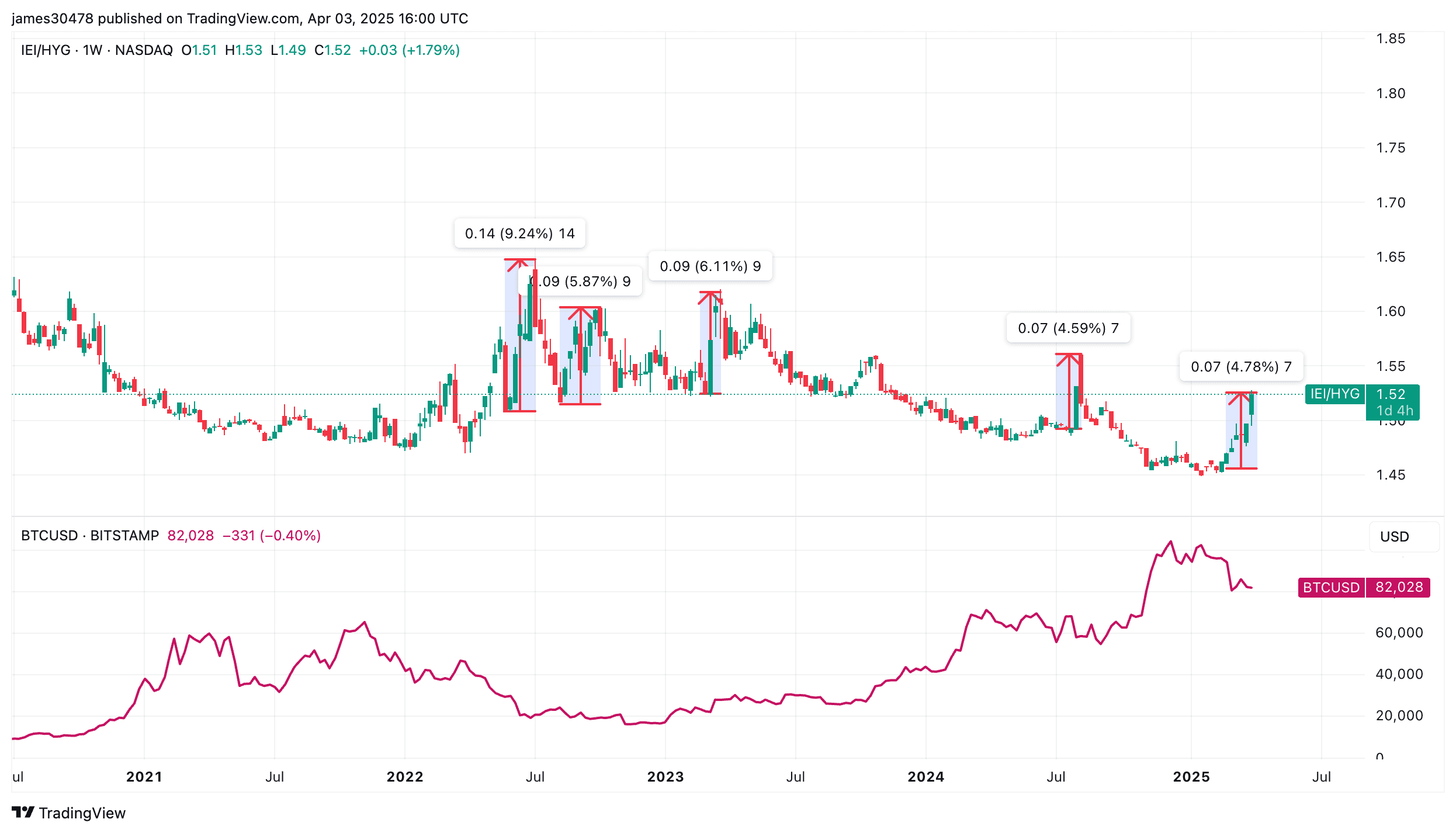

Credit spreads are widening and have reached their highest levels since August 2024 — a period that coincided with bitcoin (BTC) dropping 33% during the yen carry trade unwind. Widening credit spread via IEI and HYG ratio. (TradingView) One way to track this is through the ratio of the iShares 3–7 Year Treasury Bond ETF (IEI) to the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). This IEI/HYG ratio, highlighted by analyst Caleb Franzen, serves as a proxy for credit spreads and is now showing its sharpest spike since…

Day: April 6, 2025

Decentralized exchanges gain ground despite $6M Hyperliquid exploit

Decentralized cryptocurrency exchanges (DEXs) continue to challenge the dominance of centralized platforms, even as a recent $6.2 million exploit on Hyperliquid highlights risks in DEX infrastructure. A cryptocurrency whale made at least $6.26 million profit on the Jelly my Jelly (JELLY) memecoin by exploiting the liquidation parameters on Hyperliquid, Cointelegraph reported on March 27. The exploit was the second major incident on the platform in March, noted CoinGecko co-founder Bobby Ong. “$JELLYJELLY was the more notable attack where we saw Binance and OKX listing perps, drawing accusations of coordinating an…

XRP Will Explode—And This Expert Says He’ll Be ‘Laughing’

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. A Korean financial analyst who uses the name XForceGlobal has made bold claims about XRP’s future price, stating the cryptocurrency could reach between $10 and $20 in the coming…

Wall Street Bleeds, US Banks Cleared for Crypto, and More — Week in Review

Wall Street bleeds, US Banks cleared for crypto, SEC commissioner calls for 7 crypto reforms, and more in this Week in Review. Week in Review Wall Street shed $2.85 trillion in value amid growing recession fears, following Trump’s new tariffs. Meanwhile, over 5,000 U.S. banks are now cleared to offer crypto services. In Washington, an […] Source CryptoX Portal

Solana Faces Defining Level At $120 – Will History Repeat?

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Solana continues to face mounting selling pressure as it struggles to reclaim the $150 level, with broader market uncertainty weighing heavily on price action. Down nearly 60% from its…

Tried automating crypto trades with Grok 3? Here’s what happens

Key takeaways Grok 3 adjusts its predictions based on evolving market trends by analyzing real-time data patterns. Combining technical analysis with sentiment data improves accuracy; Grok 3 effectively identifies potential trade opportunities. Backtesting strategies before live trading is crucial; testing Grok 3’s prompts using historical data helps refine conditions and improve performance. While Grok 3 can automate trades, human oversight remains critical in adapting to unexpected market conditions. Crypto trading is complex. Prices can swing wildly, and even experienced traders struggle to keep up. That’s why automation tools are gaining…

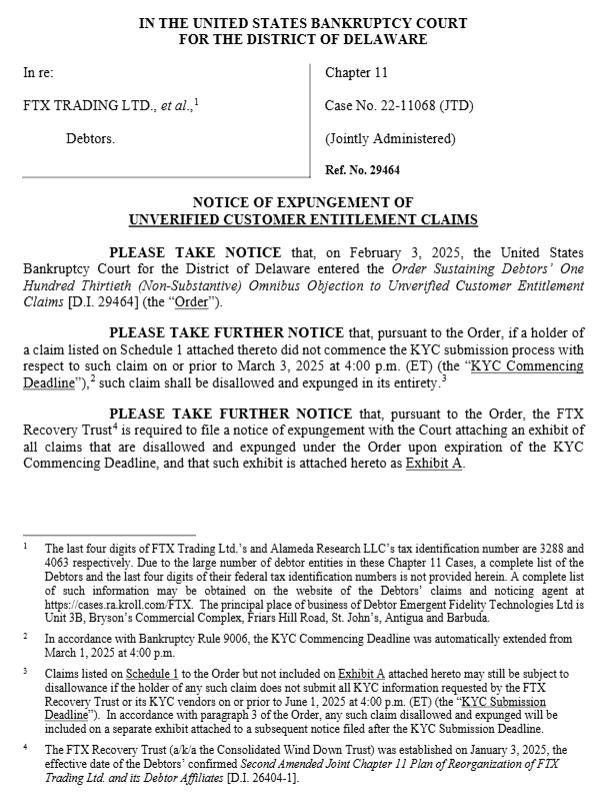

Nearly 400,000 FTX users risk losing $2.5 billion in repayments

Nearly 400,000 creditors of the bankrupt cryptocurrency exchange FTX risk missing out on $2.5 billion in repayments after failing to begin the mandatory Know Your Customer (KYC) verification process. Roughly 392,000 FTX creditors have failed to complete or at least take the first steps of the mandatory Know Your Customer verification, according to an April 2 court filing in the US Bankruptcy Court for the District of Delaware. FTX users originally had until March 3 to begin the verification process to collect their claims. “If a holder of a claim…

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

Despite a widespread weekly gain in the crypto market, Chainlink (LINK) remains under significant bearish pressure printing losses across multiple time frames. Since hitting a local price peak of $29.28 in December, the altcoin has slipped into a downtrend losing over 56% since then. Amid this negative performance, top crypto analyst Ali Martinez postulates LINK could soon experience some short-term price gain. LINK Recovery Depends On Critical Trendline Support In a recent post on X, Martinez shares a positive technical outlook on LINK hinting the altcoin is likely to experience…

Ethereum Tanks Nearly 50% As Bitcoin Holds Stronger In Q1

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Ethereum and Bitcoin went through very different trajectories in the first quarter of 2025, and the divergence could not be more obvious. According to data from on-chain analytics firm…

BTC’s Strength Amid Nasdaq Drop is Impressive, But Potential Basis Trade Blowup That Catalyzed the COVID Crash Poses Risk

Bitcoin’s (BTC) recent stability amid Nasdaq turmoil driven by tariffs has generated excitement among market participants regarding the cryptocurrency’s potential as a haven asset. Still, the bulls might want to keep an eye on the bond market where dynamics that characterized the COVID crash of March 2020 may be emerging. Nasdaq, Wall Street’s tech-heavy index known to be positively correlated to bitcoin, has dropped 11% since President Donald Trump on Wednesday announced reciprocal tariffs on 180 nations, escalating trade tensions and drawing retaliatory levies from China. Other U.S. indices and…