Stephen Almond is the ICO’s Executive Director of Regulatory Risk. Online tracking is a part of everyday digital life. It enables personalised advertising, funds many free services and shapes our online experiences. But when it isn’t done responsibly, harm can occur. For example, gambling addicts may be targeted with betting ads based on their browsing record – with no easy way to block them. People’s sexuality, beliefs, health and location may be identified, causing unwanted disclosures. A growing number of businesses have recognised this, and we at the ICO have…

Day: January 23, 2025

ICO takes action to tackle cookie compliance across the UK’s top 1,000 websites

ICO reviewing cookie usage on biggest UK sites 2025 strategy launched to ensure online tracking gives people “clear choices and confidence in how their information is used,” New guidance on ‘consent or pay’ models published We have today announced plans to bring the UK’s top 1,000 websites into compliance with data protection law. We have already assessed the compliance of the top 200 UK websites and communicated concerns to 134 of those organisations, setting out clear regulatory expectations that organisations must comply with the law by giving people meaningful choice…

Solana To $300? ‘All Bets Are Off’ Once It Reclaims This Level

Este artículo también está disponible en español. After some volatile days, Solana (SOL) has broken out of a three-day downtrend, fueling inventors’ bullish sentiment for its short-term performance. A crypto analyst suggested that SOL might be preparing to surpass $300 soon if a key level is reclaimed. Related Reading Solana Holds Despite Volatility Solana, the fifth-largest crypto by market capitalization, has performed remarkably over the last week, fueled by US President Donald Trump’s token launch. Last Friday, President Trump launched his official memecoin, TRUMP, on the Solana network after months…

Klein Funding Prop Firm Partners with World’s Third-Largest Crypto Exchange

Klein Funding, a newcomer to the prop trading market that launched late last year, has positioned itself uniquely by focusing on cryptocurrency instruments rather than traditional FX trading. The addition of Bybit, the world’s third-largest cryptocurrency exchange by spot volume, to their list of available trading platforms is significant news for crypto traders. “Our biggest update yet is here. Seamless trading, powerful tools, and endless opportunities with 700+ cryptos to trade await,” Klein Funding announced on social media regarding the new offering. 🚨We are now offering Bybit !🚨 Our biggest…

Bitcoin Hovers Above $104K—Analyst Reveals What’s Next Based on Funding Rates

Este artículo también está disponible en español. Bitcoin currently appears to be taking a breather after achieving a new all-time high (ATH) above $109,000 earlier this week. So far, the asset has seen a slightly reduced upward momentum with the price just hovering above $104,000. However, despite the slowing upward momentum, Bitcoin’s recent performance has prompted renewed interest in the market. CryptoQuant analyst Burak Kesmeci has recently shared insights into Bitcoin’s price behavior and key market indicators, shedding light on potential future moves. In a recent post on the CryptoQuant…

Bitcoin ETF inflows cool off as BTC slips back to $102k

Spot Bitcoin exchange-traded funds in the United States experienced a slowdown on Jan. 22 as BTC retraced back to around $102k. According to data from SoSoValue, inflows into spot Bitcoin ETFs dropped by 69% from the previous day, reaching $248.65 million on Wednesday. The entire inflows recorded on the day came from BlackRock’s IBIT which drew in $344.28 million from investors. Grayscale’s GBTC recorded outflows of $47.93 million, while Bitwise’s BITB and ARK 21Shares’ ARKB added to the negative momentum, with investors withdrawing $34.67 million and $13.02 million from the…

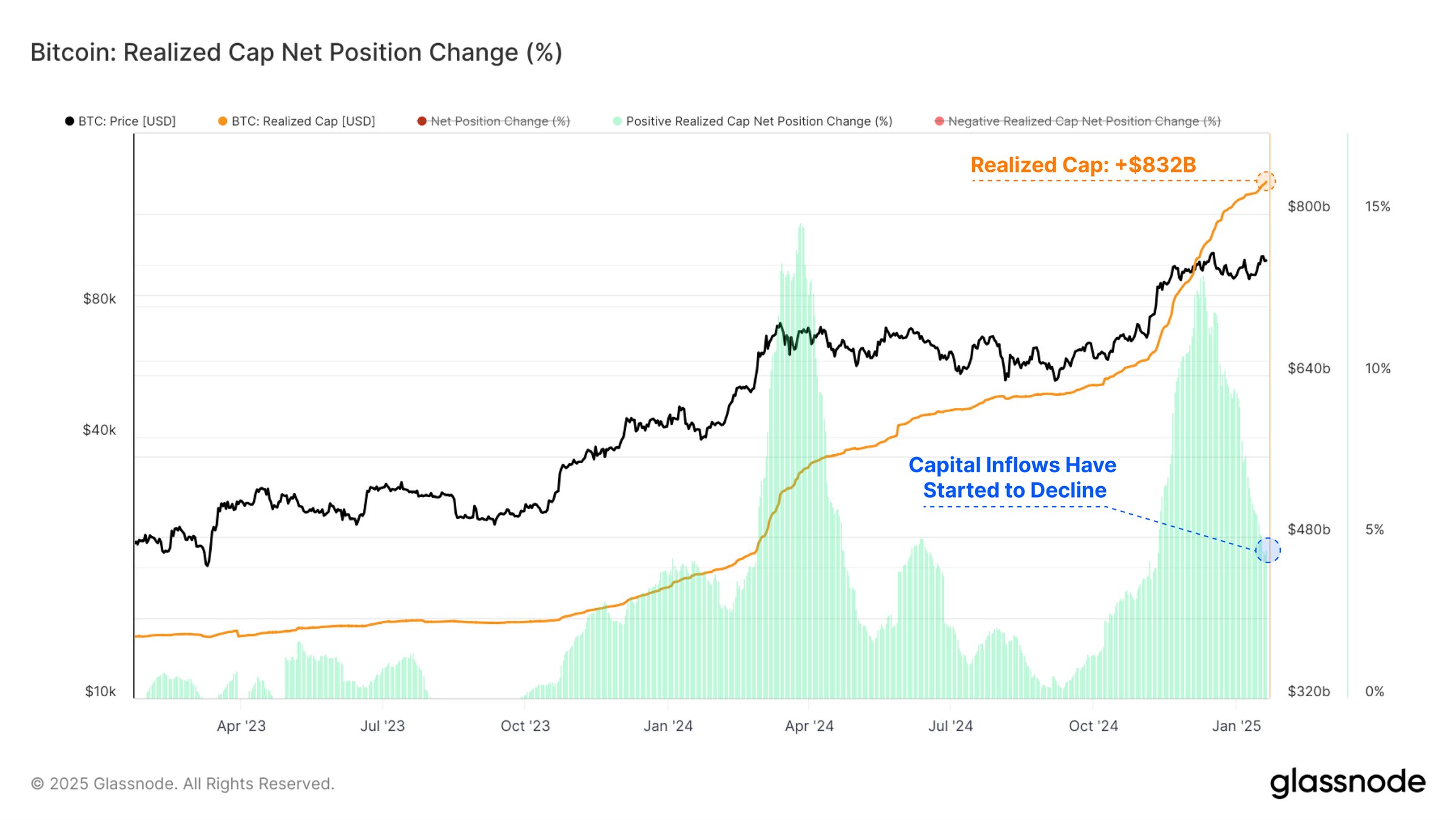

Bitcoin Capital Inflows See Notable Slowdown, But Is This A Worry?

On-chain data shows the capital inflows into Bitcoin have slowed down since last year’s high. Here’s what this could mean for BTC’s price. Bitcoin Realized Cap Continues To Grow, Albeit At A Slower Rate According to data from the on-chain analytics firm Glassnode, capital inflows into BTC have been on the decline recently. The indicator of relevance here is the “Realized Cap,” which is a capitalization model for Bitcoin that calculates its total valuation by assuming that the ‘real’ value of any token in circulation is equal to the price…

Is a Surge Around The Corner?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis. From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked…

Ethereum’s Price Stalls Below $3,500 as Leverage Ratios Climb—What Next?

Ethereum has been consolidating in a tight price range for several months, trading between $3,200 and $3,500. Despite the broader market’s recent upward movement, ETH still struggles to break out of this range. This stagnation comes after a prolonged decline from its all-time high of $4,800, recorded in late 2021. The cryptocurrency is now down roughly 32% from this peak. Notably, even the appointment of the new pro-crypto administration and a renewed sense of regulatory clarity have done little to propel Ethereum beyond its current resistance levels. Amid these market…

XRP Price Pauses Rally: Healthy Pullback or Reversal Ahead?

XRP price struggled to continue higher above the $3.30 level. The price is now correcting gains and might find bids near the $3.00 level. XRP price started a downside correction from the $3.30 zone. The price is now trading below $3.20 and the 100-hourly Simple Moving Average. There was a break below a connecting bullish trend line with support at $3.1450 on the hourly chart of the XRP/USD pair (data source from Kraken). The pair might start a fresh increase if it stays above the $3.00 support. XRP Price Dips…