A large cryptocurrency trader, known as a whale, lost more than $308 million on a leveraged Ether position, underscoring the risks of leveraged trading during volatile market conditions. The unknown crypto trader was liquidated on their 50x leveraged long position for over 160,234 Ether (ETH), worth more than $308 million at the time of writing, Hypurrscan data shows. Leveraged positions use borrowed money to increase the size of an investment, which can boost the size of both gains and losses, making leveraged trading riskier compared to regular investment positions. The…

Day: March 12, 2025

Bank of Russia Proposes Limited Crypto Investment Pilot for High-Net-Worth Investors

The Bank of Russia has submitted proposals to the government for a controlled experiment allowing a “limited group of Russian investors” to trade cryptocurrencies, based on a directive from the country’s President Vladimir Putin. The plan would introduce an experimental legal regime (ELR) lasting three years wherein “particularly qualified” investors would be allowed to conduct cryptocurrency transactions, according to a statement from the central bank. To be considered “particularly qualified,” individual investors would need to have over 100 million rubles ($1.14 million) in investments or an annual income exceeding 50…

Here are the funds awaiting SEC approval so far

American asset manager Franklin Templeton has entered the growing XRP exchange-traded fund (ETF) race, becoming the latest firm to file for a spot XRP ETF in the United States. Franklin Templeton’s XRP (XRP) ETF is designed to track the performance of the XRP price, with XRP holdings stored at Coinbase Custody Trust, according to an official filing with the US Securities and Exchange Commission on March 11. On the same day, the SEC postponed decisions on multiple crypto ETF filings, including Grayscale’s proposal to convert its XRP Trust into an…

NNewmarket Capital CEO suggests the U.S issue $2t ‘Bit Bonds’ to buy Bitcoin

Newmarket Capital CEO Andrew Hohns suggests incorporating Bitcoin into government bonds as a way to reduce national debt and purchase Bitcoin for the U.S. strategic reserve. At the Bitcoin (BTC) Policy Institute’s Bitcoin for America on March 11, Hohns proposes the idea of “Bit Bonds,” a novel type of U.S. Treasury bond that incorporates Bitcoin into government financing. The idea is to use bond issuance to reduce government borrowing costs and build a strategic Bitcoin reserve, while offering American families a tax-free investment vehicle. Hohn suggested the U.S. government issue…

XRP Cycle Top Forecast—Analyst Pinpoints The Timeline

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. A prominent analyst in the cryptocurrency community once again gave his insight on the price trajectory of XRP this year, noting that the altcoin is ripe for a massive…

How Crypto Holders Can Now Trade Global Markets on MT5 with PrimeXBT

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. As the market for Cryptocurrencies continues to grow, new innovations are giving Crypto holders more ways to take advantage of their tokens. One of these is the ability to…

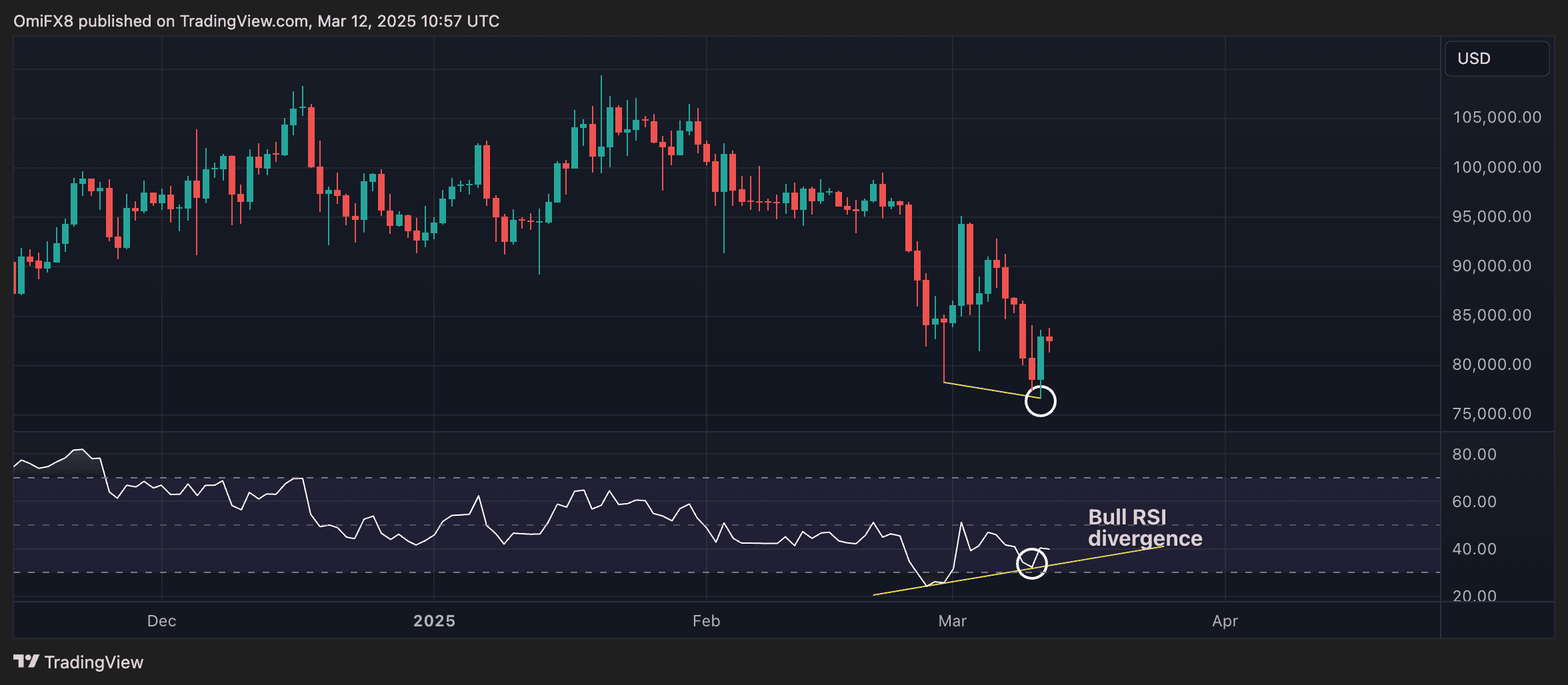

BTC Chart Forms Bullish RSI Divergence Just in Time for U.S. CPI

A technical analysis pattern hinting at bull reversal has appeared on bitcoin’s (BTC) daily price chart as market participants look to Wednesday’s U.S. inflation data to put a floor under risk assets. BTC has recently taken a beating, falling from $100,000 last month to under $80,000 this week due to several factors, including risk aversion on Wall Street, concerns about Trump’s tariffs and U.S. recession fears. The disappointment over the lack of fresh BTC purchases under Trump’s strategic reserve plan added to the downward momentum. However, as prices fell to…

Web3 gaming investors no longer throwing money at ‘Axie killers’

The Web3 gaming industry is facing tighter investment conditions as capital flows become more selective, with investors prioritizing sustainable projects over hype-driven fundraising. In February, Gunzilla Games Web3 director Theodore Agranat described blockchain gaming as a “game of musical chairs” in which the same capital cycles through different projects and “no new money” comes in. The executive also said users go from project to project to extract value. After that, they leave and search for the next project. In the same month, the much-anticipated Web3 game Illuvium announced a 40%…

Crypto ETFs Remain Under Pressure With $371 Million in Outflows for Bitcoin and $22 Million for Ether

On Tuesday, March 11, bitcoin ETFs experienced net outflows of $371 million, marking a full week of consecutive withdrawals. Ether ETFs also faced challenges, with $22 million in net outflows, extending their streak to five days. Market Caution Prevails With Bitcoin and Ether ETFs Seeing Continued Withdrawals Investors continued to reassess their positions in bitcoin […] Original

Europe’s asset manager HANetf rolls out ETC to double or short Bitcoin and Ethereum

Asset manager HANetf has introduced leveraged and inverse crypto ETCs, offering traders a new way to bet on Bitcoin and Ethereum price swings. White-label exchange-traded fund provider HANetf is offering traders in Europe new ways to speculate on crypto by launching its first leveraged cryptocurrency exchange-traded commodities and a short Bitcoin (BTC) strategy, allowing them to bet on price movements of BTC and Ethereum (ETH). Available on Nasdaq Sweden with a 2% expense ratio, traders can now access the 2x Long Bitcoin ETC, 2x Long Ethereum ETC, and 2x Short…