The layer 2, which went live in 2022, represented a big step in the evolution of Coinbase, opening a new venture for the exchange beyond being a marketplace for crypto. It has since become a fast-growing part of the company’s business, handling 55% more transactions in the third quarter than in the second. Source

Day: October 31, 2024

Institutions Bet Bitcoin Exceeds $79,300 By End Of November

Este artículo también está disponible en español. Institutional traders are betting that Bitcoin will surge to $79,300 by the end of November. This bullish sentiment is evident in recent trading activities on the Chicago Mercantile Exchange (CME), where Bitcoin options have experienced some of their highest trading volumes ahead of the US presidential election. Bitcoin To Rise Above $79,300? Joshua Lim, co-founder of Arbelos Markets—a trading firm providing liquidity across cryptocurrency derivatives markets—shared insights on X about these notable trades. “CME Bitcoin options just experienced some of its largest volume…

APT Falls 4%, Leading Index Lower From Wednesday

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation.…

Freed From Prison, Binance Founder CZ Gets Ovation in Dubai and Talks New Educational Venture

The Binance founder received an ovation at a standing-room only appearance in Dubai. Source

Bitcoin Returns to $72.5K in Muted Market Activity

Bitcoin appears to be taking a breather as October draws to a close, trading around $72,500 during the late European morning, about 0.3% higher in the last 24 hours. The broader digital asset market has fallen nearly 0.9%, as measured by the CoinDesk 20 Index, with ETH and SOL lower by 1.15% and 0.3%, respectively. Bitcoin has gained over 6% in the last week, so the temporarily muted price action may point toward profit-taking. Nevertheless, spot bitcoin ETFs registered $893 million of inflows on Wednesday, a second consecutive day of…

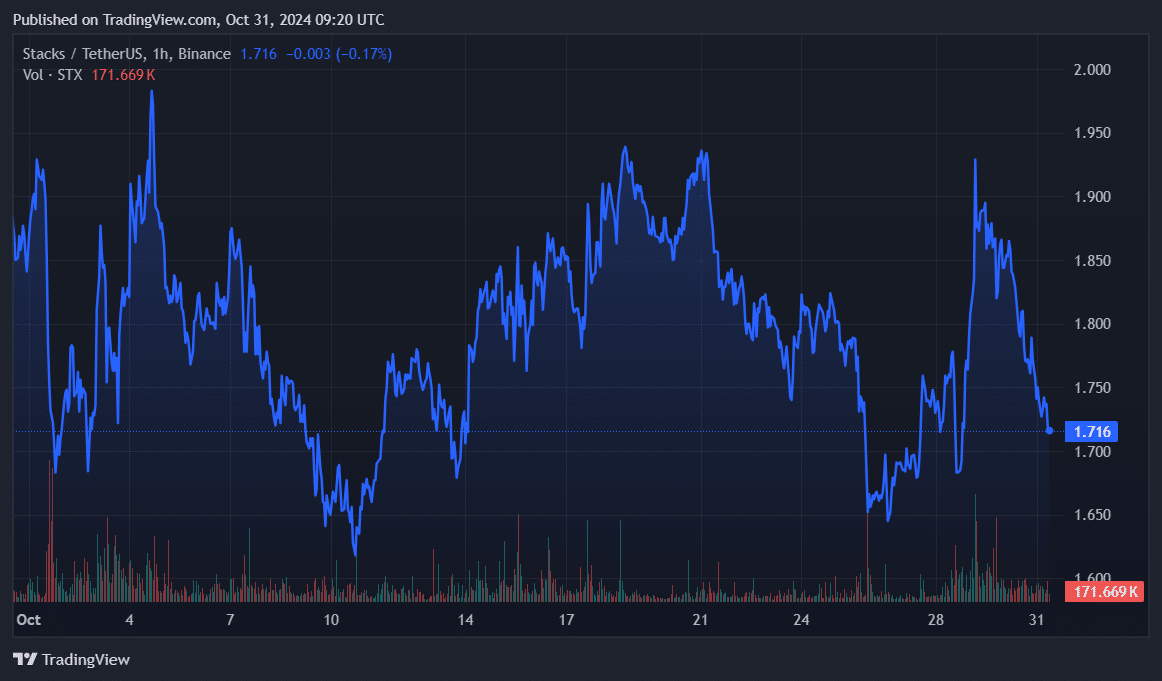

STX poised for long-term growth following Nakamoto upgrade

Stacks, a Bitcoin layer-2 solution, is currently garnering attention as its latest developments hint at substantial long-term growth potential. Following the recent Nakamoto upgrade on Oct. 29, 2024, which promises faster transactions and greater scalability for Stacks (STX), the network experienced a surge in activity, per data from Artemis. According to CEX.IO analysts, Stacks’ active addresses grew by 97%, and transactions rose by 94%. The Nakamoto upgrade also sets the stage for the upcoming sBTC release, a feature that will allow smart contracts anchored on Bitcoin (BTC). sBTC will address…

Analyst Says Expect 98% Crash After Blow Off To $250,000, Here’s Why

Este artículo también está disponible en español. A crypto analyst has forecasted a 98% Bitcoin price crash following a substantial rally to $250,000. Interestingly, the analyst is confident that Bitcoin will eventually reach this ambitious quarter-million-dollar target. However, they caution that once profits are taken at this top, Bitcoin could decline significantly to new lows. Bitcoin Price Projected To Crash 98% On October 30, crypto analyst Gert van Lagen told his 106,700 followers on X (formerly Twitter) that the Bitcoin price could drop to the $24,000 range once it hits…

Robinhood (HOOD) Shares Slump 10% After Third-Quarter Earnings Miss: Analysts

The company missed many important revenue metrics including “account growth, new net assets, trade pricing, new gold account subscriptions,” the Wall Street bank said. Still, it is managing expenses well, and this supported earnings per share (EPS) for the quarter, the bank said. Source

Brazilian Central Bank Considers Taxing Stablecoin Remittances

The stablecoin boom in Brazil has caught the attention of the central bank, which is currently exploring several ways to tax stablecoin remittances, including issuing a special license for crypto exchanges that provide these services. Central Bank of Brazil Explores Tax on Stablecoin-Based International Transactions, but There’s a Catch The Central Bank of Brazil is […] Source CryptoX Portal

UK Crypto Exchange Archax to Buy Spanish Broker King & Shaxson Capital Markets (KSCM) to Expand in Europe

“The Archax strategy has always been to expand its regulatory footprint globally, with the EU region being of prime importance for us, post-Brexit,” Graham Rodford, CEO and co-founder of Archax, said in a release. “This acquisition expands and enhances our access to permissions within the EU region, building on those we hold with the FCA in the UK,” he added. Source