Caroline Bishop Mar 05, 2025 07:17 Linea’s upgrade to native USDC marks a pivotal moment for blockchain payment networks, promising seamless transactions and enhanced security for DeFi and personal finance applications. In a groundbreaking move for blockchain payment networks, Linea, a prominent Layer-2 (L2) blockchain, is set to upgrade from Circle’s Bridged USDC Standard to native USDC. This transition is expected to bring significant enhancements to the network without requiring any action from users or developers, according to linea.mirror.xyz. The upgrade, which…

Day: March 5, 2025

OFAC designates Iranian administrator of darknet marketplace with Bitcoin and Monero addresses

The U.S. Treasury sanctioned an Iranian national for operating Nemesis, a darknet drug marketplace, and blacklisted almost 50 crypto addresses tied to it. The U.S. Treasury has taken action against Behrouz Parsarad, an Iranian national behind Nemesis, a darknet marketplace involved in fentanyl and other drug trafficking. In a March 4 announcement, the Office of Foreign Assets Control revealed it had also sanctioned 49 cryptocurrency addresses tied to the platform. Founded in 2021, Nemesis became a big hub for illegal drug sales, offering fentanyl and other substances. Per OFAC, Nemesis…

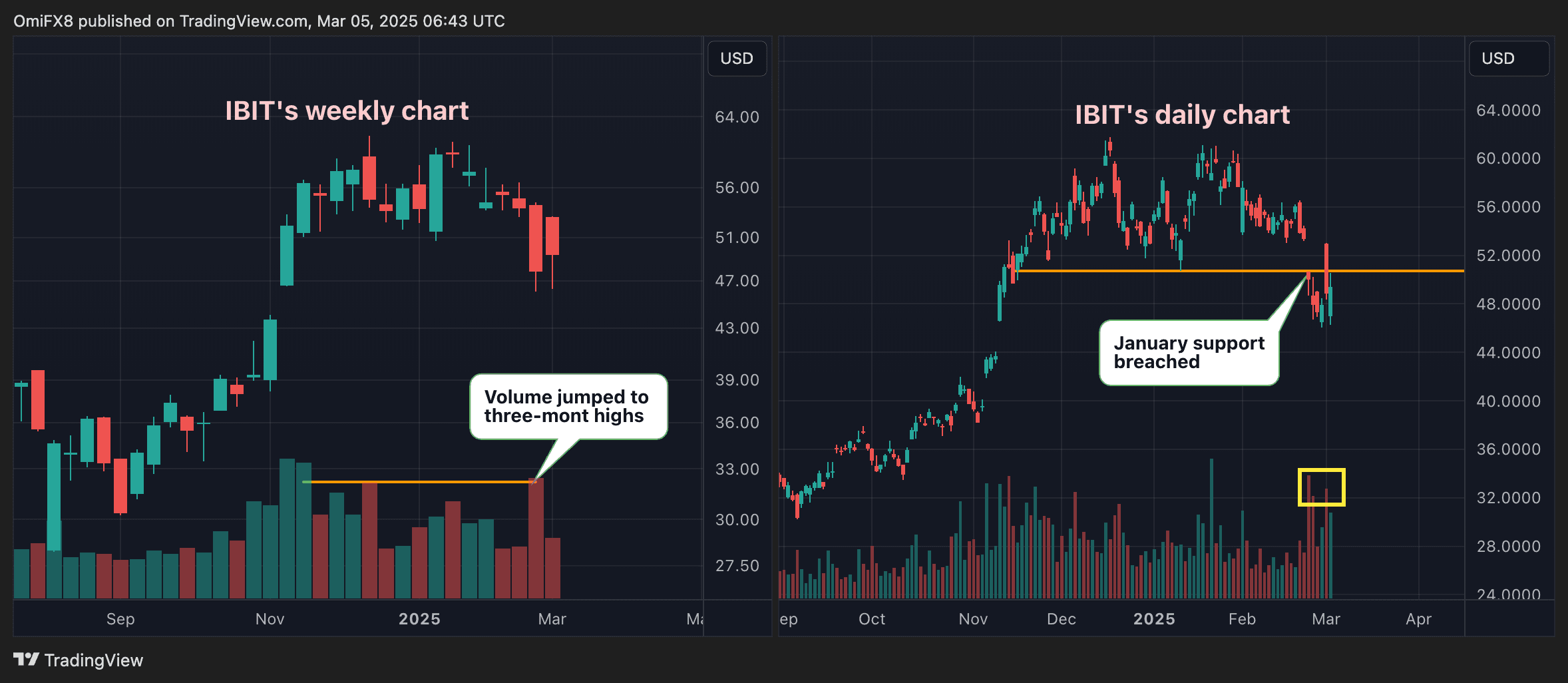

BlackRock’s BTC ETF (IBIT) Registers Highest Trading Volume in 3 Months

Last week, prices for BlackRock’s spot bitcoin (BTC) exchange-traded fund (ETF) declined over 11%, with volumes reaching the highest since mid-November, according to data source TradingView. Over 331 million shares of the ETF, which trades under the IBIT ticker on Nasdaq, changed hands as the fund’s price dipped below the January support of $50.69, eventually sliding to $46.07, the lowest since early November. That might be a disappointment development for the bulls. For decades, one of the cardinal rules in the market has been that price movements must be validated…

Bitcoin ETFs see net outflows double as optimism fades over Trump’s crypto reserve plan

Spot Bitcoin exchange-traded funds in the United States saw their net outflows nearly double as market experts expressed concerns over U.S. President Donald Trump’s proposed crypto reserve plan. According to data from SoSoValue, the 12 Bitcoin ETFs recorded $143.43 million in net outflows on March 4—almost double the previous day’s net inflows of $74.19 million. Fidelity’s FBTC and ARK 21Shares’ ARKB saw outflows of $46.08 million and $43.92 million, respectively. Franklin Templeton’s EZBC followed with net redemptions of $35.71 million. Other BTC ETFs contributing to the negative momentum included Bitwise’s…

Ex-girlfriend of crypto ‘Godfather’ pleads guilty to $2.6M tax charge

Iris Ramaya Au, the former girlfriend of admitted crypto fraudster Adam Iza, dubbed “The Godfather,” has agreed to plead guilty to a federal criminal tax charge. Au pled guilty to a single count of giving a false tax return “for failing to report more than $2.6 million in ill-gotten gains she obtained via her then-boyfriend’s criminal activities,” the US Justice Department said in a March 5 statement. Her ex-boyfriend, Iza, pled guilty in January to his involvement in multiple illicit schemes from 2020 to 2024, including fraudulently obtaining Facebook and…

Ethereum Weekly RSI Drops To Lowest Level Since May 2022

Este artículo también está disponible en español. Over the last week, Ethereum (ETH) has dropped 13.8%, currently trading at the critical $2,000 support level. While the digital asset’s weekly Relative Strength Index (RSI) has hit its lowest point in three years, analysts warn that further downside may still be ahead. Ethereum RSI At Lowest Levels In Years US President Donald Trump’s trade tariffs on Canada and Mexico took effect earlier today, fueling fears of an impending recession. According to the latest data from Kalshi, there is a 39% probability of…

Bitcoin will ‘likely continue to consolidate’ in this pullback phase — Analyst

Bitcoin’s latest pullback amid broader macroeconomic uncertainty may not see it rebound to its January $109,000 all-time high (ATH) as quickly as some hope, an analyst says. “We should assume that we are in the pullback phase after the ATH and will likely continue to consolidate for some time due to liquidity needs,” CryptoQuant contributor XBTManager said in a March 5 analyst note. Bitcoin long bids “viable” when long-term holders back to buying XBTManager said once short-term holders of Bitcoin (BTC) — those holding for under 155 days — start…

Ethereum’s Devconnect 2025 to Transform Buenos Aires into Blockchain Hub

Zach Anderson Mar 05, 2025 06:10 Devconnect 2025 will be held in Buenos Aires, Argentina, from November 17-22, aiming to boost Ethereum adoption and showcase blockchain innovations. Ethereum’s much-anticipated Devconnect 2025 is set to take place in Buenos Aires, Argentina, from November 17 to November 22. The event aims to further solidify Argentina’s position as a leading adopter of Ethereum technology, according to the Ethereum blog. Argentina’s Role in the Blockchain Ecosystem Argentina has emerged as a significant player in the blockchain…

Metaplanet stock jumps 19% as it buys the dip with 497 Bitcoin purchase

Japanese investment firm Metaplanet has bought another $44 million worth of Bitcoin, which has seen its stock jump by 19% on the day so far. Metaplanet CEO Simon Gerovich said in a March 5 X post that the firm bought 497 Bitcoin (BTC) at around $88,448 per coin for a total spend of $43.9 million. He added the company has achieved a year-to-date yield of 45%. The company’s March 5 disclosure said its latest purchase brings its total Bitcoin holdings to 2,888 BTC at an average purchase price of $84,240…

Dogecoin (DOGE) Attempts Rebound—Will Recovery Gain Momentum?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis. From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked…