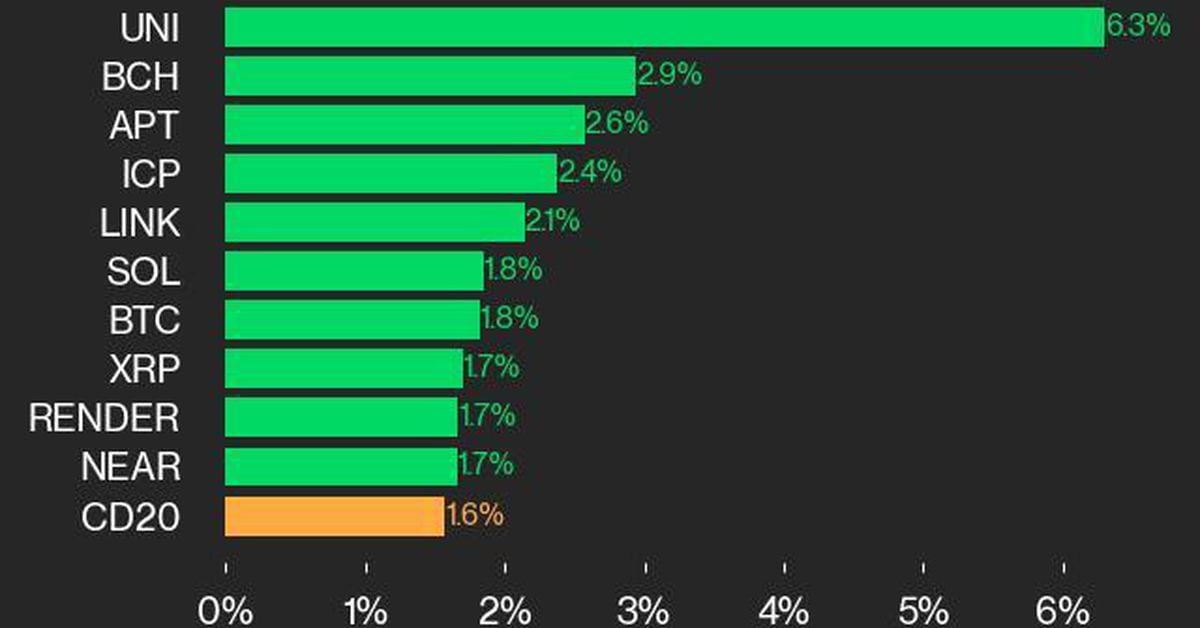

Bitcoin Cash was also among the top performers, gaining 2.9% since Wednesday. Source

Day: October 24, 2024

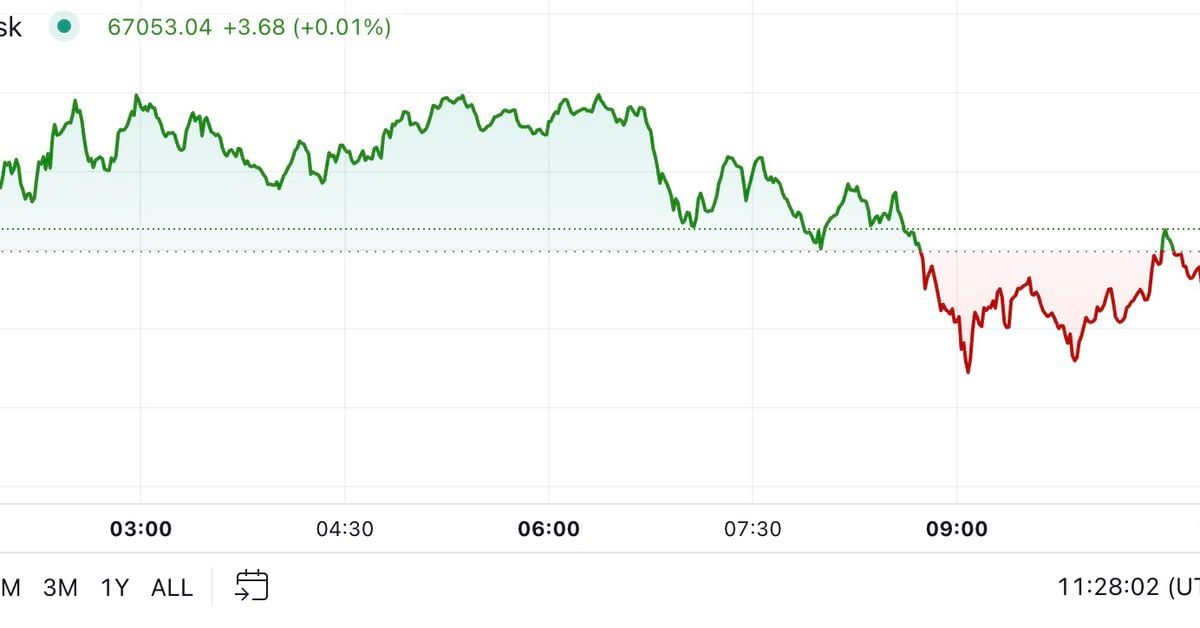

Bitcoin Price Retests Bullish Channel At $65,000, Analyst Reveals What’s Next

Este artículo también está disponible en español. Crypto analyst MMBT Trader has revealed that the Bitcoin price is retesting a bullish channel at the $65,000 price level. He further mentioned what market participants should expect if the flagship crypto holds above or breaks below this bullish channel. Bitcoin Price Retesting $65,000 And What Could Come Next MMBT Trader mentioned in a TradingView post that the $65,000 support zone is now the major daily support, and market participants can expect a valid retest of the channel breakout. The analyst claimed that…

CryptoQuant CEO predicts Bitcoin will be used as a ‘currency’ by 2030

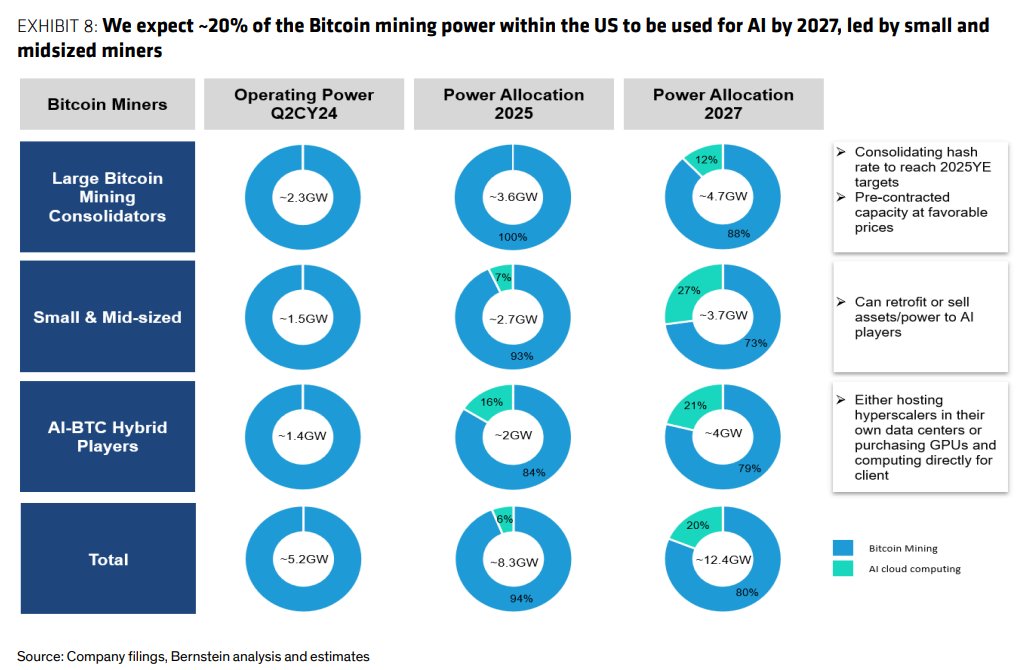

Founder and CEO of CryptoQuant, Ki Young Ju, stated a rise in Bitcoin mining difficulty could signal the possibility of Bitcoin becoming a digital currency. According to data from CryptoQuant’s live chart, Bitcoin(BTC) mining difficulty has been on the rise in the past three years. CryptoQuant CEO Ki Young Ju explained that Bitcoin’s mining difficulty has increased by 378%, indicating a rise in competition. An increase in mining difficulty is caused in large part from the influx of large mining companies that are backed by institutional investors which dominate the…

BTC Rebounds to $67K After Subdued U.S. Economic Data Reading

The number of so-called whales or network entities owning at least 1,000 BTC jumped to 1,678 early this week, reaching the highest since January 2021, according to data tracked by Glassnode and Bitwise. The growing accumulation by large holders alongside solid uptake for alternative vehicles, especially the U.S.-listed spot ETFs, suggests increasing confidence in bitcoin’s price prospects. Meanwhile, retail investor accumulation has slowed, with the cryptocurrency’s price nearing $70,000, according to analytics firm CryptoQuant.”Retail holdings have risen by just 1K Bitcoin in the last thirty days, a historically slow pace,”…

Bitcoin miner TeraWulf seeks $350m in convertible notes for stock buybacks

Crypto mining firm TeraWulf plans to offer $350 million in convertible senior notes due 2030 to qualified institutional buyers, with proceeds aimed at corporate purposes. Maryland-headquartered Bitcoin (BTC) mining firm TeraWulf announced its intention to offer $350 million in convertible senior notes due 2030 in a private placement aimed at qualified institutional buyers, contingent on market conditions. In a Wednesday press release, on Oct. 23, the firm said the offering may include an additional $75 million if initial purchasers exercise their option within a 13-day window post-issuance. The company plans…

$200,000 Bitcoin In 2025? $791 Billion Firm Calls It ‘Conservative’

Este artículo también está disponible en español. Bernstein Research, the esteemed research arm of global asset manager AllianceBernstein, is projecting that Bitcoin will reach $200,000 by the end of 2025. The firm, which manages assets worth $791 billion as of August 2024, labels this prediction as “conservative” in its latest 160-page “Black Book” on Bitcoin. Why BTC Price Will Hit $200,000 In 2025 Bernstein’s report, titled “From Coin to Computing: The Bitcoin Investing Guide,” delves into the multifaceted dynamics propelling Bitcoin’s ascent. The firm underscores the surge in institutional adoption,…

Senator Claims BRICS Push to Ditch US Dollar Could Boost USD Global Dominance

U.S. Senator Bill Hagerty has warned of growing efforts by BRICS nations to bypass the U.S. dollar’s dominance but argued this could ultimately strengthen the status of the dollar as the world’s reserve currency. He emphasized the need for a regulatory framework to boost demand for U.S. treasuries and stablecoins, while his stablecoin legislation aims […] Source CryptoX Portal

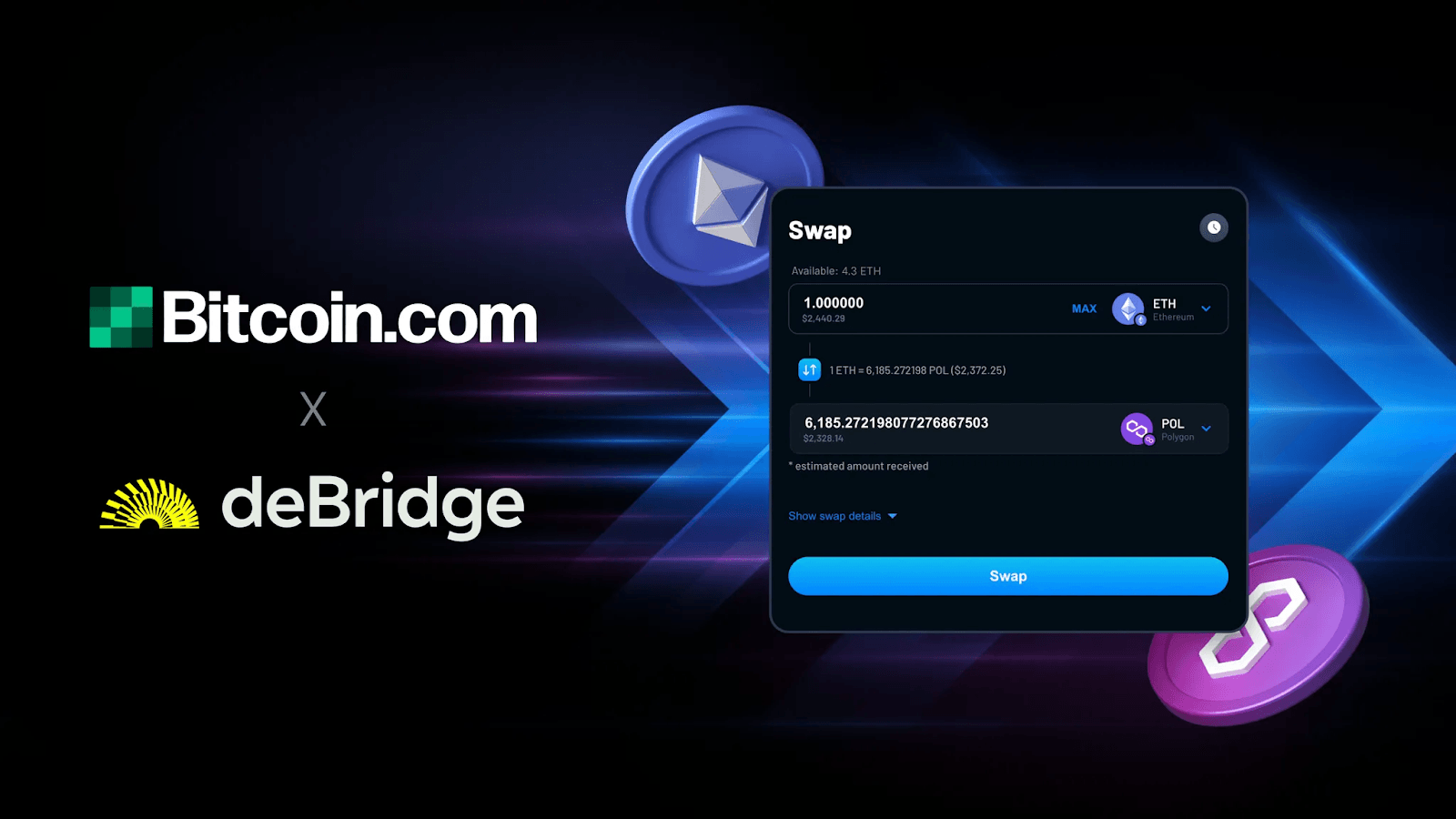

Bitcoin.com Enhances Cross-Chain Swaps on Verse DEX With deBridge Integration for Faster, More Efficient Trading

Bitcoin.com, a pioneer in the Bitcoin and crypto space since 2015, has announced a significant upgrade to the cross-chain swap capabilities on its decentralized exchange, Verse DEX, thanks to a partnership with deBridge. The new integration brings major improvements in speed, cost efficiency, and flexibility to cross-chain trading. The update allows users to perform cross-chain […] Original

Solana (SOL) Looks Overbought Against Ethereum (ETH); BTC-Gold (XAU) Ratio Stuck in a Downtrend

Some savvy traders see an overbought RSI, especially on longer duration charts, as a sign of bullish solid momentum or evidence of the path of least resistance being on the higher side. As the adage goes, the RSI can stay overbought longer than bears can stay solvent. Source

Bitcoin ETF Inflow Streak Breaks With Nearly $80 Million Outflows

Este artículo también está disponible en español. The recent increase in the appeal of spot Bitcoin exchange-traded funds (ETFs) in the United States has temporarily ceased. Related Reading On Tuesday, these funds underwent a reversal, resulting in net outflows of $79.01 million, following an extraordinary seven-day streak of positive inflows. Farside Investors are the source of this data, a company that specializes in the analysis of ETF flows. A Brief Obstacle The $79 million outflow represents a significant shift in sentiment among investors who had previously demonstrated a strong interest…