Este artículo también está disponible en español. Microsoft is preparing for a critical shareholder meeting on December 10, during which the future of Bitcoin as a potential investment will be a heated topic. At present, Bitcoin is trading at approximately $68,115, which represents an increase of approximately 1.22%. The rise in interest aligns with constant debates around the cryptocurrency as an inflation hedge, which some Microsoft investors find appealing. Related Reading Bitcoin price up in the last 24 hours. Source: Coingecko Microsoft’s Position On Bitcoin Microsoft revealed in a recent…

Day: October 25, 2024

NYSE Proposes 22 Hour Trading on Arca Equities Exchange During Weekdays

The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar The Role of PAMM, MAM & Copy Trading in Business Growth Strategies | Webinar The copy trading market is projected…

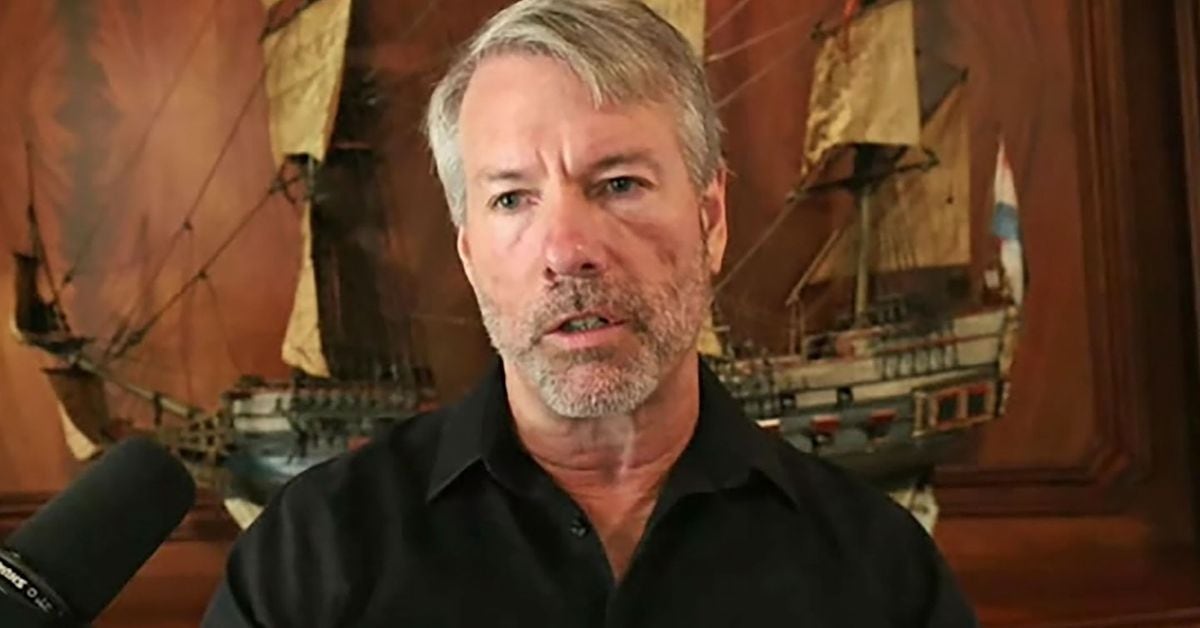

Michael Saylor’s MicroStrategy Makes New Highs as Trading Volume Relative to Nvidia Surges

With a year-to-date gain of over 240%, MSTR has outperformed NVDA’s 192% surge by a big margin. Since MSTR adopted bitcoin as a treasury asset in August 2020, the gap has grown even bigger, with MSTR up 1,800% versus NVDA’s 1,150%, that’s probably the best evidence of MicroStrategy and its CEO Michael Saylor’s success. Source CryptoX Portal

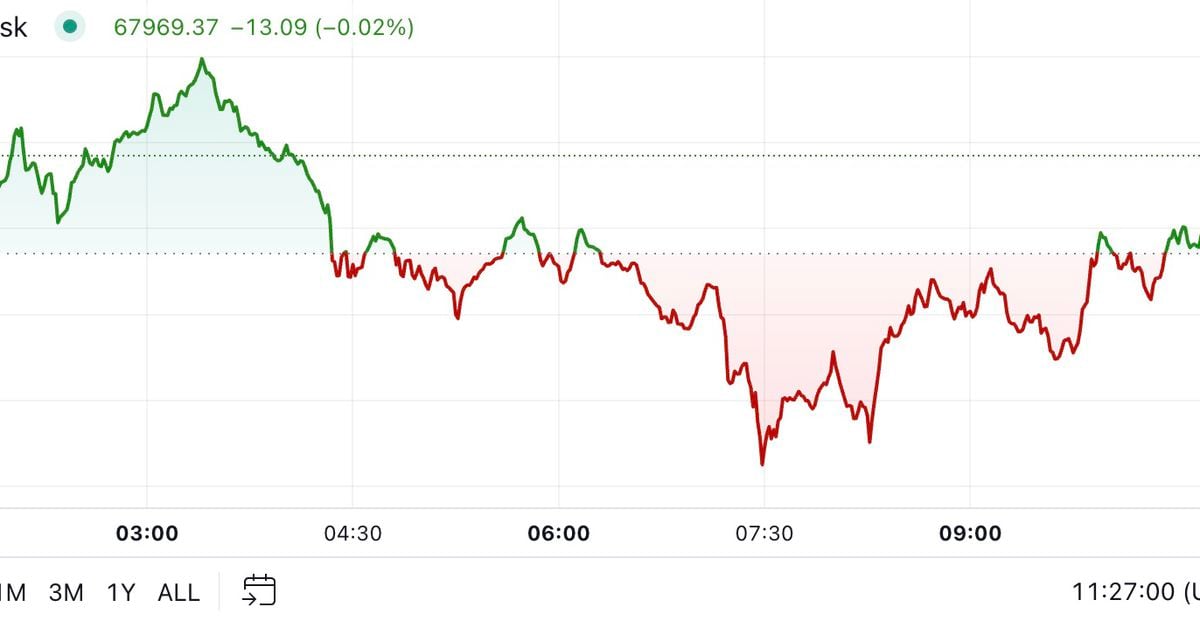

Bitcoin Falls Back Below $68K, Still Outperforms Broader Market

Bitcoin traded between $67,500-$67,900 during the European morning following a retreat from above $68,000. BTC remains over 1.2% higher in the last 24 hours, outperforming other major tokens, which have posted more modest gains. ETH and SOL have risen around 0.75%, while DOGE is up nearly 1%. The broader digital asset market, as measured by the CoinDesk 20 Index, has risen just under 0.8%. Bitcoin looks on course to close the week over 1% lower, according to CoinDesk Indices data, having failed to sustain any of its ascents north of…

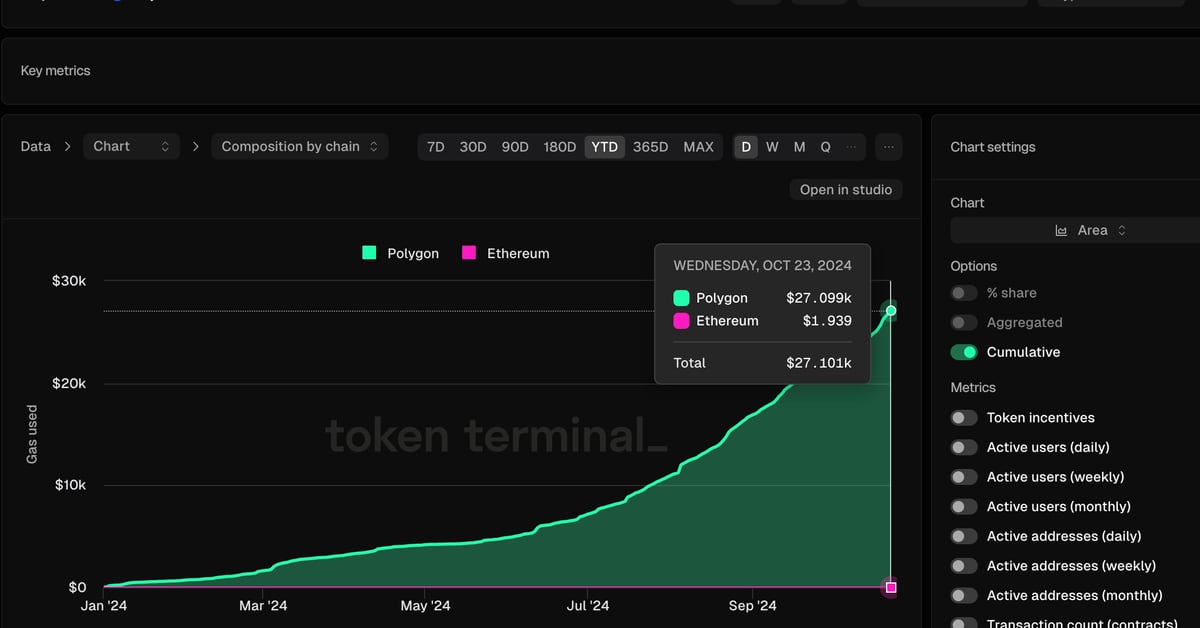

Polymarket Is Huge Success for Polygon Blockchain – Everywhere But the Bottom Line

“Now, that’s very different from, let’s say there’s somebody who comes and builds an order book DEX on Polygon PoS,” he said. “If they were doing $20,000 of fees over multiple months, it would be a massive failure, because you would expect massive numbers of orders placed and canceled and filled, then that would drive huge numbers of transactions. So the key here is like, different applications have different intended purposes.” Source

Major Japanese companies want to prioritize Bitcoin and Ether for crypto ETFs

A group of Japanese financial institutions urge the government to focus on major tokens such as Bitcoin and Ether in talks of allowing exchange-traded funds for cryptocurrencies. According to a Bloomberg report, a group of Japanese companies lodged a series of proposals on Oct. 25 with a title that translates into “Recommendations for the composition of crypto assets ETFs, etc. in Japan”. The country remains on the fence about whether it will permit the instrument. In the group’s proposal, it states that the majority of voices agree that if Japan…

Michael Saylor’s MicroStrategy (MSTR) Makes New Highs as Trading Volume Relative to Nvidia Surges

With a year-to-date gain of over 240%, MSTR has outperformed NVDA’s 192% surge by a big margin. Since MSTR adopted bitcoin as a treasury asset in August 2020, the gap has grown even bigger, with MSTR up 1,800% versus NVDA’s 1,150%, that’s probably the best evidence of MicroStrategy and its CEO Michael Saylor’s success. Source

Solana’s Evolution: High-Speed Blockchain Faces New Challenges in 2024

Jessie A Ellis Oct 25, 2024 10:18 Solana, known for its speed and efficiency, has rebounded from initial setbacks to secure a niche in payments and consumer markets. The blockchain continues to evolve amidst growing competition. Solana, a high-performance blockchain recognized for its low latency and user-centric design, has made significant strides since its inception. Despite early challenges such as network outages and a strong association with the now-defunct FTX exchange, Solana has carved out a niche in payments, decentralized physical infrastructure…

MEW Hits $1B Market Cap After New ATH, Cat Season Arrived?

Rubmar is a writer and translator who has been a crypto enthusiast for the past four years. Her goal as a writer is to create informative, complete, and easily understandable pieces accessible to those entering the crypto space. After learning about cryptocurrencies in 2019, Rubmar became curious about the world of possibilities the industry offered, quickly learning that financial freedom was at the palm of her hand with the developing technology. From a young age, Rubmar was curious about how languages work, finding special interest in wordplay and the peculiarities…

Newly-Qualified Crypto Custodian Balance Aims to Bring ETF Assets Held in the U.S. Back to Canada

The bigger picture concerns the growth of the crypto sector in Canada more broadly. The amount of crypto collectively held in Canada’s ETFs might not seem like a big deal right now, Bordianu says, but given the growth of things like tokenized real world assets and the proliferation of stablecoins, Canada needs to focus on building its own infrastructure to handle these assets. Source