Law enforcement in Thailand’s Chon Buri province recently seized nearly 1,000 bitcoin mining rigs from a company accused of illegally accessing electricity. Modified Meters Used to Aid Electricity Theft On Jan. 8, law enforcement agents in Thailand’s Chon Buri province seized nearly 1,000 bitcoin mining rigs from a company accused of illegally accessing electricity from […] Original

Day: January 9, 2025

Is Bitcoin Heading for a $90K Correction?

Este artículo también está disponible en español. Bitcoin’s recent price fluctuations have left investors in a state of uncertainty, as the cryptocurrency has seen a dramatic decline from its peak of nearly $107,000 to around $94,550. This volatility raises essential questions about the ability of Bitcoin to maintain its rally and whether it can regain its footing in the coming weeks. Related Reading Critical Support Levels Under Threat CryptoQuant analyst Shayan has had something important to say about current conditions in Bitcoins. According to him, the price is trying to…

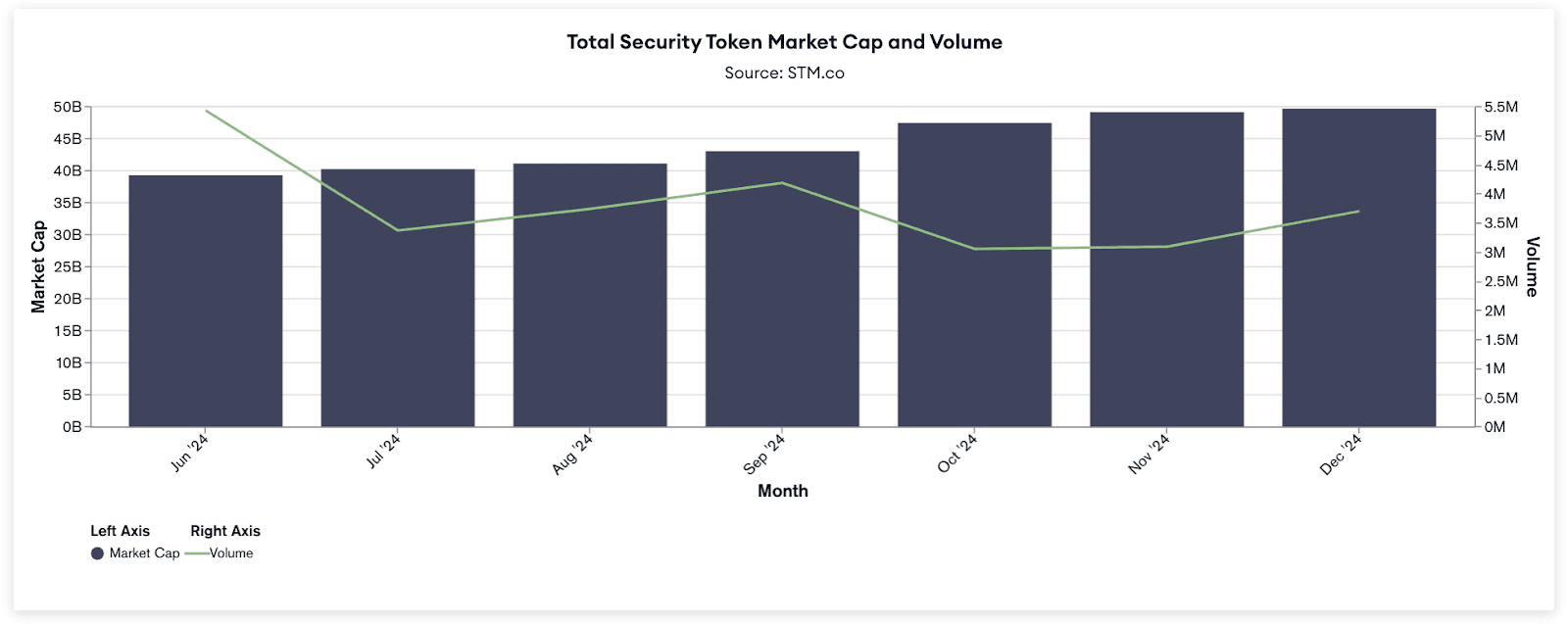

What 2025 Holds for Tokenized Real World Assets

Real world assets (RWAs). This is what the crypto natives and institutions are now calling on-chain representations of ownership in real estate, debt, equity, fund LP units, and other traditional assets. Throughout 2024, RWA tokenization grew in popularity thanks to key catalysts including: BlackRock tokenizing one of its funds and investing in a tokenization company. Banks and asset managers graduating from proofs of concept to in-production use cases. Licenses being granted such as 21X under the DLT Pilot Regime, Ursus-3 Capital as the first ERIR in Spain, and Nomura’s Laser…

What To Expect After The Bitcoin Price Crash Below $100,000

Este artículo también está disponible en español. The crypto market faces renewed volatility and uncertainty following the recent Bitcoin price crash below the $100,000 mark. As a result, a crypto analyst has shared a rather lengthy X (formerly Twitter) post outlining what to expect following this significant decline. He warns of critical levels to watch as selling pressures intensify, noting that both macro and technical indicators paint a mixed picture of Bitcoin’s short-term price trajectory. Key Levels To Watch After The Bitcoin Price Crash According to prominent crypto analyst Ali…

US-based Bitcoin reserves flipped foreign holdings, now 65% greater

Bitcoin held by U.S. firms far exceeded reserves boasted by offshore counterparts as spot ETFs and Trump’s win unlocked a wave of capital. According to CryptoQuant analysis, Bitcoin (BTC) reserves domiciled in the U.S. outpace holdings in offshore control by 65%. Data shows the ratio of U.S. entities’ BTC treasuries versus tokens owned by non-U.S. institutions reached 1.65 on Jan. 6. The ratio is calculated by dividing public U.S. BTC reserves by foreign-based holdings, CryptoQuant CEO Ki Young Ju explained on X. The findings are in. We surveyed 430 financial…

Massive Crypto ETF Exodus: $742M Vanishes Overnight

Recent data reveals that spot bitcoin (BTC) and ether (ETH) exchange-traded funds (ETFs) experienced collective net outflows amounting to $742.24 million. Blackrock, Valkyrie, and Grayscale Among Crypto ETFs Hit by $742M Reduction On Wednesday, U.S.-based bitcoin and ethereum ETFs faced significant reductions, with bitcoin ETFs losing $582.90 million and ether ETFs seeing $159.34 million in […] Source CryptoX Portal

U.S. still holds $6.5b in seized Silk Road Bitcoin

U.S. authorities have not executed any new Bitcoin sales, despite reports suggesting that the Department of Justice had authorized a massive offload. Blockchain intelligence platform Arkham confirmed that billions in seized Silk Road and FBI-confiscated Bitcoin (BTC) remain in U.S. government-controlled addresses as of Jan. 9. The data provider shared on-chain proof confirming a $6.44 billion balance amid chatter suggesting authorities were selling. Rumors of the sale began circulating after reports that the DOJ had cleared 69,370 BTC for liquidation. According to these reports, a federal judge ruled on the…

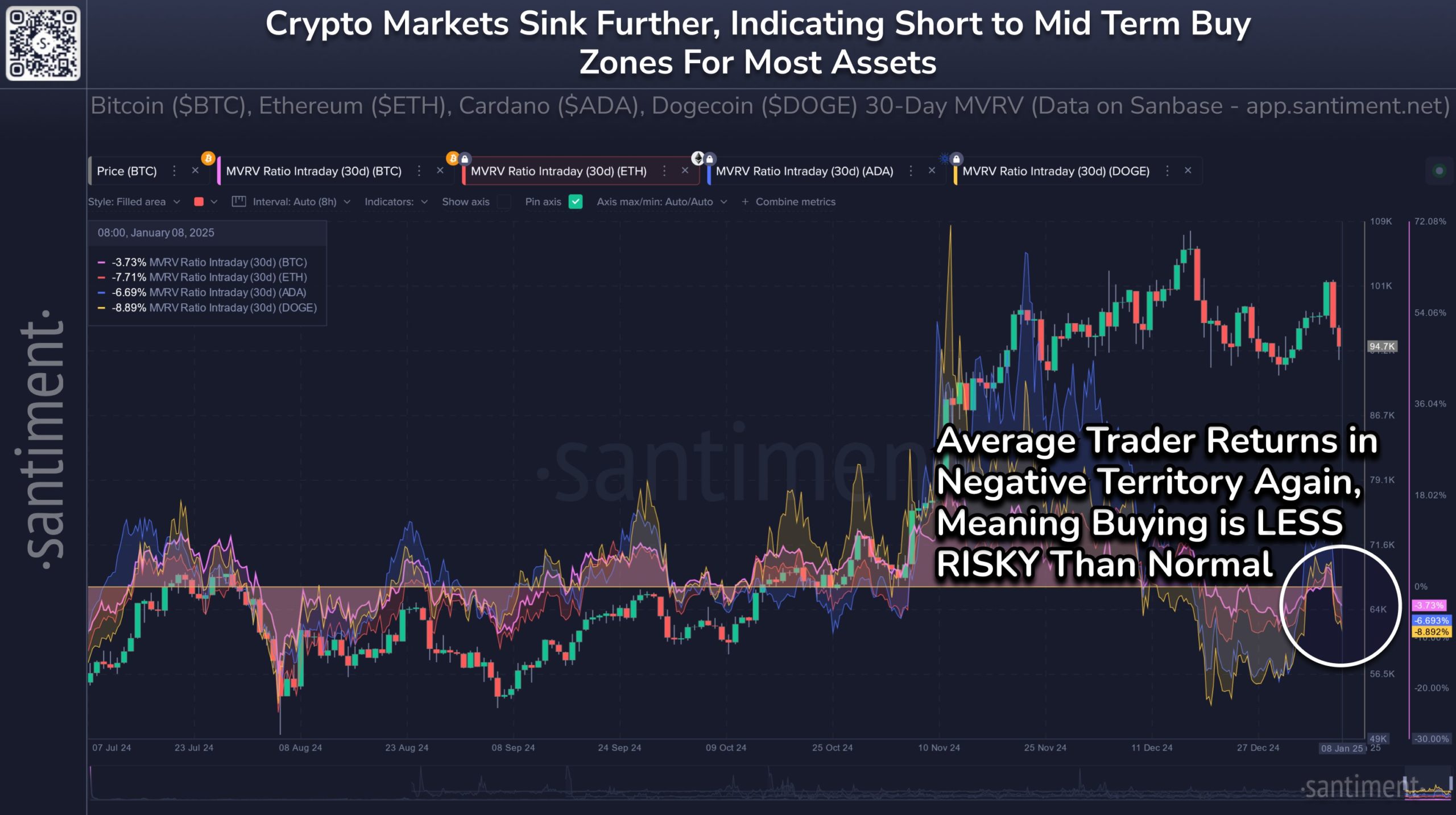

Dogecoin Hits A ‘Blood In The Streets’ Moment: Buy Or Sell Now?

Este artículo también está disponible en español. Dogecoin (DOGE) has again found itself in the crosshairs of market watchers, with a “blood in the streets” moment emerging according to data from on-chain analytics firm Santiment. The firm’s latest research, shared on January 8 via X, highlights a series of negative MVRV (Market Value to Realized Value) ratios across the crypto landscape—encompassing Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Dogecoin. “Average trading returns are a great representation of whether ‘buying low’ or ‘selling high’ is actually the right timing,” Santiment stated,…

Bitcoin Meets AGI: Could AI’s Evolution Lead to Bitcoin Becoming Its Default Currency?

Earlier this week, a Reddit post sparked a thoughtful discussion about artificial intelligence (AI) potentially adopting bitcoin in the era of artificial general intelligence (AGI). The conversation revolved around the idea that, as AI matches or surpasses human-level intelligence across a wide array of tasks, it might naturally turn to bitcoin as the leading cryptocurrency. […] Original

Bitcoin miner CleanSpark hits 10,000 BTC in its treasury

CleanSpark, a U.S.-listed Bitcoin miner, has surpassed 10,000 BTC in its treasury, a milestone achieved entirely through its self-mining operations. According to an announcement CleanSpark shared on Jan. 9, its Bitcoin (BTC) treasury reached 10,097 BTC, all mined through its own activities. The milestone came a day after the company revealed it had mined 668 BTC in December 2024. The company’s Bitcoin treasury as of the end of last year stood at 9,952 BTC. “Surpassing the 10,000-bitcoin mark reflects CleanSpark’s commitment to operational excellence, strategic growth, and disciplined capital management,”…