The 12 U.S. spot bitcoin exchange-traded funds (ETFs) experienced a challenging Monday, with outflows reaching $438.38 million during the day’s trading. Bitcoin ETFs Bleed $438M in a Single Day as Crypto Prices Plunge. As the crypto market faced a general downturn and bitcoin (BTC) prices dipped, the 12 ETFs kicked off the week on a […] Original

Day: November 26, 2024

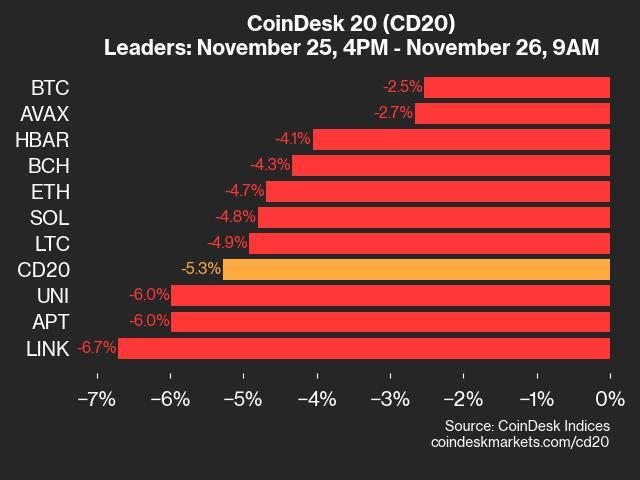

CoinDesk 20 Performance Update: XLM Falls 14.6% as All Index Constituents Decline

CryptoX Indices presents its daily market update, highlighting the performance of leaders and laggards in the CryptoX 20 Index.The CryptoX 20 is currently trading at 3150.49, down 5.3% (-175.81) since 4 pm ET on Monday.None of the 20 assets are trading higher. Leaders: BTC (-2.5%) and AVAX (-2.7%). Laggards: XLM (-14.6%) and POL (-10.4%). The CryptoX 20 is a broad-based index traded on multiple platforms in several regions globally. Source CryptoX Portal

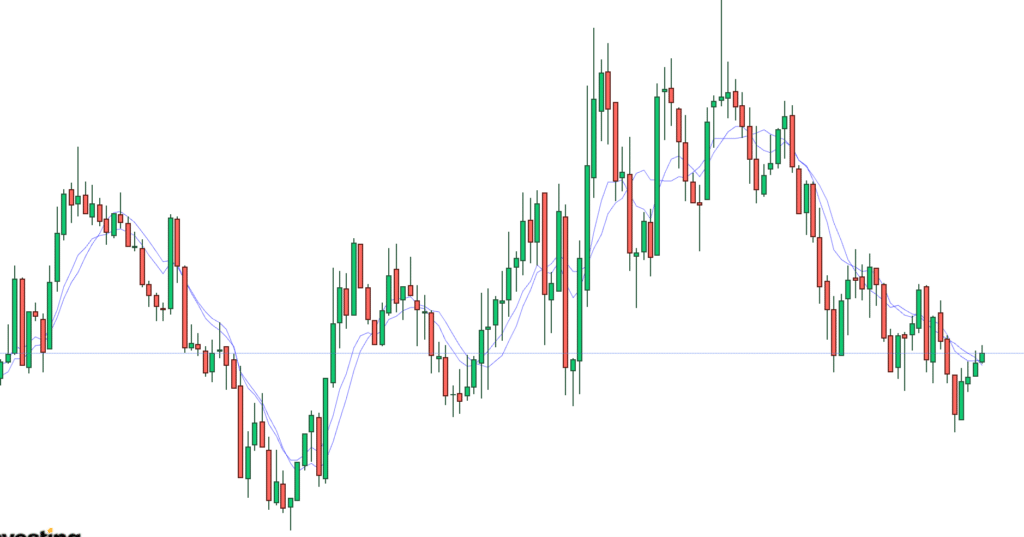

Bitcoin Holds At $93,257 As Bulls Struggle To Avoid Deeper Losses

Este artículo también está disponible en español. Bitcoin (BTC) stands firm at $93,257, a crucial support level that could determine its next major move. As the battle between bulls and bears intensifies, the stakes are high: a successful defense could spark renewed momentum, while a break below might trigger significant losses. As the market navigates this pivotal moment, this article aims to analyze BTC’s current position at the critical $93,257 support level, exploring the factors influencing its price movement. By examining key technical indicators and market dynamics, the goal is…

DOGE surges, Popcat struggles as trending ETH hybrid coin hits $1m

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Bitcoin nears $100k, Dogecoin rallies 195%, and Cutoshi emerges as a memeFi star, raising $1m in its presale. Crypto markets are breaking records. With Bitcoin hovering around $100k, altcoins are following. Doge has outperformed most major tokens, while Popcat is struggling. At the same time, a new ETH-based memeFi hybrid token Cutoshi is taking the markets by storm. Doge is poised for major gains After years of slow performance,…

Critics Debate Microstrategy’s High-Stakes Bitcoin Play: Genius or a Ticking Time Bomb?

Microstrategy’s bold move to accumulate bitcoin has drawn its share of fire from critics, largely due to the financial hazards and strategic questions it raises. Bubble Trouble? Critics Call Microstrategy Stock a ‘Ponzi Scheme’ Since 2020, the business intelligence firm has been on a bitcoin shopping spree, with its latest acquisition adding 55,500 BTC to […] Original

Swan Bitcoin Files Lawsuit Against Its Own Lawyers

Swan Bitcoin is suing its law firm for attempting to withdraw from a trade secrets case due to a conflict of interest with another client. Misappropriated Trade Secrets Cryptocurrency financial services firm Swan Bitcoin has filed a lawsuit against its own legal representative, Gibson, Dunn & Crutcher, alleging legal malpractice. In a lawsuit filed with […] Original

Bitcoin Leverage Remains High – Data Reveals Selling Pressure Above $93K

Este artículo también está disponible en español. After a historic rally, Bitcoin has faced its first major setback, pulling back 7% from its all-time high of $99,800. This comes after an impressive surge from $67,500 on November 5, marking a nearly 50% climb in just a few weeks. The price action has largely been “only up,” attracting significant attention from traders and investors alike. Related Reading However, the current pullback highlights growing caution in the market. Market caution said leverage levels remain elevated despite recent deleveraging efforts. Adler’s analysis reveals…

Digital Assets Platform Nexo Introduces USD, EUR, and GBP Fiat Accounts

Nexo, a digital assets wealth platform, has announced the launch of personal USD, EUR, and GBP fiat accounts. This new offering provides clients in over 150 countries with a seamless way to conduct bank transfers directly in their name, enabling efficient multi-currency management within a single platform. The introduction of these fiat accounts marks a […] Source CryptoX Portal

The transformative potential of Bitcoin in the job market

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial. Bitcoin (BTC) has already changed the world, and as it gains traction, its potential to reshape the job market is becoming increasingly apparent. Even though recently we saw layoffs by big companies like Consensys and Kraken, it must be due to the industry’s maturing nature where companies are not yet certain about hiring principals. The real story is that Bitcoin and its associated technologies will drive long-term…

Bitcoin Price Crash Not Over? Why A Decline To $89,000 Is Possible

Este artículo también está disponible en español. The Bitcoin price could crash if it fails to hold key resistance levels. A crypto analyst has revealed that a decline to $89,000 was well within possibility, as sell-offs below the $100,000 mark have continued to hinder Bitcoin’s price upward momentum. Bitcoin Price Correction To $89,000 Possible On November 26, TradingView crypto analyst Pejman Zwin shared a detailed chart representing a technical analysis of Bitcoin‘s price movements in a 1-hour time frame. The Bitcoin price chart highlighted vital resistance lines, support zones, and…