On Oct. 23, investors in BlackRock’s IBIT capitalized on Bitcoin’s over 3% decline, contributing $317 million in inflows to the fund as the cryptocurrency tested a critical support level at $65,000. On Oct. 23, Bitcoin faced significant downward pressure, sliding 3.3% to close at $66,649, a sharp contrast to the 0.12% gain in the previous session. Testing buyer demand at $65,000, BTC managed to find support with a session low of $65,161 before climbing back above the $66,000 level. The broader cryptocurrency market mirrored this decline, shedding 1.45% to a…

Day: October 24, 2024

$581m in Bitcoin left CEXs in 7 days, whales restart accumulation

The Bitcoin outflows from centralized exchanges and the rising whale accumulation helped it surpass the $67,000 mark again. According to data provided by IntoTheBlock, the Bitcoin (BTC) exchange net flows witnessed two days of inflows on Oct. 20 and 21, bringing the price down from the local high of $69,400. BTC CEX net flows – Oct. 24 | Source: IntoTheBlock On Oct. 22 and 23, this movement shifted back to outflows. Per ITB data, BTC recorded a net outflow of $581 million over the past week. The increased outflows show…

Web3 Automation Provider Ava Protocol’s Demand Surges 900% Ahead Of Token Launch

Ava Protocol, the event-driven EigenLayer Active Validated Service (AVS), has seen notable growth since launching in July. The Web3 automation provider reported a significant increase in demand for its “super-transactions” solution ahead of its token launch. Web3 Automation Provider Sees 900% Demand Increase Ava protocol reported a 900% surge in demand for its blockchain automation solution. The EigenLayer AVS offers Web3 infrastructure to support cross-chain automation, enabling composable autonomous transactions and allowing developers to deploy dApps rapidly. The protocol records $3 billion in restaked assets since launching on EigenLayer’s mainnet four months…

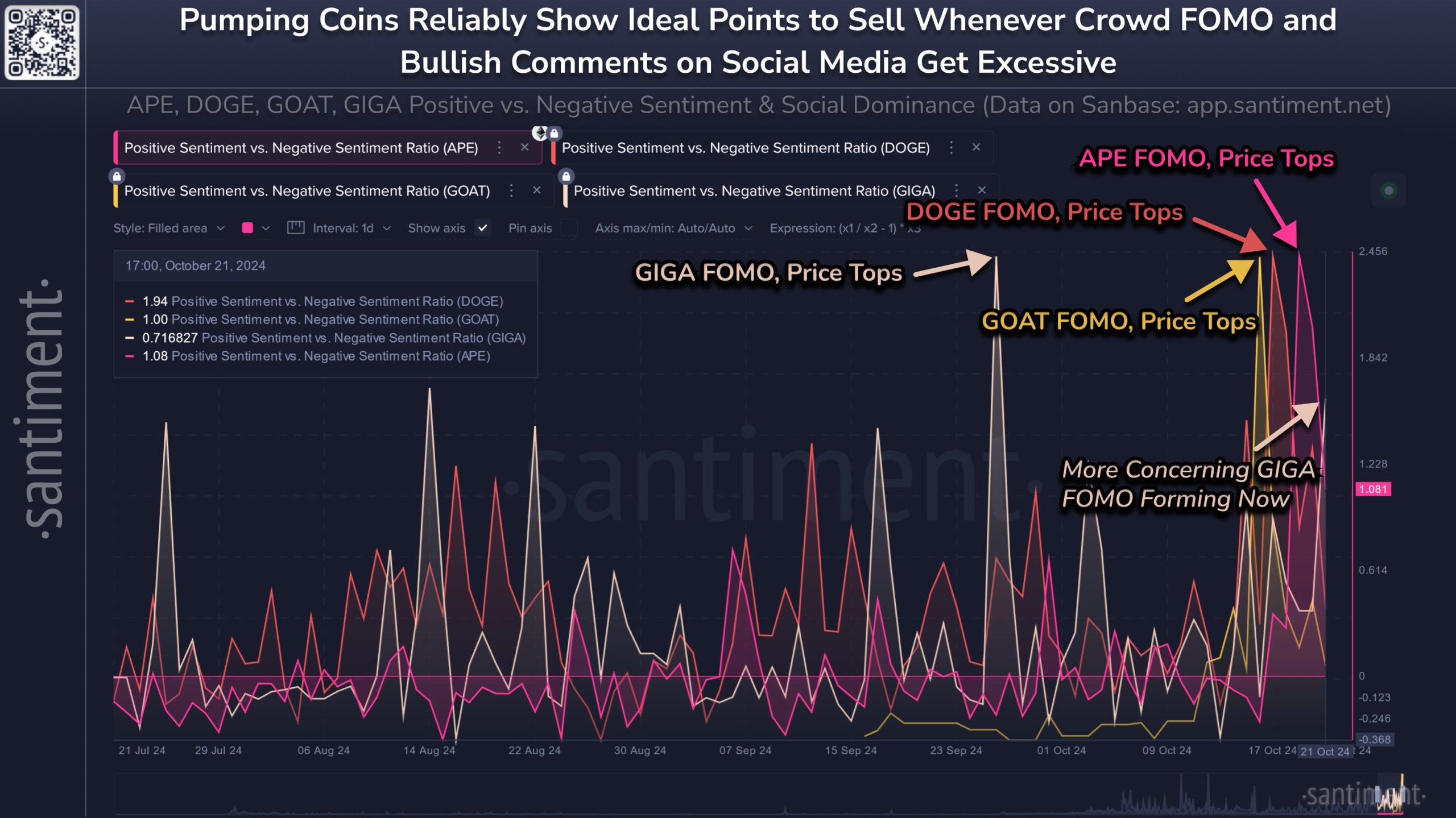

Analytics Firm Reveals Why Dogecoin & Apecoin Hit Tops

The on-chain analytics firm Santiment has revealed the potential reason behind the corrections that Dogecoin and Apecoin have faced recently. Dogecoin & Apecoin Are Among Memecoins That Fell Prey To FOMO Recently As explained by Santiment in a new post on X, the Positive Sentiment vs. Negative Sentiment Ratio has seen a spike for Dogecoin and other memecoins recently. The “Positive Sentiment vs. Negative Sentiment Ratio” here refers to an indicator that tells us whether major social media platforms are leaning towards positive or negative comments right now. This indicator…

Bitcoin (BTC) Price Retakes $67K as Beige Book Supports Fed Rate Cuts

Bitcoin has recovered from the overnight lows under $53,500 to trade 1% higher on the day at $67,300 at press time, and the dollar index (DXY) rally has stalled. The index has pulled back to 104.30 from the overnight high of 104.57, according to data source TradingView. Original

Russia Pushes for New Precious Metals Platform to Reshape BRICS Trade

Russia pushed for the creation of a BRICS platform to trade precious metals and diamonds at the BRICS Summit, criticizing excessive global trade regulations. President Vladimir Putin emphasized the need to bypass barriers that stifle the market. The summit also backed a BRICS Grain Exchange to ensure stable agricultural trade, highlighting efforts to boost cooperation […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Predictions Of Cycle Top And Next Bear Market Bottom

Este artículo también está disponible en español. As Bitcoin (BTC) experiences a minor correction, trading below the critical $66,000 support level after several unsuccessful attempts to breach the $70,000 mark, analysts observe significant technical indicators that may signal future price recoveries. Notably, BTC’s weekly Moving Average Convergence Divergence (MACD) has turned bullish for the first time since October 2023. This shift in the MACD parallels previous market behavior, particularly the substantial rally in the 2021 bull market. Current Bitcoin Trends Echo 2021 Rally, New ATH Possible Crypto analyst CryptoBullet has…

Cardano (ADA) Struggles to Build Bullish Momentum: Will It Turn Around?

Cardano price started a fresh decline below the $0.3550 zone. ADA is consolidating above $0.3400 and might attempt a recovery wave. ADA price started a downward move below the $0.3500 support level. The price is trading below $0.3550 and the 100-hourly simple moving average. There was a break below a key bullish trend line with support at $0.3600 on the hourly chart of the ADA/USD pair (data source from Kraken). The pair could attempt a recovery wave if it clears the $0.3585 resistance zone. Cardano Price Consolidates Losses After testing…

Uncharted Territory: Bitcoin’s Mining Difficulty Reaches New Extremes

Bitcoin’s difficulty has soared once again at block height 866,880, reaching a record-breaking 95.67 trillion. Meanwhile, the network’s computational power is keeping pace, operating at a blazing 729.13 exahash per second (EH/s) at the time of reporting. In the coming days, it’ll be fascinating to watch how the combination of increased difficulty and dipping prices […] Original

Global Finance Faces a Shift as Mbridge Digital Currency Platform Challenges US Dollar

The People’s Bank of China emphasized the Mbridge platform’s role in improving cross-border payments through the use of central bank digital currencies (CBDCs), aiming to reduce inefficiencies and avoid new barriers. The platform, which targets underserved regions like ASEAN, could reshape global finance and challenge the U.S. dollar’s dominance while requiring careful coordination to maintain […] Source CryptoX Portal