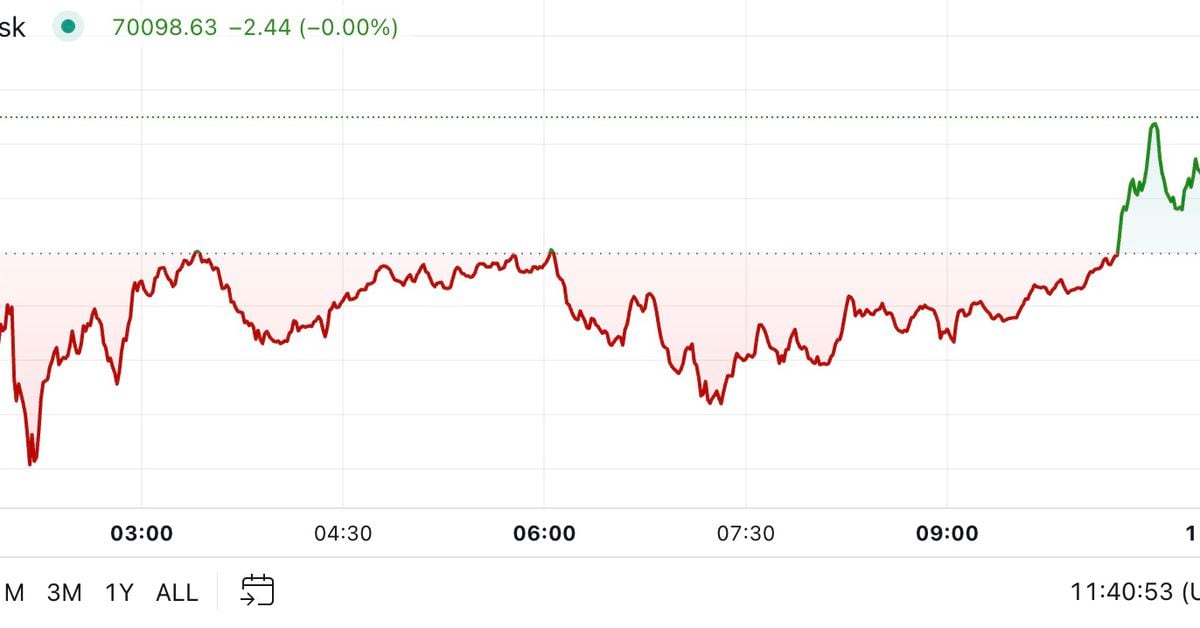

Cryptocurrencies and stocks remained on edge after the U.S. released weak nonfarm payroll data, pointing to a potentially dovish Federal Reserve. Bitcoin (BTC) pulled back from around $72,500 to the $70,000 level while Ethereum (ETH) is now down more than 3% over the past 24 hours to $2,500. The total market cap of all coins dropped to $2.45 trillion, while the crypto fear and greed index moved from the greed zone of 65 to 57. American stock index futures responded positively, with the Dow Jones, S&P 500, and Nasdaq 100…

Day: November 1, 2024

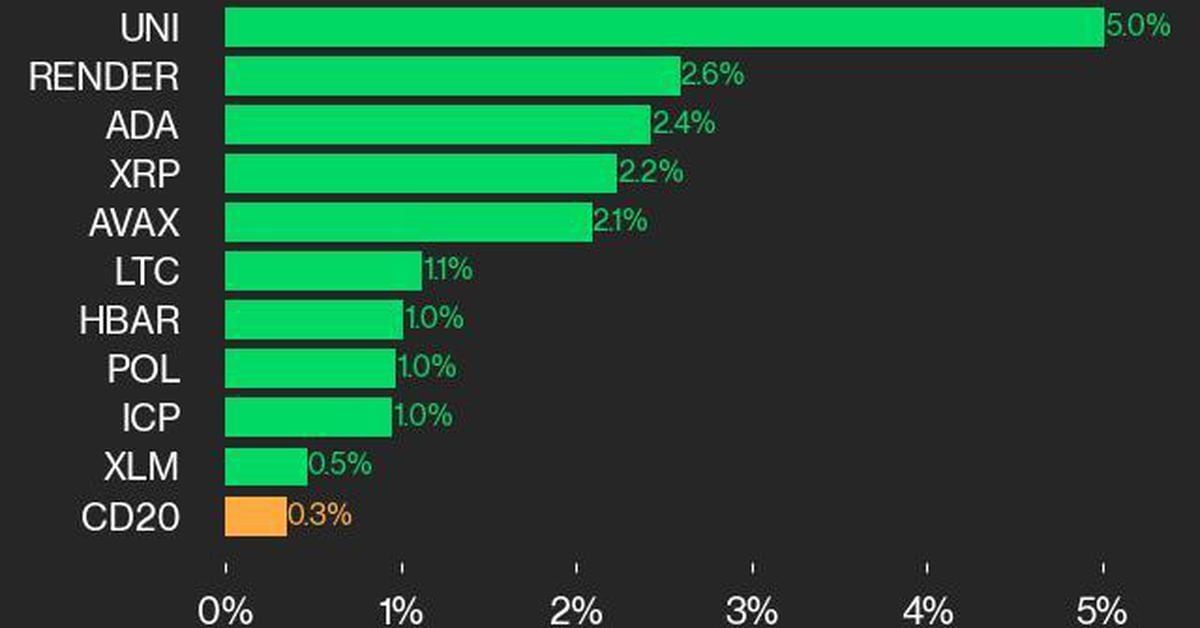

CoinDesk 20 Performance Update: UNI Gains 5% as Index Rises from Thursday

Render joined Uniswap as a top performer, gaining 2.6%. Source

Why was Bitcoin price down overnight?

Bitcoin price has pulled back over the past three days as the recent rally paused ahead of next week’s election. Bitcoin (BTC) retreated to $68,762, down 6.60% from its highest level this year. This decline has also triggered further sell-offs among altcoins, with the Mask Network (MASK), Immutable X (IMX), Doland Tremp, and Moo Deng being some of the worst performers. Bitcoin and these altcoins have declined partly due to the reduced odds of Donald Trump winning the general election next week. According to Polymarket, his odds have dropped to…

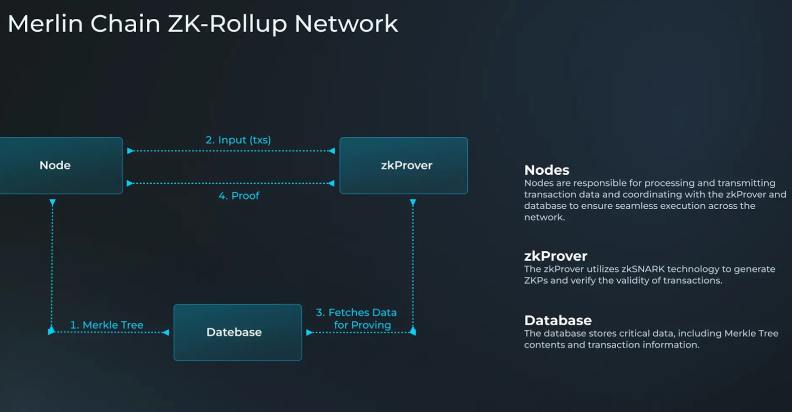

From Sidechain to ZK: Merlin Chain Pioneers Transformation in the Bitcoin Ecosystem

PRESS RELEASE. Since its inception, Merlin Chain has adeptly leveraged its technical strengths and flexible strategies to foster innovation within the Bitcoin ecosystem. With a robust community foundation spanning areas such as BRC-20, BRC-420, Blue Box, and Bitmap Game, Merlin is evolving from a Bitcoin sidechain to a ZK Layer 2 solution, unlocking significant potential […] Original

Bitcoin Price (BTC) Volatile, but Holding Near $70K Following Weak Employment Report

The U.S. added just 12,000 jobs in October, according to the Nonfarm Payrolls report, well shy of economist forecasts for 113,000. September’s job gain of 254,000 was revised down to 223,000. October’s unemployment rate was 4.1% versus 4.1% expected and 4.1% in September. Original

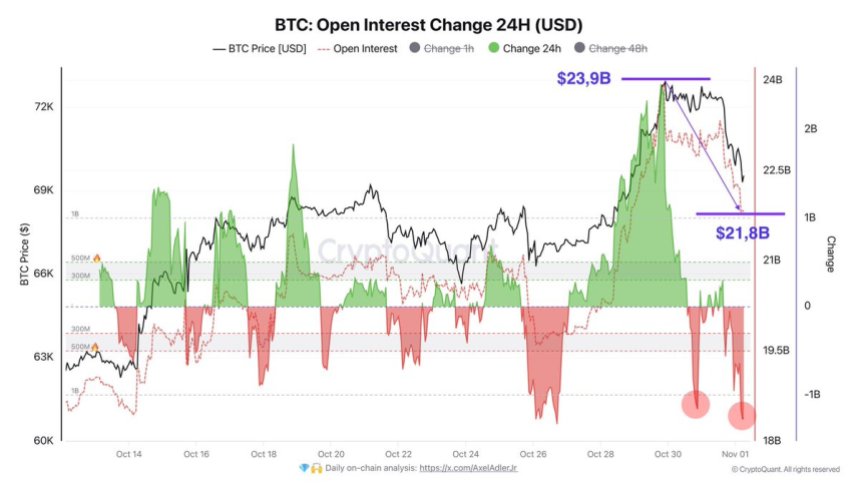

Bitcoin Open Interest Reduced By $2.1 Billion In 24 Hours – Time For Spot To Push The Price?

Este artículo también está disponible en español. Bitcoin is currently trading above $69,000, following a 6% pullback from its recent peak at $73,600. The recent surge in open interest has been a key factor in driving BTC’s price action, with open interest reaching $23.9 billion on October 30, a significant uptick that indicated high market engagement. However, in the past 24 hours, data from CryptoQuant reveals a $2.1 billion decline in open interest, signaling a shift as BTC’s price retraces to lower levels. Related Reading This cooling off has led…

Bitcoin Pares Losses Following Thursday’s Slump

Bitcoin pared some of its losses, returning to $70,000 during the European morning after falling as low as $68,800. Still, BTC remained about 3% lower in the last 24 hours. Altcoins suffered greater losses, with the CoinDesk 20 Index’s measurement of the broader crypto market down over 3.5%. Explanations for the slide range from profit-taking following the rally earlier in the week to a dip in Donald Trump’s election victory odds on Polymarket. Traders have also been looking at tech earnings, tensions between Iran and Israel and a sharp rise…

Bridge, Which Is Being Bought by Stripe for $1.1B, Acquires Web3 Infrastructure Platform Triangle

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information have been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation.…

Canaccord Lauds MicroStrategy’s (MSTR) Leverage Strategy, Labels It One of the Best Bitcoin (BTC) Exposure Plays

“If stock price is the true test for any business model, then in our view MSTR is hard to beat,” analysts led by Joseph Vafi wrote, noting that since the firm adopted its bitcoin acquisition strategy in 2020 it has significantly outperformed both equities and the world’s largest cryptocurrency. Original

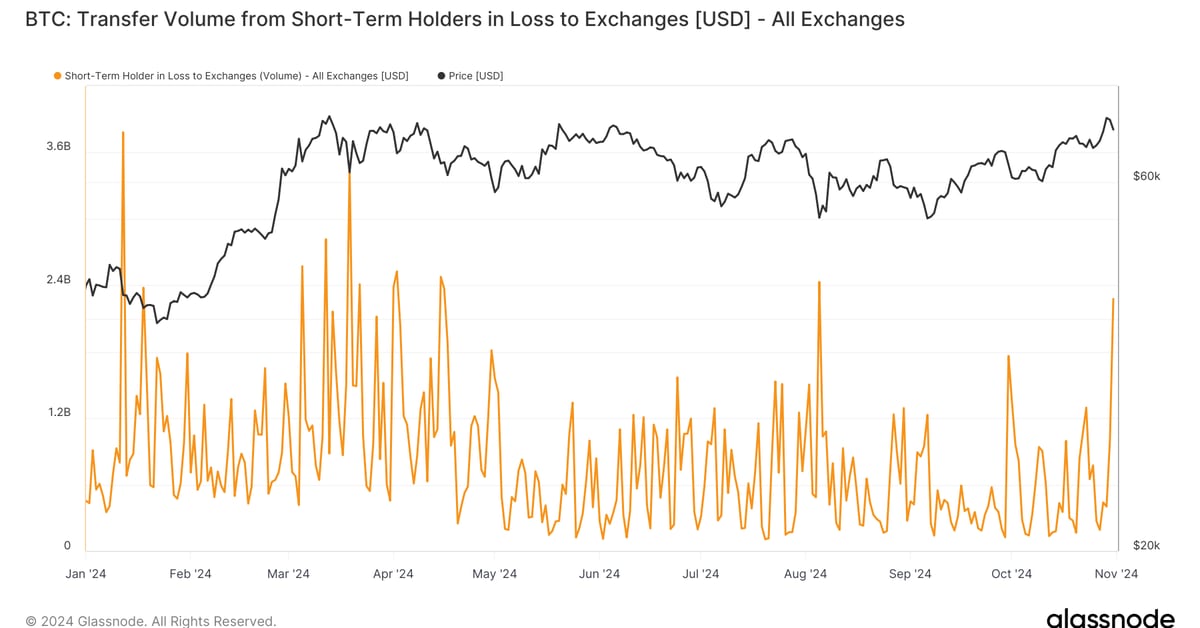

Bitcoin’s Drop on Thursday Spurred Short-Term Holders to Sell BTC at a Loss: Van Straten

The panic selling was the most since Aug. 5’s yen carry trade unwind. Short-term holders — investors who have held bitcoin for less than 155 days — tend to panic and sell when the price drops, and buy when there is euphoria or greed in the market. In total, they sent over 54,000 BTC to exchanges on Thursday, the highest amount since Mar. 27. Source