Este artículo también está disponible en español. Renowned macro analyst Alex Krüger posits that Bitcoin is “highly likely” in a supercycle. Krüger articulated his perspective via X, emphasizing the distinct trajectory Bitcoin is currently undertaking compared to previous market cycles. A Bitcoin supercycle is a theoretical phase wherein Bitcoin’s price is anticipated to ascend extraordinarily, surpassing its traditional boom-and-bust cycles. This concept implies a prolonged period of growth fueled by increased mainstream adoption, leading to a significantly stronger and more enduring upward trajectory than the typical four-year halving cycle that…

Day: December 9, 2024

November Was a ‘Monumental’ Month For The Crypto Market, JPMorgan (JPM) Says

November was a monumental month for the crypto market in terms of performance, activity, politics and sentiment, JPMorgan (JPM) said in a research report Monday. “President-elect Donald Trump’s reelection triggered a historic rally and jump in market caps across the crypto ecosystem,” analysts led by Kenneth Worthington wrote. This included tokens, decentralized finance (DeFi), stablecoins and publicly listed companies with crypto exposure. The bank noted that the crypto ecosystem recorded its best monthly return, with its market cap rising 45%. Total crypto market cap swelled to $3.3 trillion. Volumes across…

Bukele Bitcoin Law May Change Under New IMF Deal: Financial Times

El Salvador may roll back a small aspect of its Bitcoin law as part of a new deal with the International Monetary Fund. The Latin American country may no longer require Salvadorean merchants to accept bitcoin (BTC) as a means of payment across the nation, instead making bitcoin acceptance voluntary, according to a new report from the Financial Times. The legal modification is part of the conditions imposed by the IMF for El Salvador to gain access to a $1.3 billion loan program, the report said. The World Bank and…

Crypto Shockwave: Meme Tokens Outperform Bitcoin and Ethereum in a Down Market

Kicking off the week, meme coins are stealing the spotlight amid a widespread dip in the crypto economy. Monday’s trading saw tokens like pepecoin network, fartcoin, and baby doge coin pulling ahead as the few standouts in an otherwise lackluster market. Several Meme Tokens Thrive Despite 3.4% Market Decline The broader crypto economy has dropped […] Original

Saylor’s MicroStrategy added $2.1b in Bitcoin

MicroStrategy acquired an additional 21,550 Bitcoin for approximately $2.1 billion in cash between Dec. 2 and Dec. 8, executive chairman Michael Saylor confirmed. This latest purchase increased MicroStrategy’s total Bitcoin (BTC) holdings to 423,650 tokens, valued at roughly $41 billion. The acquisition marks the company’s fifth consecutive weekly buy, as reported by Dec. 9 According to Saylor, MicroStrategy has spent an estimated $25.6 billion on BTC at an average price of $60,324 per coin. Bitwise Europe data indicates that the company’s Bitcoin purchases have accelerated significantly in 2024. MicroStrategy has…

XRP Slides After Failing To Reclaim $2.9, What’s Next For Bulls?

XRP’s upward momentum has taken a hit after the price failed to reclaim its previous high of $2.9, sparking a fresh decline that has resulted in the price dropping toward previous support levels. The rejection has raised questions about the strength of the bulls and whether they can regain control to steer the price back to higher levels. Bearish Build-Up On The 4-Hour Timeframe With bearish pressure mounting, the focus now shifts to key support zones and whether the bulls can hold firm against the downside movement, preventing XRP from experiencing…

Bitcoin Layer 2 Stacks launches with a 35% all-time high annual yield by USDh

Stacks has announced the launch of a 35% annual percentage yield for Hermetica’s stablecoin USDh, setting a record for the Stacks DeFi ecosystem. In a recent post on Dec. 9, the Bitcoin (BTC) layer-2 scaling solution Stacks reveals the launch of a 35% annual percentage yield on its DeFi ecosystem. This yield marks a new all-time high for the Stacks (STX) ecosystem and is available through Hermetica’s stablecoin USDh. “Shoutout to the incredible Bitcoin builders on the leading Bitcoin L2 for pushing the boundaries of what’s possible on Bitcoin!” said…

El Salvador to Adjust Bitcoin Policy for $1.3b IMF Loan

El Salvador is negotiating a $1.3 billion loan with the IMF that reportedly could bring significant changes to its Bitcoin legal tender law. In the coming weeks, El Salvador could finalize a multi-billion dollar deal with the International Monetary Fund that might unlock more funding from global lenders. The only catch is that the country would need to reconsider its main bet, Bitcoin (BTC). According to a Dec. 9 Financial Times report, which cites sources close to the matter, the talks also include commitments to tackle the country’s budget deficit…

Microstrategy’s Bitcoin Holdings Hit 423,650 After $2.1 Billion Purchase

Microstrategy has amassed 423,650 BTC worth $25.6 billion and just bought 21,550 more, underscoring its aggressive bet on bitcoin as a transformative asset. Michael Saylor Highlights Microstrategy’s 423,650 BTC Portfolio and KPI Success Software intelligence firm Microstrategy Inc. (Nasdaq: MSTR) has significantly expanded its bitcoin portfolio, as disclosed in a Dec. 9 filing with the […] Original

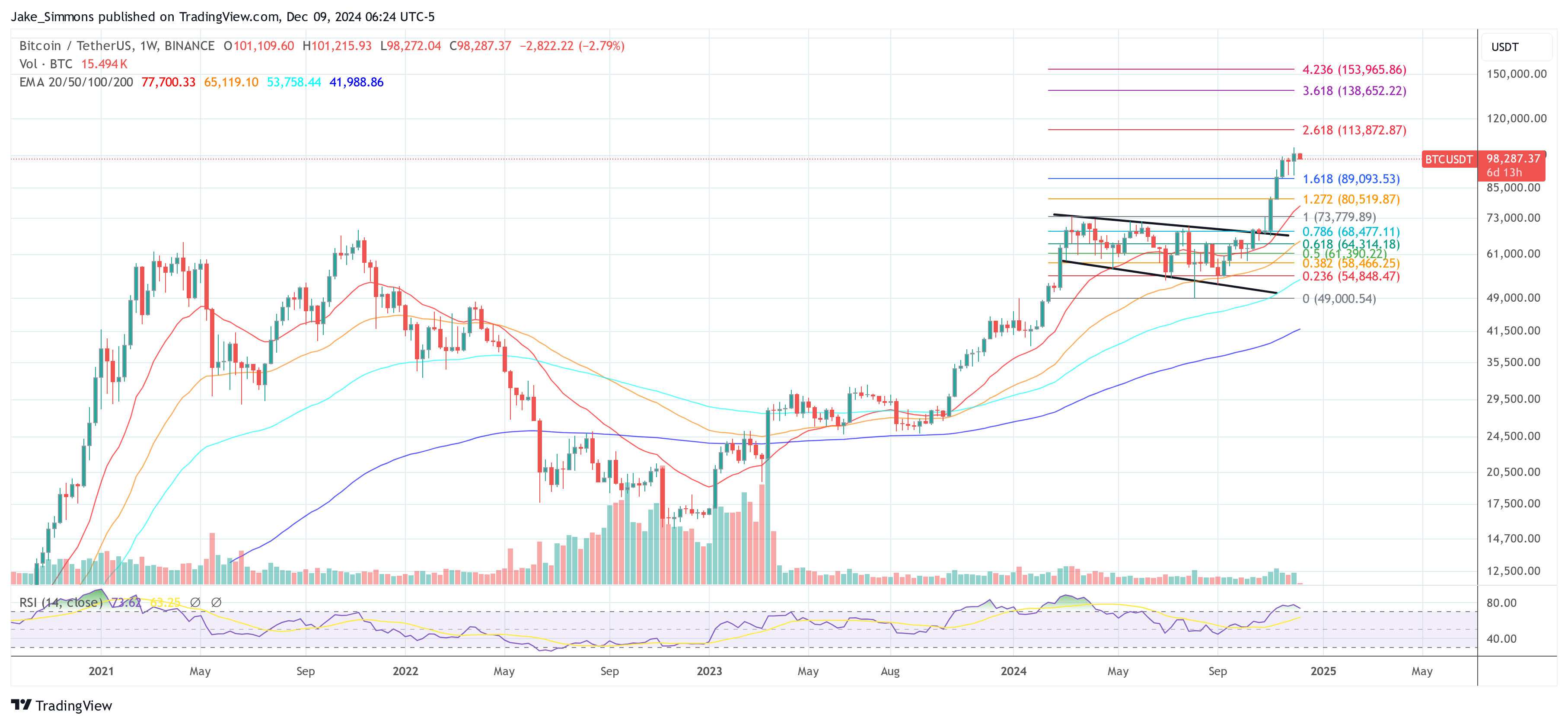

Bitcoin Technical Analysis: Consolidation Phase Precedes Next Big Move

Bitcoin is currently trading at $98,403, showcasing a dynamic interplay of market forces across short-term, medium-term, and long-term charts. Bitcoin Bitcoin‘s 1-hour chart reflects recent price fluctuations, with bitcoin peaking at $101,407 before succumbing to bearish pressure, reaching a low of $97,931. Lower highs suggest a short-term downtrend, while volume spikes align with sell-offs, reinforcing […] Original