An anonymous cryptocurrency trader has accumulated almost $68 million in unrealized profit by shorting Ether amid its recent price decline. According to blockchain data from Hypurrscan, the trader opened a 50x leveraged short position when Ether (ETH) was trading at $3,176, on Feb. 1. As of 9:06 am UTC on March 5, the position had almost $68 million in unrealized profit. Shorting involves “borrowing” the underlying cryptocurrency from a broker, selling it at the current price, and then repurchasing it once the price falls — a strategy used by traders…

Day: March 5, 2025

Sygnum adds off-exchange crypto custody to Deribit with Fireblocks tech

Cryptocurrency banking firm Sygnum is partnering with crypto derivatives exchange Deribit, providing its off-exchange custody platform, Sygnum Protect. On March 5, Sygnum announced the expansion of Sygnum Protect, its off-exchange custody platform, to include Deribit, one of the world’s largest derivatives exchanges in crypto. This integration enables institutional Deribit traders to hold their assets in Sygnum’s institutional-grade custody while accessing Deribit’s broad trading offering and liquidity. “This integration provides institutional traders with both the capabilities and security assurances they require to trade any of Deribit’s leading products comfortably,” Deribit CEO…

Metaplanet buys 497 BTC, surpasses Boyaa Interactive as Asia’s top corporate holder

Japan’s Metplanet has become the largest corporate holder of Bitcoin in Asia after its latest purchase. According to the company’s CEO, Simon Gerovich, Metaplanet grabbed another 497 BTC at around $88,448 per coin, investing nearly $44 million in the process on March 5. This latest buy bumps its total stash to 2,888 BTC, worth over $251 million, with Bitcoin hovering around $87,198 at press time. The Japanese firm bought the dip as Bitcoin dropped over 8% on March 4 as concerns regarding a potential trade war and fresh tariffs from…

Memecoin market crashes 56% since December peak amid fading hype

The memecoin market has erased all of the gains that followed Donald Trump’s presidential victory in November 2024, having lost more than half of its value since December. According to CoinMarketCap data, the total market capitalization of memecoins stood at $54 billion on March 5, down 56% from $124 billion on Dec. 5, 2024. The memecoin market has gradually declined after peaking at a record-breaking market cap of $137 billion on Dec. 8, briefly rising and dropping amid memecoin launches by Trump and First Lady Melania Trump in January. Total…

AUSTRAC Tightens Screws on Crypto Exchanges, Warns of Enforcement Action

The Australian Transaction Reports and Analysis Centre has announced that peer-to-peer cryptocurrency exchanges will be required to capture user information starting March 31, 2026. Reporting Suspicious Transactions The Australian financial agency responsible for monitoring transactions has said virtual assets services providers such as peer-to-peer cryptocurrency exchanges and custody service providers will be required to capture […] Source

Ethereum $2,000 Support Retest Key For ETH’s Next Move

Este artículo también está disponible en español. On Tuesday, Ethereum (ETH) retested the $2,000 support zone, falling below this level for the first time in over a year. Some analysts suggested the second-largest crypto risks a 40% correction as its price attempts to hold its support level “between heaven and hell.” Related Reading Monday Dump Sends Ethereum To 15-Month Low Ethereum has fallen to a yearly low of $1,993, according to Binance market data. The cryptocurrency has dropped below $2,000 for the first time in 15 months, hitting its lowest…

Why is Cardano (ADA) price up today?

Cardano (ADA) has recovered strongly, bouncing 30% from March 4 low of $0.7570 to an intraday high of $0.9792 ahead of this week’s first-ever White House Crypto Summit. The top-ten altcoin is up 13% over the last 24 hours to trade at $0.9384 at the time of writing. ADA/USD daily chart. Source: Cointelegraph/TradingView Let’s take a closer look at all the main factors driving ADA price up today. Anticipation for the White House Crypto Summit The first-ever White House Crypto Summit, scheduled for March 7, 2025, is generating significant buzz…

Tether Strengthens Regulatory Focus With New CFO

Tether has appointed Simon McWilliams as its new Chief Financial Officer (CFO) to lead its efforts toward a full financial audit, reinforcing its commitment to transparency. The move comes as Tether expands its institutional reach. Tether Appoints New CFO to Drive Full Audit, Reinforcing Transparency Efforts Tether, the world’s largest stablecoin issuer has appointed Simon […] Source CryptoX Portal

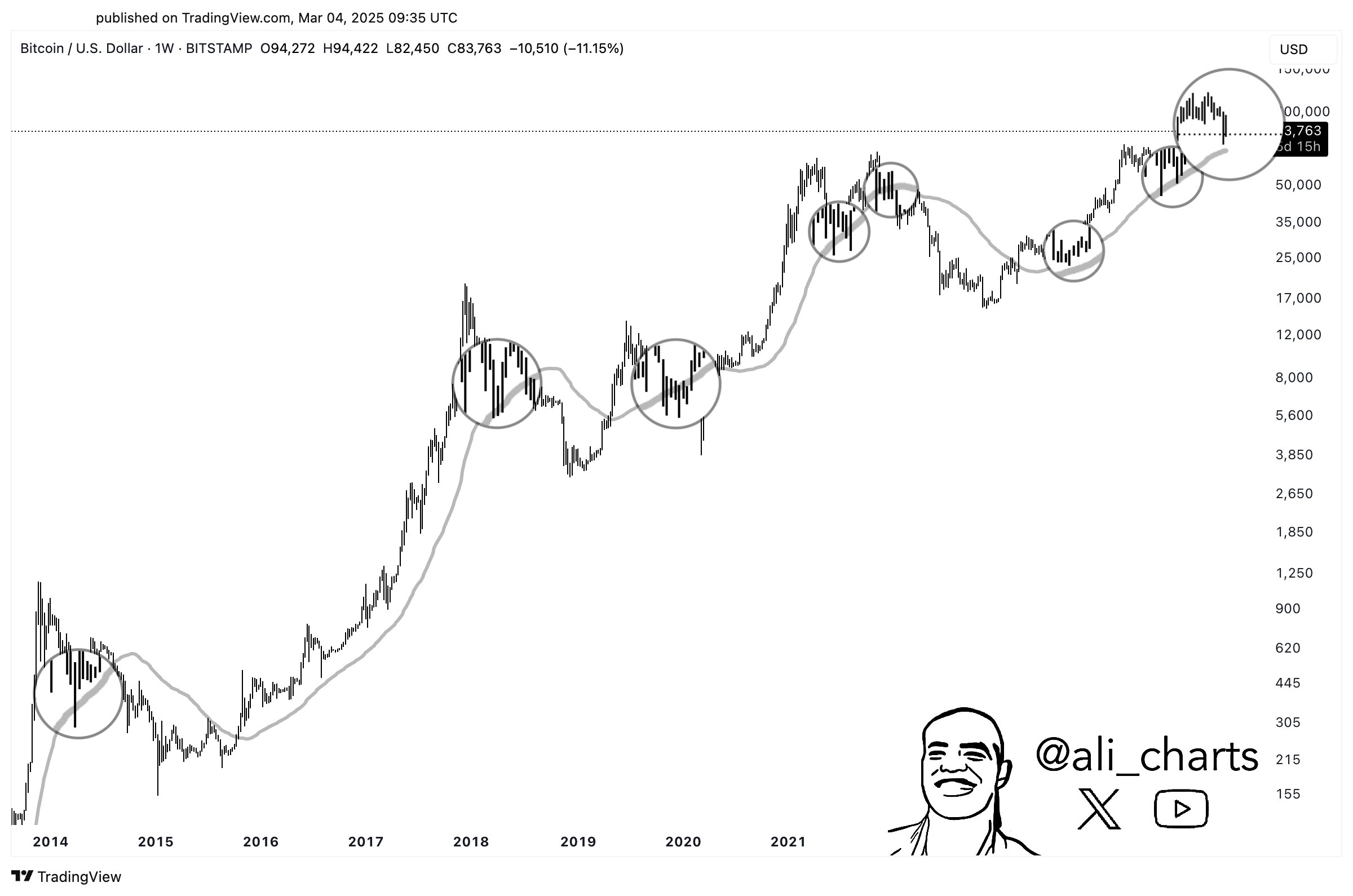

$75,500? Analyst Reveals Historical ‘Magnet’ Level

Este artículo también está disponible en español. An analyst has pointed out how the 50-week moving average (MA) of Bitcoin has historically acted as a sort of magnet for the asset’s price. 50-Week MA Is Currently Situated At $75,500 For Bitcoin In a new post on X, analyst Ali Martinez has discussed about the 50-week MA of Bitcoin. An “MA” is a technical analysis indicator that calculates the average value of any asset’s price over a given period of time and as its name suggests, moves in time, updating its…

Pornstar Shoots Armed Robbers Who Were After Her $20M Bitcoin Fortune

The adult actress claims she was suddenly dragged out of bed and violently pistol-whipped before shooting one of the assailants. Armed Robbers Target Pornstar’s $20M Bitcoin, But She Fights Back Famous pornstar and Twitch streamer Kaitlyn Siragusa who goes by the moniker “Amouranth,” claims she narrowly escaped with her life on Sunday after an armed […] Original