Thomas Trutschel | Photothek | Getty Images The board of Acurx Pharmaceuticals approved Wednesday the purchase of up to $1 million in bitcoin to hold as a treasury reserve asset. Shares of the the company were last lower by more than 6% after spiking about 8% in premarket trading. “As demand for bitcoin grows, and so does its acceptance as a major and primary asset class, we believe that bitcoin will serve as a strong treasury reserve asset for cash not needed over the next 12 to 18 months” CEO David P. Luci said…

Day: November 20, 2024

Gamma Squeeze Frenzy: Could Bitcoin Prices Skyrocket Past Six Figures?

A gamma squeeze, a high-stakes event in options trading, has the potential to catapult bitcoin (BTC) prices beyond the six-figure mark, reshaping the crypto market landscape. Understanding Call Options in the Bitcoin Market and the Gamma Squeeze To understand a gamma squeeze, it’s key to first grasp the basics of options trading. Options are financial […] Original

After Dogecoin & Pepe exploded, Flockerz raises $2M and could be the next 10x meme coin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Dogecoin and Pepe soar, adding billions to market caps, but new meme coin Flockerz’s $2M presale hints at a potential 10x surge. Dogecoin and Pepe have both exploded in price this month, adding multiple billions to their market caps. Yet, with new meme coin Flockerz raising $2 million in its presale, traders think a 10x gain could well be on the way. DOGE targets ATH, PEPE enters price discovery …

Hoth Therapeutics approves purchase of $1m Bitcoin

Nasdaq-listed Hoth Therapeutics has announced plans to purchase Bitcoin as a treasury reserve asset. Hoth disclosed on Nov. 20 that its board of directors had approved the acquisition of $1 million worth of Bitcoin (BTC). The biopharmaceutical company will become the latest institution to adopt Bitcoin as a reserve asset. While Hoth’s Bitcoin acquisition is relatively small compared to other recent purchases, it marks another significant boost for Bitcoin. The leading cryptocurrency continues to attract attention on Wall Street and globally, recognized for its value as a store of wealth…

$13 XRP? Analyst Says It’s Closer Than You Think

Este artículo también está disponible en español. Recently, XRP has experienced a significant increase in value, reaching a three-year peak of $1.27. The token is currently trading at $1.09 on a sustained weekly increase of 80%, and many investors are contemplating whether this marks the beginning of a new bull run. Related Reading Nevertheless, a seasoned analyst is uncertain. She cautions that XRP has demonstrated bullish potential; however, it is probable that a correction will occur before the altcoin can make its next significant move. XRP Hits 3-Year High –…

Canaan Expands North American Bitcoin Mining Operations, Secures Order From Hive

Canaan Inc., a publicly listed manufacturer of bitcoin (BTC) mining hardware and blockchain infrastructure provider, has shared plans to broaden its self-mining footprint in North America. Publicly Listed Bitcoin Miner Canaan Bolsters U.S. Presence The announcement published on Wednesday says Canaan (Nasdaq: CAN) aims to reach a computing capacity of 10 exahash per second (EH/s) […] Original

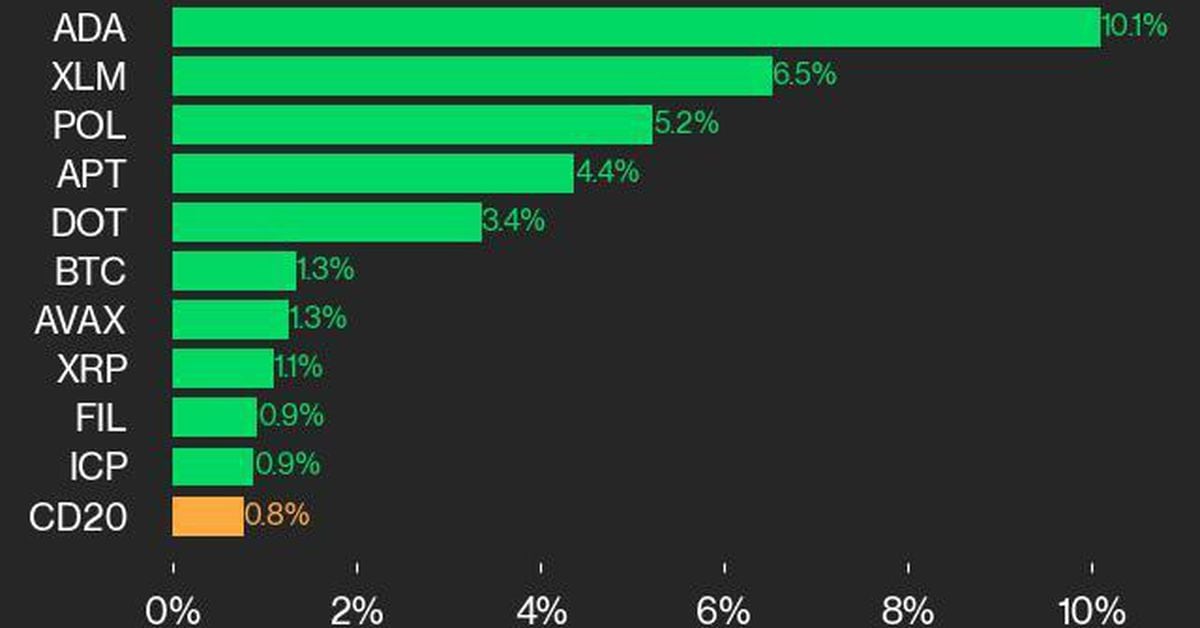

CoinDesk 20 Performance Update: ADA Gains 10.1% as Index Continues Higher

Stellar was also among the top performers, gaining 6.5% from Tuesday. Source

FDUSD Stablecoin Launches on Sui Blockchain

Rebeca Moen Nov 20, 2024 14:36 First Digital introduces its stablecoin, FDUSD, as a native token on the Sui blockchain, expanding DeFi options and showcasing institutional confidence in Sui’s growing ecosystem. First Digital has expanded its stablecoin offerings by launching the FDUSD stablecoin as a native token on the Sui blockchain. This development provides decentralized finance (DeFi) users with an additional option, further enhancing the ecosystem’s diversity, according to Sui Foundation. FDUSD Joins Sui’s Stablecoin Roster FDUSD joins a growing list of…

Coincheck Makes History as First Japanese Exchange Listed on Nasdaq

As the crypto space chases mainstream success, one of the institutions within it that has led the charge is crypto exchanges. This is to be expected as crypto exchanges are one of the most important businesses, helping investors to buy and sell their assets. On top of this, the state of crypto exchanges is typically […] Source BitcoincryptoexchangeExchanges CryptoX Portal

December 20 Call Signals BTC Price Target Of $180,000

Este artículo también está disponible en español. BlackRock, the world’s largest asset manager, has officially launched options trading for its Bitcoin ETF, the iShares Bitcoin Trust (IBIT). This debut comes after the ETF received regulatory approval in January and has since attracted significant inflows. Increased Liquidity And Reduced Volatility On The Horizon According to Bloomberg, the introduction of options trading on the $43 billion iShares Bitcoin Trust is anticipated to reduce volatility while broadening Bitcoin’s investor base. Related Reading Alex Thorn, head of firmwide research at Galaxy Digital, stated during…