The decrease of bitcoin’s supply on exchanges could lead to higher price volatility, market maturity, and increased influence from institutional investors. Bitcoin Investors Are Not Selling Anytime Soon Bitcoin has seen a significant decline in its supply on cryptocurrency exchanges, reaching its lowest level since November 2018. This trend indicates that investors are increasingly opting […] Original

Day: November 18, 2024

Bitcoin Forms Bullish Pennant That Shows Surge To $113,000 Is Coming, Here’s How

Este artículo también está disponible en español. Crypto analyst Trader Tardigrade has revealed a bullish pattern that has formed on the Bitcoin chart. Based on this, the analyst explained how the Bitcoin price could rally to as high as $113,000. Bitcoin Bullish Pennant Could Send Price To $113,000 In an X post, Trader Tardigrade mentioned a bullish pennant that had formed on the Bitcoin chart. The analyst remarked that the BTC price is still preparing for the next pump with this bullish pattern. A bullish pennant indicates the continuation of…

How DeFi Is Preparing for DC’s Next Chapter

Second, build useful applications. During the hearing, representatives asked about financial and non-financial use cases. It was a privilege to answer questions and discuss The Value Prop, an open database cataloging use cases for blockchain-based applications across all crypto networks, like Ethereum, Bitcoin and more. I’ll say the quiet part out loud: For many, speculation is fun. But if the industry only chases the pump, it will never demonstrate the transformative value of DeFi. Source

Coinshares: Digital Asset Market Hits Unprecedented $138 Billion in Managed Funds

Coinshares reported that digital asset inflows reached $2.2 billion last week, pushing year-to-date inflows to a record $33.5 billion. Crypto Boom: Bitcoin Leads $2.2 Billion Weekly Inflows, Ethereum Surges Back The latest exchange-traded product (ETP) surge was analyzed in the latest report led by James Butterfill, Coinshares’ head of research. The data from the digital […] Source CryptoX Portal

Polymarket Trader Loses Millions on Tyson After Making Bank on Trump

Prediction markets are usually structured as yes/no bets on a given outcome; each share pays out $1 (in cryptocurrency, in Polymarket’s case) if the bet proves correct, and zero if not. The price of a share, expressed in cents on the dollar, indicates the market’s assessment, when translated into percentage terms, of the prediction coming true. Source

MicroStrategy Makes Record $4.6 Billion Bitcoin Purchase, Largest Yet

Business intelligence firm MicroStrategy has ramped up its Bitcoin (BTC) investment following President-elect Donald Trump’s victory in the presidential election. This pivotal moment on November 5 has provided a catalyst for the broader crypto market, further encouraging investment in digital assets. Bitcoin Holdings To Over $29 Billion Led by Bitcoin advocate Michael Saylor, MicroStrategy disclosed on Monday that it has acquired approximately 51,780 Bitcoin for around $4.6 billion. This acquisition marks the largest purchase by the company since it began its Bitcoin buying strategy more than four years ago. According…

Dogecoin Breaking Out Of Falling Wedge Pattern – Analyst Reveals Target

Este artículo también está disponible en español. Dogecoin (DOGE) is consolidating below local highs after an impressive 200% surge over the past two weeks. As the biggest meme coin by market capitalization, DOGE has again captured the spotlight, leading the market with its explosive performance. Top analyst and investor Carl Runefelt recently shared a technical analysis on X, highlighting Dogecoin’s breakout from a bullish pattern. Runefelt emphasized the potential for DOGE to sustain its upward momentum, citing increased demand and positive market sentiment as key drivers. He also shared a…

Semler Scientific buys 215 more Bitcoin, raises $21.5m in equity offering

Semler Scientific, a healthcare-focused medical equipment company, has updated investors on its Bitcoin holdings. It now owns $114 million worth of Bitcoin. Between Nov. 6 and Nov. 15, Semler acquired 215 Bitcoin for $17.7 million, averaging $82,502 per Bitcoin. The company now holds 1,273 Bitcoins, purchased at a total cost of $88.7 million, with an average price of $69,682 per Bitcoin, according to a press release. As of the time of writing, Bitcoin (BTC) is trading at $90,400. In May, Semler announced its first purchase under its new reserve strategy,…

MARA Plans $700 Million Convertible Notes Offering to Fund Bitcoin Purchase

MARA Holdings, Inc., a Nasdaq-listed bitcoin mining firm, has announced plans for a $700 million private offering of convertible senior notes due in 2030. MARA Holdings Proposes $700 Million Convertible Notes Offering MARA Holdings (Nasdaq: MARA) disclosed on Nov. 18 that the proposed offering is intended for qualified institutional buyers under Rule 144A of the […] Original

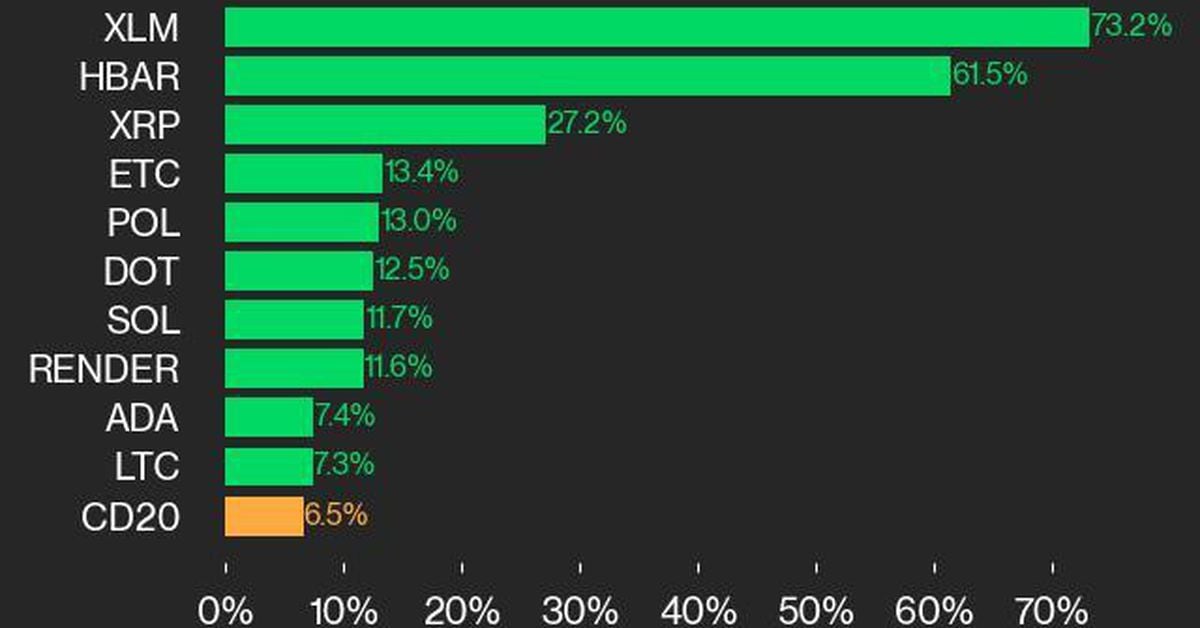

CoinDesk 20 Performance Update: XLM Surges 73.2% Over Weekend in Broad Rally

The CoinDesk 20 gained 6.5% over the weekend with all but two assets trading higher. Source