The most successful cryptocurrency traders are still chasing quick profits in memecoins, despite signs that the broader “supercycle” for the speculative assets may be winding down. The shift follows recent disappointment tied to memecoin launches associated with US President Donald Trump. The industry’s most successful cryptocurrency traders by returns — tracked as “smart money” traders on Nansen’s blockchain intelligence platform — continue hunting for quick memecoin returns. While growing stablecoin holdings show increased caution, smart money remains open to speculative plays, according to Nicolai Sondergaard, a research analyst at Nansen.…

Day: April 5, 2025

Bitcoin Taker Buy Volume Witnesses Notable Spike — Is BTC Price Next?

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies. Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking”…

‘Shock’ Fed warning risks crashing Bitcoin, altcoin prices

After Donald Trump announced his Liberation Day tariffs, Bitcoin and most altcoins outperformed stocks. Bitcoin (BTC) remained between $80,000 and $90,000, while Ethereum (ETH) was stuck slightly below $2,000. The total market cap of all cryptocurrencies dropped from $2.7 trillion to $2.6 trillion. Meanwhile, the stock market had its worst week since 2020. The blue-chip Nasdaq 100, S&P 500, and Dow Jones slumped into a correction. Bitcoin vs Dow Jones vs Nasdaq 100 | Source: crypto.news Shock Fed warning on stagflation Bitcoin, altcoins could come under pressure after the Federal…

Bitcoin holds firm as stocks lose $5T in record Trump tariff sell-off

Bitcoin is gaining renewed attention as a hedge against financial instability after holding relatively steady during a record-breaking stock market downturn that saw $5 trillion wiped from the S&P 500. The S&P 500 posted a $5 trillion loss in market capitalization over two days, its largest drop on record, surpassing the $3.3 trillion decline in March 2020 during the initial wave of the COVID-19 pandemic, according to an April 5 report by Reuters. The record sell-off occurred after US President Donald Trump announced his reciprocal import tariffs on April 2.…

Bitget secures full licensing in El Salvador for crypto services

Bitget has secured a key license in El Salvador, joining other crypto firms exploring the country’s growing appeal as a regulated hub for digital assets. Cryptocurrency exchange Bitget has received a digital asset service provider license from El Salvador‘s National Commission of Digital Assets, following its earlier approval for a Bitcoin services provider license earlier in 2024, the company said in a Friday press release. According to the exchange, the new license allows it to offer more services in the country, including spot and derivatives trading as well as staking…

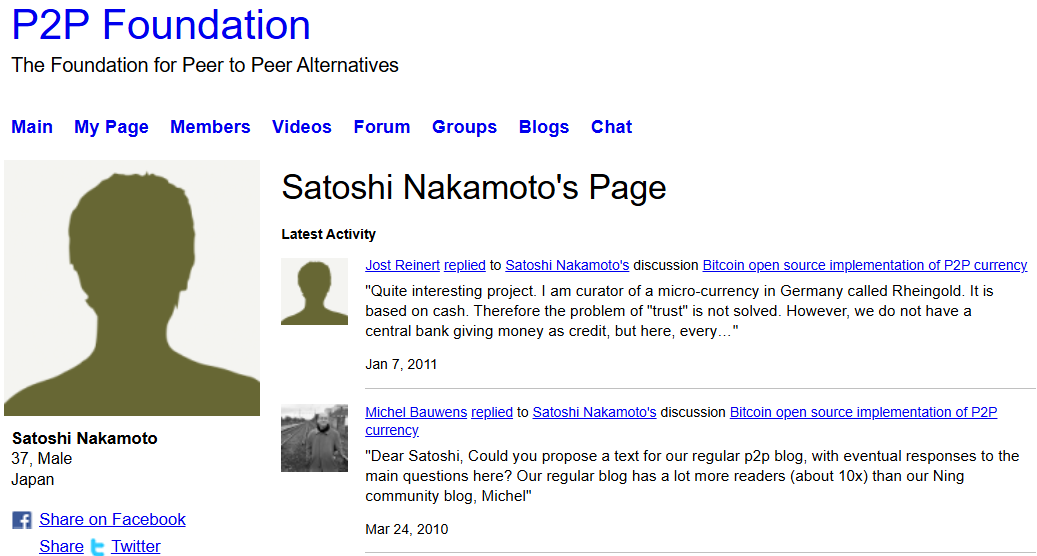

Satoshi Nakamoto turns 50 as Bitcoin becomes US reserve asset

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, marks their 50th birthday amid a year of rising institutional and geopolitical adoption of the world’s first cryptocurrency. The identity of Nakamoto remains one of the biggest mysteries in crypto, with speculation ranging from cryptographers like Adam Back and Nick Szabo to broader theories involving government intelligence agencies. While Nakamoto’s identity remains anonymous, the Bitcoin (BTC) creator is believed to have turned 50 on April 5 based on details shared in the past. According to archived data from his P2P Foundation profile, Nakamoto…

Massive Chainlink Demand Wall At $6.26 As 90K Investors Buy 376M LINK

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Chainlink is currently trading at critical demand levels as the broader crypto market faces ongoing pressure. With global financial conditions growing increasingly fragile, volatility continues to dominate across risk…

Bitcoin’s Most Critical Support Level At $69,000 — Here’s Why

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies. Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking”…

Securitize Reports Highest-Ever Dividend of $4.17 Million for Tokenized Treasury Product

Securitize, the issuer behind Blackrock’s BUIDL tokenized U.S. Treasury fund, reported a record $4.17 million in dividends for March, marking the highest monthly payout among tokenized Treasury products. Since its launch, BUIDL has distributed $25.4 million, demonstrating the increasing appeal of tokenized institutional investments. Blackrock’s BUIDL Tokenized Fund Hits Record $4.17M Monthly Payout Securitize, the […] Source CryptoX Portal

Nansen urges caution amid Trump tariffs, market fear

As global markets reel from the United States’ sweeping reciprocal tariff announcements, analysts at Nansen have issued a note urging caution. Their view: don’t fight the market tape. Instead, investors should wait for clarity on trade negotiations, labor market data, and the Federal Reserve’s next moves before repositioning. The note, shared with crypto.news, comes after President Trump introduced aggressive new tariff rates — starting at a baseline of 10% and rising sharply for countries like China, Japan, and Vietnam. Some effective rates may approach 50% once exemptions are factored in.…