In December 2020, the SEC filed a lawsuit against Ripple Labs, accusing the company of conducting an unregistered securities offering by selling XRP, which the SEC classified as a security. In July of last year, a U.S. court ruled that Ripple’s XRP sales to institutional investors qualified as securities transactions. However, it also determined that sales of XRP on public exchanges did not fall under the definition of a security. In October, the SEC appealed against this ruling, seeking further clarification on the legal status of XRP. Source

Day: November 16, 2024

Bitcoin Technical Analysis: BTC Holds Above $90K Despite Consolidation

Bitcoin has been holding steady at $90,258 to $90,509 over the last hour and indicators suggest a continuation of positive momentum, though minor pullbacks across timeframes hint at chances for strategic moves. Bitcoin Bitcoin‘s hourly chart showcases a recent climb to $91,909, followed by a slight dip. Recent drops signal bearish movement, but the decline […] Original

Dogecoin Drama Ends: Investors Drop Elon Musk Lawsuit Appeal

A lawsuit claiming that Tesla’s Elon Musk rigged Dogecoin to benefit his company has ended. According to reports, investors who initially claimed that Musk manipulated Dogecoin’s price have withdrawn their complaint. Also, the group is withdrawing its bid to sanction Musk’s lawyers for supposedly interfering with the appeal, including canceling a request to cover their legal fees. The lawsuit alleged that Tesla and Musk influenced Dogecoin’s price through social media posts and public statements. They highlighted Musk’s appearance on Saturday Night Live in 2021, arguing that the Tesla owner made…

How crypto could save the US from a debt crisis

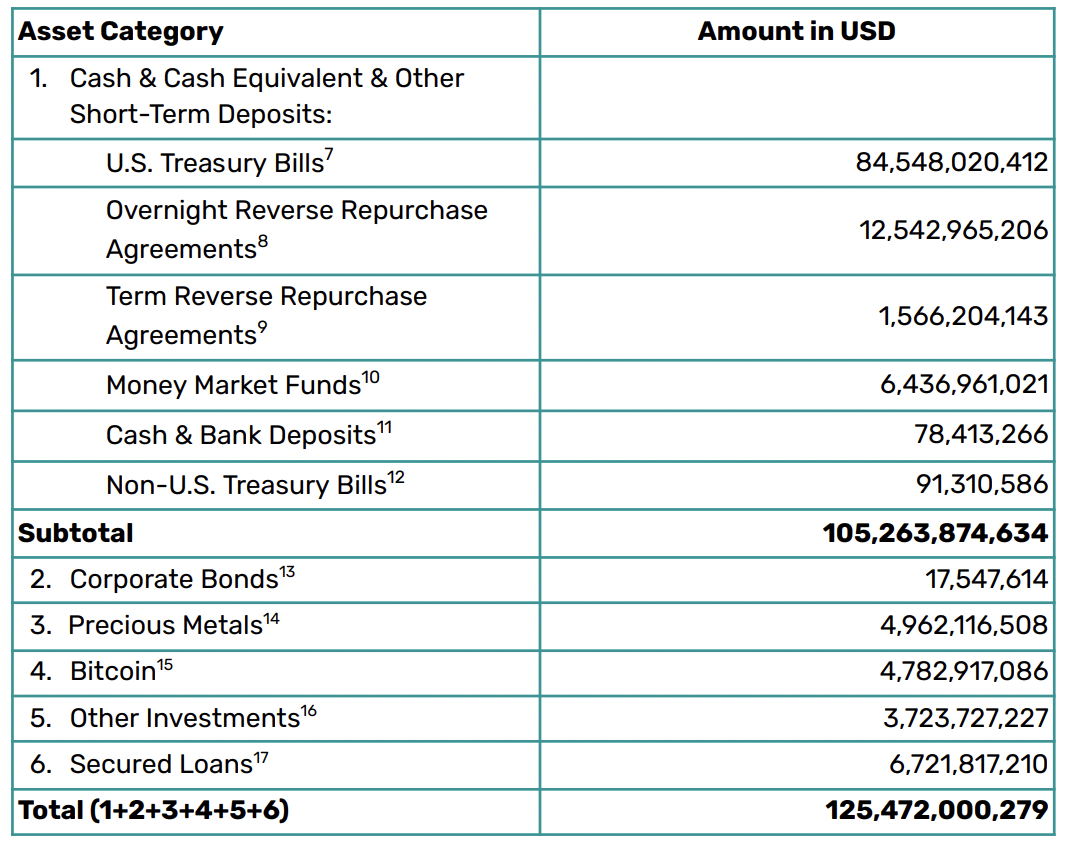

Crypto could stave off the U.S. debt crisis, according to Former House Speaker Paul Ryan in his recent op-ed published in the Wall Street Journal. Ryan argues that America’s $35.46 trillion and rising debt threatens the U.S. dollar’s status as a global reserve currency. Stablecoins could delay the crisis as they emerge as purchases of U.S. debt. Stablecoins as a source of demand for U.S. debt Dollar-backed stablecoins like USDT (USDT) and USD Coin (USDC) hold over $95 billion in U.S. Treasury bills, per their recent reserve reports. As stablecoins…

Michael Saylor’s ‘No Second Best’ Holds Strong as BTC Outpaces Hypothetical ETH Investment

Based on blockchaincenter.net’s “there is no second best” index—drawing from Michael Saylor’s well-known remark—Microstrategy’s strategy of purchasing bitcoin outshines what the company would have gained if it had opted for ethereum instead. Microstrategy’s Bitcoin Holdings Deliver, Leaving Ethereum Alternatives Behind Over the past month, bitcoin has held its own, but ethereum (ETH), the second-largest cryptocurrency […] Source CryptoX Portal

Bitcoin NVT Golden Cross Signals ‘Local Bottom’ — What’s Next?

According to the latest on-chain data, the Bitcoin Network Value to Transactions (NVT) Golden Cross has fallen into a crucial region. What could this mean for the price of the premier cryptocurrency? What Does The Falling NVT Golden Cross Mean For Price? In a recent Quicktake post on the CryptoQuant platform, an analyst with the pseudonym Burakkesmeci revealed that the price of Bitcoin might have reached a “local bottom.” This exciting prognosis is based on the latest movement by the “NVT Golden Cross” metric. For context, the “Network Value to…

As Bitcoin Rises, Why is Ethereum Struggling To Catch Up? Analyst Explains

Este artículo también está disponible en español. While Bitcoin has faced strong bullish momentum in recent weeks, achieving new all-time highs consistently for days, Ethereum has been an underperformer, unable to catch up with BTC’s bullish pace. Even compared to other crypto assets (altcoins) in the market, Ethereum has failed to make a major rally that melts faces. Instead, as Bitcoin achieved a peak above $93,000, leading the overall crypto market in a bullish market, Ethereum has only been able to surge to just $3,396 over the same period BTC…

It’s Morning in America for Crypto

With a decisive electoral sweep of the presidency and Congress, Trump’s second term could mark a transformative era for bitcoin, crypto, and the broader blockchain industry. This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished. Trump’s Victory Could […] Source CryptoX Portal

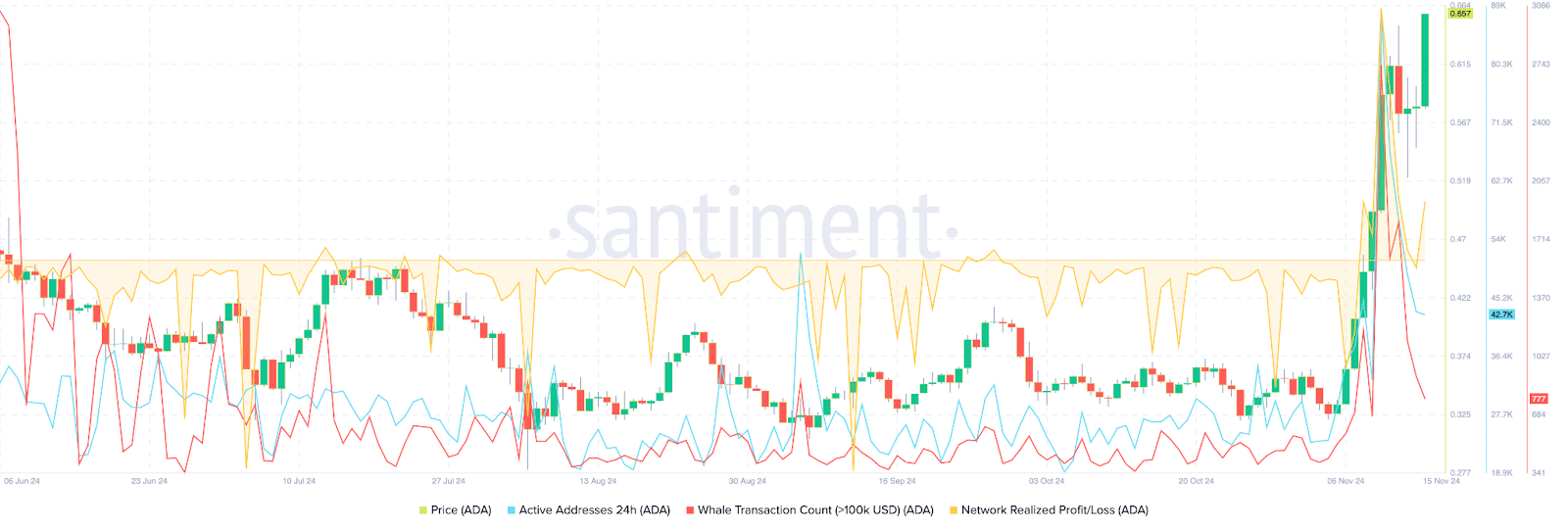

Cardano Could Rally 25%, Here’s Why

Cardano gained 35% on November 10, and the altcoin held steady close to the $0.65 level. The Ethereum competitor token, ADA, is rallying alongside Bitcoin, Ethereum, Dogecoin, and other leading cryptocurrencies, post BTC all-time high on Wednesday. Cardano’s on-chain indicators signal price growth Cardano (ADA) rallied alongside Bitcoin (BTC) as the largest cryptocurrency hit a new all-time high on November 12. BTC hit a record high at $93,265, while ADA climbed to a six-month high at $0.6599. Open interest in ADA climbed 15.51% in the last 24 hours as the…

Cardano To Hit $6 By Q3 2025? Analyst Forecast 2,000% Rally

Este artículo también está disponible en español. Cardano (ADA) has seen a massive rally in the last few weeks, surging over 81% in the past fourteen days. As the cryptocurrency continues breaking past key levels, a renowned crypto analyst highlighted its potential 2,000% climb. Related Reading Cardano To Hit $6 By Q3 2025 Crypto analyst Ali Martinez forecasted that Cardano might hit the $6 mark by September 2025. Earlier this year, the analyst noted that ADA’s chart reassembled a pattern similar to 2020, which suggests that the cryptocurrency could experience…