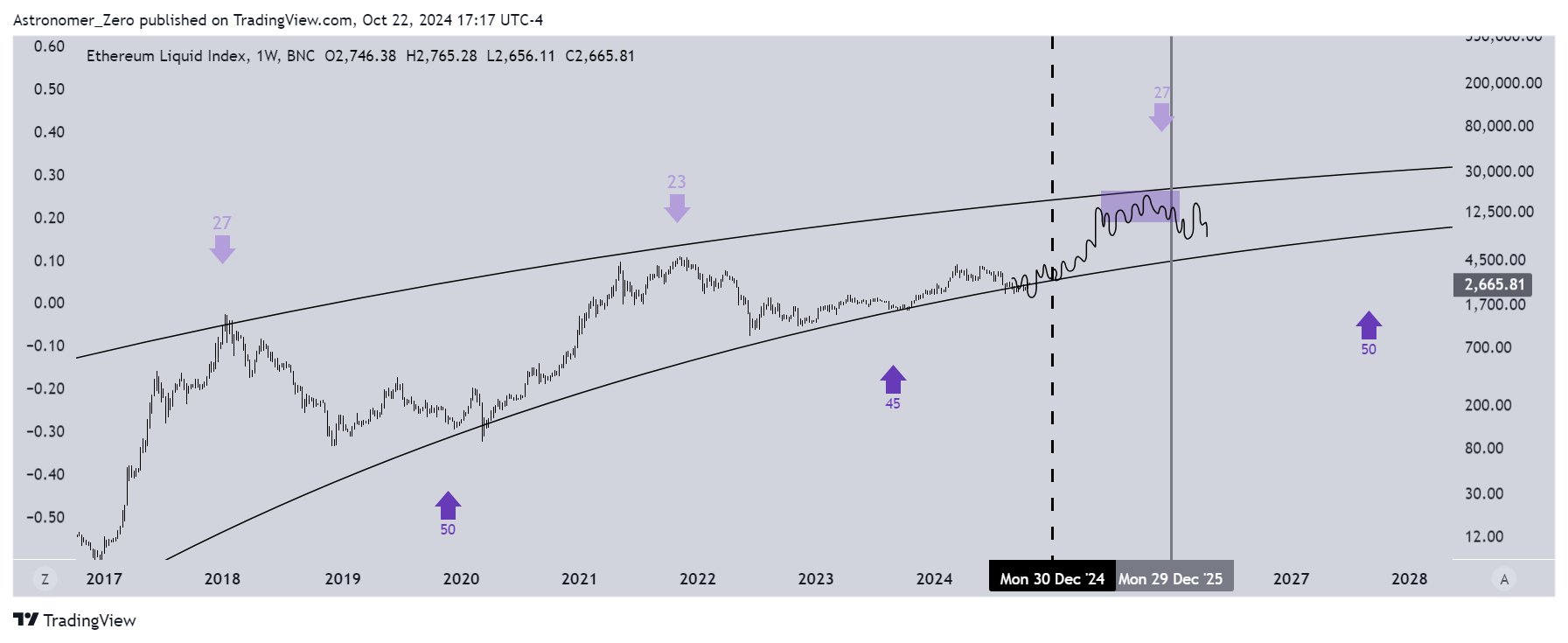

Crypto Analyst Unveils The ‘True Time To Sell It All’: Here’s When

Este artículo también está disponible en español. In an analysis shared on X, crypto analyst Astronomer (@astronomer_zero) has provided an in-depth macro outlook on Bitcoin (BTC) and Ethereum (ETH), suggesting that the next significant market peak—and potentially the ideal time to “sell it all”—may occur in the second half of 2025. “Another month and a half has passed, and the full macro breakout thesis is really pushing many eyes onto the crypto charts now,” Astronomer states. Reflecting on his earlier predictions, he notes, “Last time we posted our plan of…

QCP Capital Analysts Highlight Impact of US Elections on Crypto Markets

QCP Capital’s latest market update highlights the influence of the upcoming U.S. elections on financial markets, with a particular focus on cryptocurrencies like bitcoin (BTC). Analysts predict increased volatility as the elections near, with potential outcomes shaping investor sentiment and price movements. QCP Analysts Link U.S. Elections to Crypto Market Movements QCP Capital‘s analysts observe […] Source CryptoX Portal

BitMEX achieves industry-leading low on-chain AML risk profile through strategic partnership with Chainalysis

BitMEX reports a 35% lower on-chain risk exposure than global averages, demonstrating its commitment to cutting-edge security and regulatory adherence. VICTORIA, Seychelles, Oct. 22, 2024 /PRNewswire/ — BitMEX, the world’s leading crypto derivatives exchange, has announced that it continues to maintain a low on-chain Anti-Money Laundering (AML) risk profile, successfully reducing its risk exposure from 1.7% in 2019 to just 0.2% in 2024. This 88% reduction in on-chain risk exposure over the past five years is a direct result of BitMEX’s collaboration with Chainalysis, combined with substantial investments in compliance controls…

Solana Stays Strong Despite BTC Drop – $176 Next?

Este artículo también está disponible en español. Solana (SOL) is holding strong above the $160 mark after the broader market experienced a healthy dip to previous demand levels. Despite the dip, Solana has shown resilience, though the past few hours have been marked by short-term volatility with rapid price fluctuations. Investors are closely monitoring the next moves as Solana navigates this uncertain phase. Related Reading Top analyst Carl Runefelt recently shared a technical analysis suggesting a potential surge for SOL in the coming days, with a target of $176. His…

The Fed Is the Wrong Regulator for Stablecoins

First, and perhaps foremost, the Fed would be conflicted. As an alternative payment service, stablecoins compete with the Fed’s own payment infrastructure, including FedNow, the central bank’s instant payment service. The Fed’s consideration of a central bank digital currency would leave it further conflicted when regulating privately issued stablecoins, as those two digital representations of the dollar can be seen as substitutes. Any government body, the Fed included, would struggle to objectively analyze private payment innovations that compete with its own services. Giving the Fed the authority to regulate stablecoins…

How a Small Crypto Allocation Can Diversify Portfolios and Improve Risk-Adjusted Returns

Crypto markets have shown explosive growth, far outpacing traditional asset classes in terms of returns. For example, bitcoin has delivered an annualized return of 230% over the past decade, compared to the S&P 500’s annualized return of around 11%. Ether, another dominant cryptocurrency, has also offered triple-digit annual growth rates in its early years. Even with their volatility, these digital assets provide investors with the potential for significantly higher returns, particularly during periods of market expansion. Source

Reducing Risk and Enhancing Liquidity in Crypto Markets

The cryptocurrency and decentralized finance (DeFi) ecosystems currently lack access to stable, high-quality collateral besides stablecoin. Crypto and DeFi traders typically rely on volatile assets like bitcoin or ether as collateral for loans, staking, and liquidity pools. While effective, this system introduces significant risks, as the value of these assets can fluctuate wildly within short time frames, leading to over collateralization to mitigate risks. The alternative is to post stable coins that only earn a yield to the stablecoin issuers or selected market participants through opaque yield-sharing agreements. Source

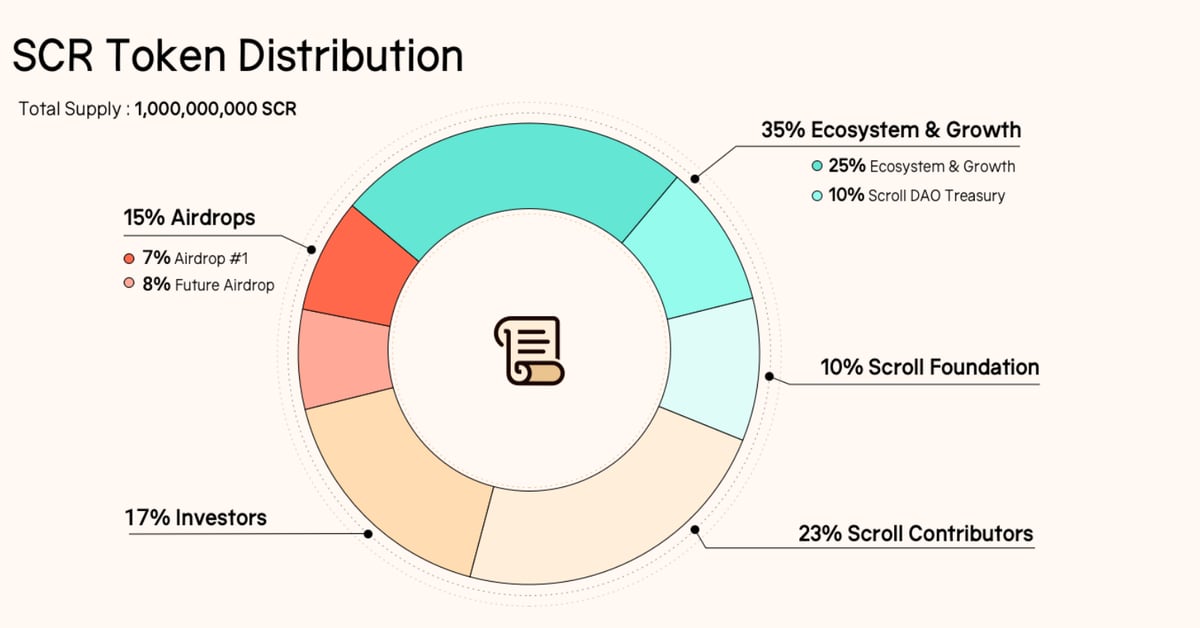

Scroll's Token Declines 32% as Whales Scoop Up Airdrop

After more than a year of hype and expectation, layer-2 network Scroll’s governance token launch is beginning to fall short of expectations after being plagued by token allocation issues. Source

$40 XRP? Analyst Reveals Key Insights Suggesting Uptrend Ahead

Este artículo también está disponible en español. A crypto market analyst recently released a study that predicts a big rise in the price of XRP. This study fits with the current excitement in the crypto community, especially since Elon Musk made his first public reference to XRP. Related Reading In a video that went viral on Crypto Twitter, Musk talked about how valuable cryptocurrencies like XRP are. This caused a purchasing frenzy. Musk didn’t fully back XRP, but his comments about how cryptocurrencies can help people’s freedom have made people…