The Consumer Price Index (CPI) rose 0.2% in October versus forecasts for 0.2% and a 0.2% rise in September, according to a government report on Wednesday morning.. On a year-over-year basis, the CPI was higher by 2.6%, also matching forecasts even as it rose from 2.4% in September. Original

Day: November 13, 2024

BTC’s Climb Lifts Miner Revenue, Restoring Hashprice to June Levels

As bitcoin’s price rises to new heights, miners are cashing in, with the value of 1 petahash per second (PH/s) of SHA256 hashrate reaching the highest peak in 152 days. Miner Earnings Rebound as Bitcoin Climbs Bitcoin miners are savoring the latest BTC price highs, with the hashprice climbing 31.63% since Nov. 5. Essentially, hashprice […] Source CryptoX Portal

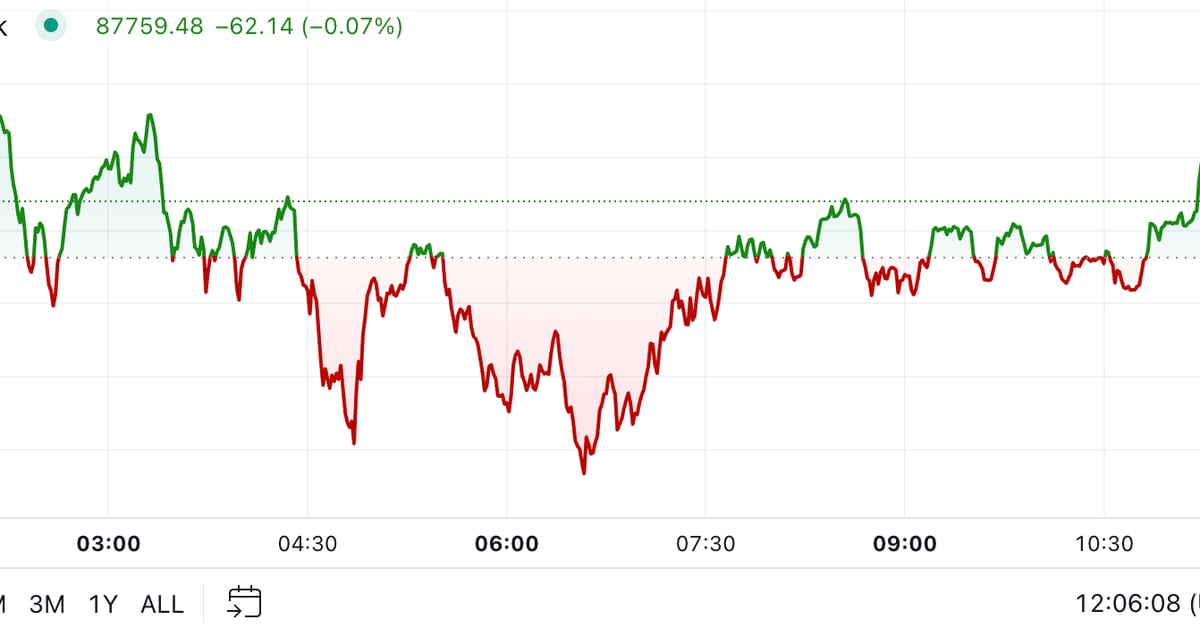

Bitcoin Consolidates After Encountering Resistance at $90K

Bitcoin has applied the brakes to its record-shattering rally after encountering resistance at the $90,000 level. Having briefly hit $90,100 on Coinbase during the U.S. afternoon Tuesday, BTC succumbed to selling pressure, falling as low as $86,200 during the European morning. It subsequently recovered some ground to settle around $87,500, about 2.65% lower than its Tuesday highs. Altcoins saw greater losses, with ETH and SOL falling by 3.6% and 2.8, respectively, in the last 24 hours. The broader crypto market, as measured by the CoinDesk 20 Index, dropped 1.4%. Original

Dogecoin Outperforms Bitcoin: Bloomberg Expert Explains Why

Este artículo también está disponible en español. Over the past few weeks, Dogecoin (DOGE) has exhibited a massive surge, significantly outperforming Bitcoin (BTC) and other major altcoins. The memecoin has soared by 170% in the last two weeks, an astounding 250% over the past five weeks, and 95% in just the last five days. This meteoric rise has positioned Dogecoin as one of the top-performing digital assets in the current market landscape. Why Is Dogecoin Outperforming Bitcoin? Michael P. Regan, the global team leader for cryptocurrencies at Bloomberg and a…

XRP Hits $0.74, Highest Since Mid-March: Here’s Why

Este artículo también está disponible en español. Over the past nine days, XRP has experienced a significant rally, climbing from $0.4957 on November 4 to a peak of $0.7407 today on Binance—a surge of over 50% at one point. Approximately 30% of this ascent occurred within the last 48 hours. However, following this rapid rise, XRP saw a sharp correction, retreating by -12% to $0.65 as of press time. These are the key reasons for the rally: #1 XRP Funding Rates and Social Dominance Spike One of the primary drivers…

SOLCAT Debuts as the First Memecoin with a Live Pre-Launch Game on Solana

PRESS RELEASE. [Dubai / UAE] — In an exciting leap forward for memecoins, SOLCAT is set to make history as the first memecoin on Solana to debut with a fully live, interactive AAA game at pre-launch. Scheduled for November 18 at 1 PM EST, SOLCAT invites users to join a unique, immersive experience: an exclusive […] Source CryptoX Portal

Ether ETFs in the Black for the First Time After 5 Days of Inflows

After that, the ether ETFs did not enjoy the same response as their bitcoin equivalents had done in January. Grayscale’s Ethereum Trust (ETHE), which already had over $8 billion in assets at the time of listing, began experiencing outflows that were not offset by flows into the other funds. Source

Cardano Foundation Spent $23.7M in 2023: Financial Insights Report

“This report highlights the importance of accountability, disclosing the allocation of our resources, and how they help advance Cardano as a public digital utility across a wide range of industries. We have 100+ employees working with institutions, businesses, regulators, and policymakers to solve societal and enterprise challenges in new ways across 25 countries.” Source

Volatility Expected in Bitcoin Later Today as US Headline Inflation Data Is Expected to Tick Higher

The concern of inflation not being slayed can be shown in the U.S. yields, which have only soared since the Federal Reserve started the rate-cutting cycle with a 50bps rate cut, followed by a further 25bps rate cut. Since the first rate cut on Sep. 16, the U.S. 10Y has jumped from 3.6% to 4.4%. With the U.S. 3-month treasury yield trading at 4.6%, which follows the effective federal funds rate, it’s suggesting that no more than 25bps of rate cuts will occur over the next three months, as the…

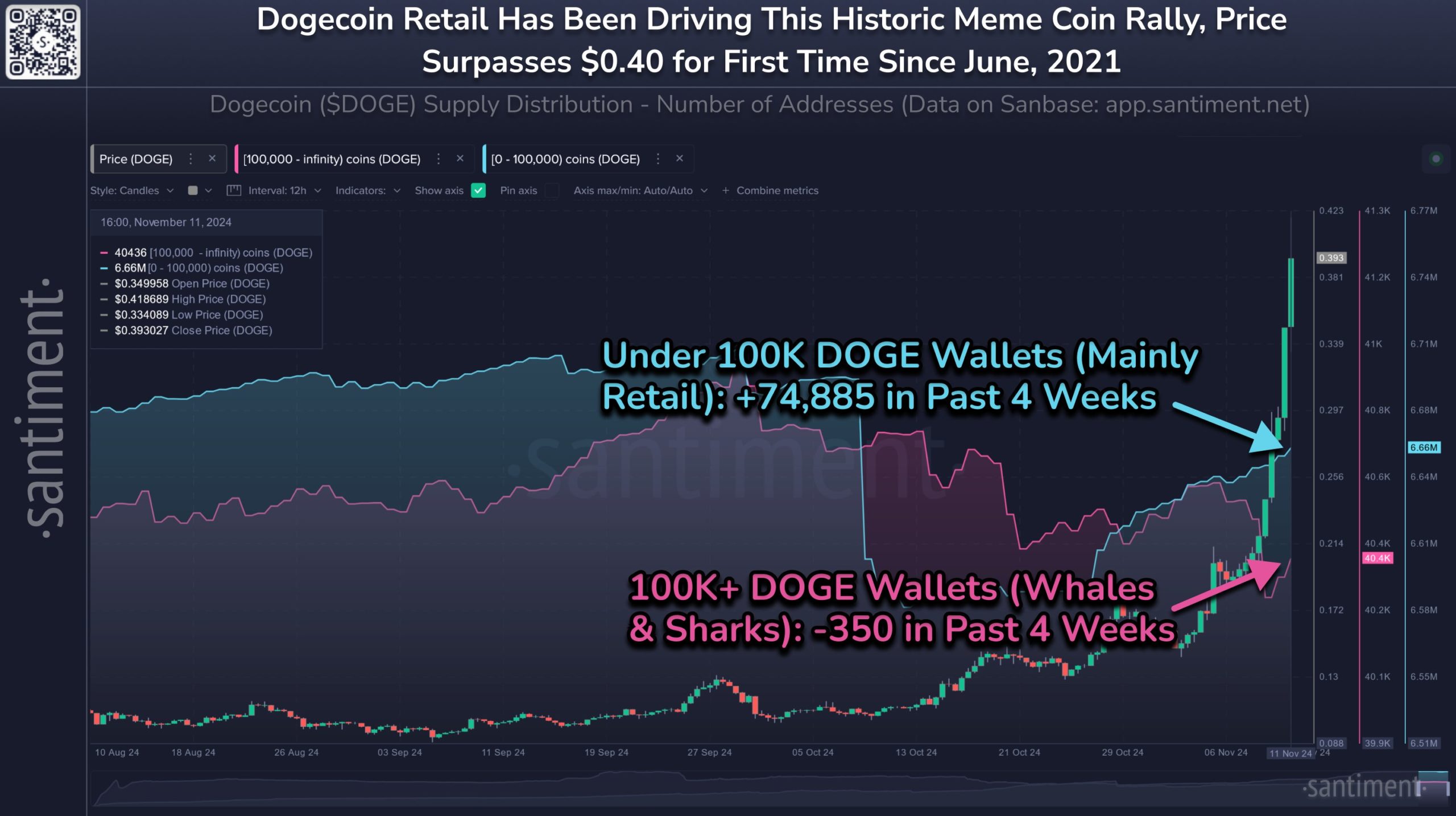

Dogecoin Explodes 150% As Shark & Whale Buying Returns

Este artículo también está disponible en español. Dogecoin has rocketed up with a rally of over 150% during the past week as on-chain data shows the return of sharks and whales on the network. Dogecoin Sharks & Whales Have Seen Their Count Grow Recently According to data from the on-chain analytics firm Santiment, the sharks and whales have shown a reversal in their count recently. The indicator of relevance here is the “Supply Distribution,” which tells us, among other things, how many addresses belong to a particular Dogecoin wallet group.…