Historically, only crypto-native companies held bitcoin on their balance sheets. However, a significant structural shift has occurred over the past four years. Public and private companies are now embracing bitcoin, motivated by economic, geopolitical, and regulatory factors. For instance, public and private companies currently hold over 4% of all bitcoin, valued at around $50 billion, with MicroStrategy leading the way, having accumulated a bitcoin portfolio worth $13 billion since August 2020. Source

Day: October 24, 2024

Denmark Unveils Crypto Tax Plan, Recommendations Draw Fire From Bitcoiners

The Danish Tax Council has recommended what it terms non-backed crypto assets like Bitcoin be taxed similarly to asset-based crypto assets. The council argues the recommendations would allow crypto investors to deduct losses from gains thus making taxation more fair. However, some observers believe this amounts to a “declaration of war on crypto” as it […] Source CryptoX Portal

Binance Executive Tigran Gambaryan Has Left Nigeria Following Detention

“The government has reviewed the case and, taken into consideration that the second defendant (Mr. Gambaryan) is an employee of the first defendant (Binance Holdings Limited), whose status in the matter has more impact than the second defendant’s, and also taking into consideration some critical international and diplomatic reasons, the state seeks to discontinue the case against the second defendant,” the EFCC prosecutor stated in court. Source

Number Of Bitcoin Bulls Increases As Funding Rate Shows Steady Growth – Details

Este artículo también está disponible en español. Bitcoin has rebounded strongly from the $65,000 mark after a 6% dip from Monday’s high of around $69,500. Despite the recent pullback, BTC remains in a bullish trend that has been in place since early September. This rebound shows resilience, helping maintain the bullish market structure. Key data from CryptoQuant reveals that the average funding rate has steadily grown since September, indicating that bullish sentiment is increasing as more traders actively engage in the market. Related Reading The coming two weeks will be…

Chainlink (LINK) Teams Up With Botanix Labs to Expand Into Bitcoin (BTC) for the First Time

Chainlink’s service is an established feature of many of the major blockchains as well as Ethereum. These include Solana, BNB Chain, Solana, Fantom and Gnosis Chain. Its first arrival on Bitcoin highlights the work being done to align the world’s oldest blockchain with the services and functionality that is a given on other networks. Original

Why Web3 VCs Are Embracing Crypto+AI

Coinbase Ventures is shifting focus away from pure-play crypto investments. Source

Bitcoin Project BOB Maps Out How the Original Blockchain Could Take Over DeFi

The developers behind BOB, a build-on-Bitcoin project, released a new “vision paper” Thursday outlining a design for a “hybrid layer-2” network they say could help to position Bitcoin – the oldest and largest blockchain – as the new foundation for decentralized finance (DeFi). Original

Kraken Picks Optimism for New Layer-2 Network, Joining Coinbase's Base on 'Superchain'

The disclosure comes nearly a year after CoinDesk broke the news that Kraken was considering its own layer-2 network, following the runaway success enjoyed by Base after it launched in mid-2023. Source

Vintage 2011 Bitcoin Wallet Moves $10M, Linked to All of October’s 2011 Spends

On Oct. 24, at block height 867,127, a bitcoin wallet from 2011 suddenly moved 150 bitcoins, marking the first transaction in over 13 years. This is the fifth occurrence this month of bitcoins from 2011 being spent, and it’s extremely likely that most of these transactions are all connected to the same individual or entity. […] Original

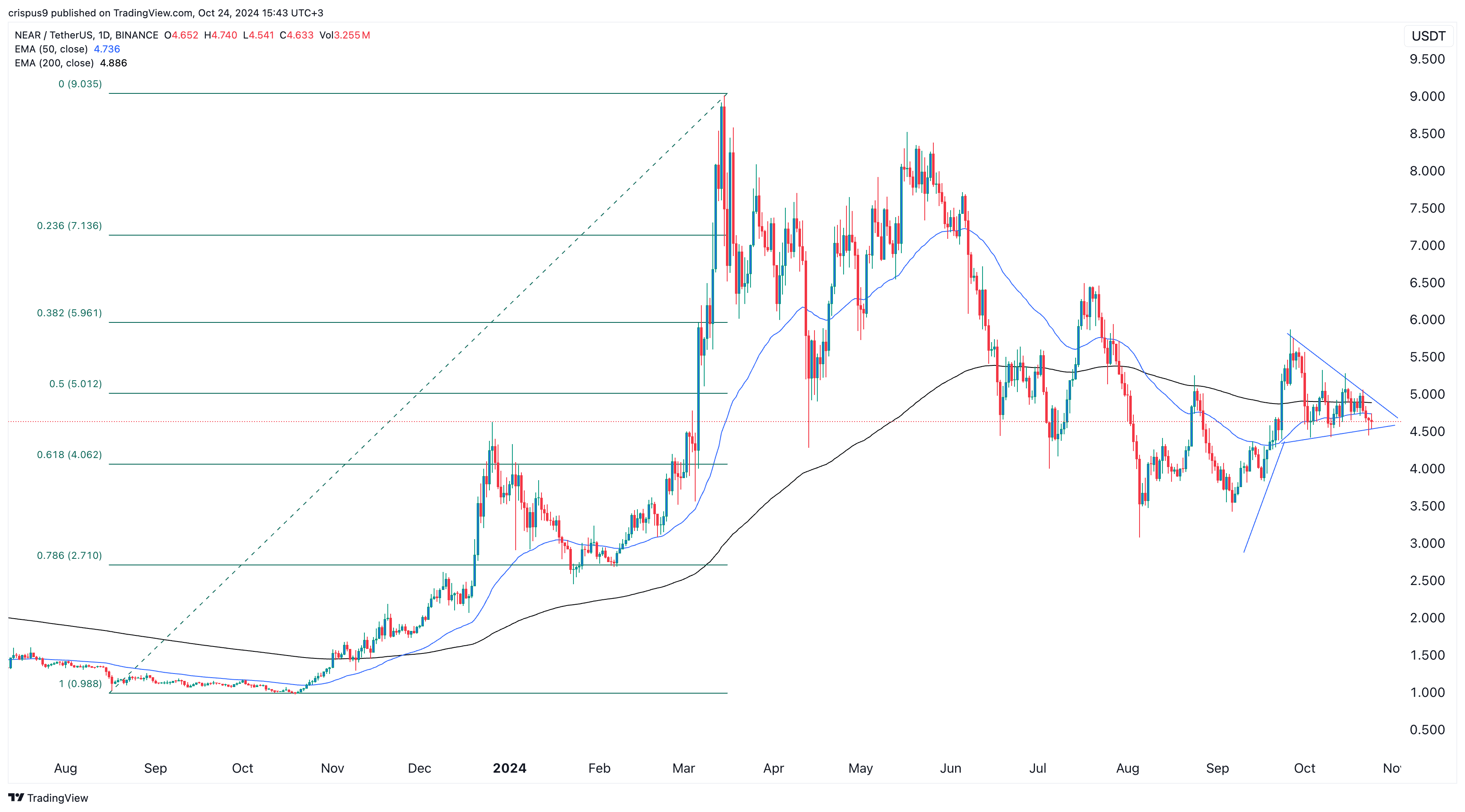

Near token could surge 225%, crypto analyst predicts

Near Protocol token remains in a strong bear market after falling by almost 50% from its highest level this year. Near (NEAR) was trading at $4.62 on Oct. 24, as Bitcoin (BTC) and most altcoins remained under pressure. However, Michael van de Poppe, a popular crypto analyst with over 700,000 followers on X, predicted that it will soon bounce back and move to between $10 and $15. If it rises to the upper side of his forecast, it would mean a 225% increase from the current level. The markets are…