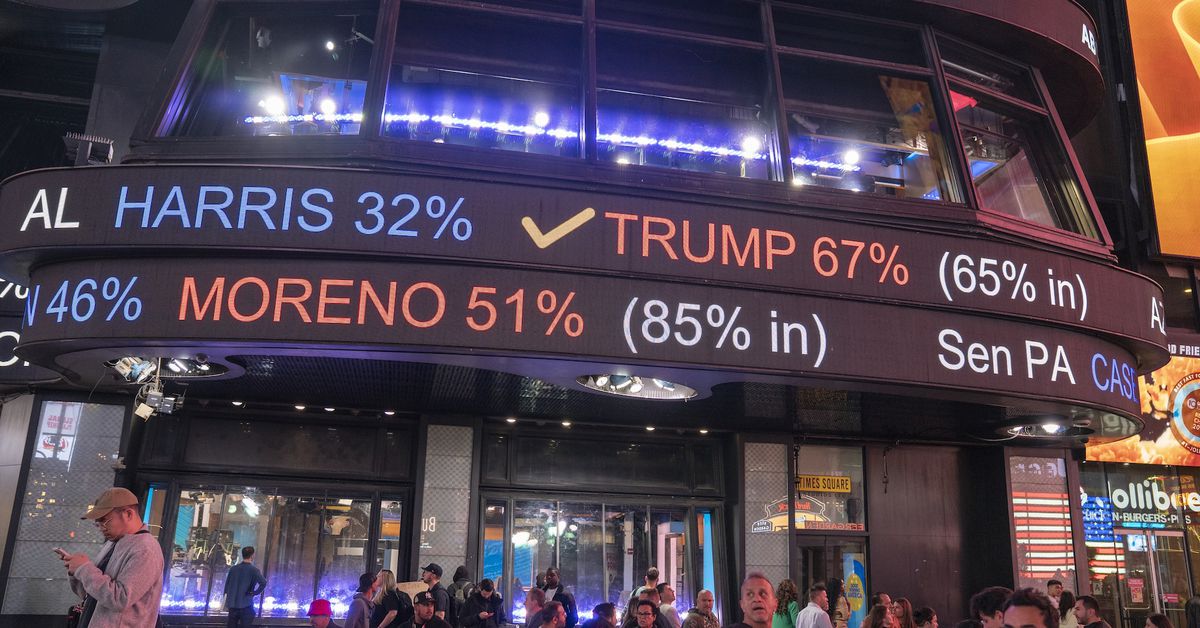

If the prediction market’s traders are right – and lately, they’ve been right – the election results are even more bullish for crypto than they appear. Source

Day: November 6, 2024

Massive Bitcoin Short Liquidations Send BTC Above ATH – Trump Win Sets A Bullish Environment

Este artículo también está disponible en español. Bitcoin surged to new all-time highs during election night, hitting an impressive $75,300 as market excitement reached a fever pitch. This milestone pushed Bitcoin into price discovery, igniting significant liquidations across trading platforms. Data from CryptoQuant reveals an unprecedented surge in short liquidations, surpassing $100 million within a single one-minute candle, marking a historic moment for BTC. This explosive price action was fueled by the surprise Trump win in the U.S. election, which appears to have sparked renewed enthusiasm for crypto assets as…

Boom or Bust? Research Shows Only 3% of Meme Coins Survive

Meme coins are the current rave in the crypto industry. However, question marks remain over their long-term viability. Meme Coins: Next Big Thing or Exit Liquidity for Cabals? Meme coin traders, hold your seats. According to a recent publication by Binance Research, 97% of meme coins are already dead with almost $0 of trading volume. […] Source CryptoX Portal

Futures Market Hints At More To Come

The futures market is signaling that the current Bitcoin rally, spurred by Donald Trump’s recent election victory on Tuesday, might be starting. According to Vetle Lunde, head of research at K33 Research, the election’s immediate aftermath has seen a “risk-on rotation” across derivatives, indicating a surge in investor confidence. Bitcoin Options Market Targets $80,000 By Late November On the Chicago Mercantile Exchange (CME), the basis—the difference between the spot market price and futures contract prices—has risen sharply from 7% to over 15% in a single day, reflecting heightened interest from…

How to Build an Asset Class in Three Easy Steps

Kelly Ye, portfolio manager at Decentral Park Capital and Andy Baehr, head of product at CoinDesk Indices, trade views, active manager vs indexer, on what steps are most important to shape the capital markets and investment landscape for digital assets in a post U.S. election world. Source

How Trump Could Change Crypto

So far this year, the rise of crypto prices has mostly been in BTC and a small number of other popular assets. Out of the 20 assets in the CoinDesk 20 index, only six were in the green as of Nov. 1 (Bitcoin Cash, Render, Near, Bitcoin, Ether, Solana). Source

Dogecoin and Shiba Inu Pumping as Bitcoin Passes $75K, Flockerz Could Explode Next

Pro-crypto Donald Trump has claimed in the US election and the market is booming, with Bitcoin hitting a new all time high of $75,000. Meme coins are surging across the board, with Dogecoin (DOGE) and Shiba Inu (SHIB) having both posted hefty gains in the past day as the bulls take control of the crypto […] Original

Bitcoin Mining Stocks Skyrocket as Trump’s White House Win Sparks Crypto Rally

After last week’s turbulent period, publicly traded bitcoin mining companies rebounded on Wednesday, celebrating a strong performance as Trump clinched the White House. Bitcoin Mining Stocks See Explosive Gains On Nov. 6, bitcoin mining stocks rallied, riding high alongside bitcoin, which hovered at $74.6K by 9:40 a.m. ET on Wednesday. MARA Holdings (MARA), boasting the […] Original

Uniswap Surges Toward $8.74 – Can UNI Push Through To New Heights?

Uniswap (UNI) is riding a wave of renewed bullish momentum, with its price inching closer to the critical $8.74 resistance level. This surge has captured the attention of investors eager to see if UNI can overcome this hurdle and unlock fresh upside potential. As the market sentiment shifts more positively, the $8.74 level is a pivotal strength test for Uniswap’s rally. This article uncovers the dynamics behind Uniswap’s climb toward $8.74, evaluating if this resistance level could be the gateway to further gains. We’ll examine the key technical indicators, market…

Bitcoin Price (BTC) Rises, but Altcoins and UNI Outperform Following Trump Victory

Additionally, funding rates for UNI have doubled over the last day from approximately 5% to 10%, with a positive funding rate meaning traders who are long have to pay short traders to keep their position open. Other things being equal, higher funding rates mean traders are anticipating further price advances. Source