Jack Mallers, founder and CEO of crypto payments firm Strike, is taking on a new role as CEO of the newly formed Bitcoin-centric company Twenty One. The announcement that Jack Mallers will be the new Twenty One Capital, Inc. CEO comes after the new company revealed a business venture involving Cantor Equity Partners,a special-purpose acquisition company by a Cantor Fitzgerald affiliate. Backed by stablecoin issuer Tether and Japanese investment powerhouse SoftBank Group, Twenty One will launch with more than 42,000 Bitcoin (BTC) under management. The company aims to maximize BTC…

Day: April 23, 2025

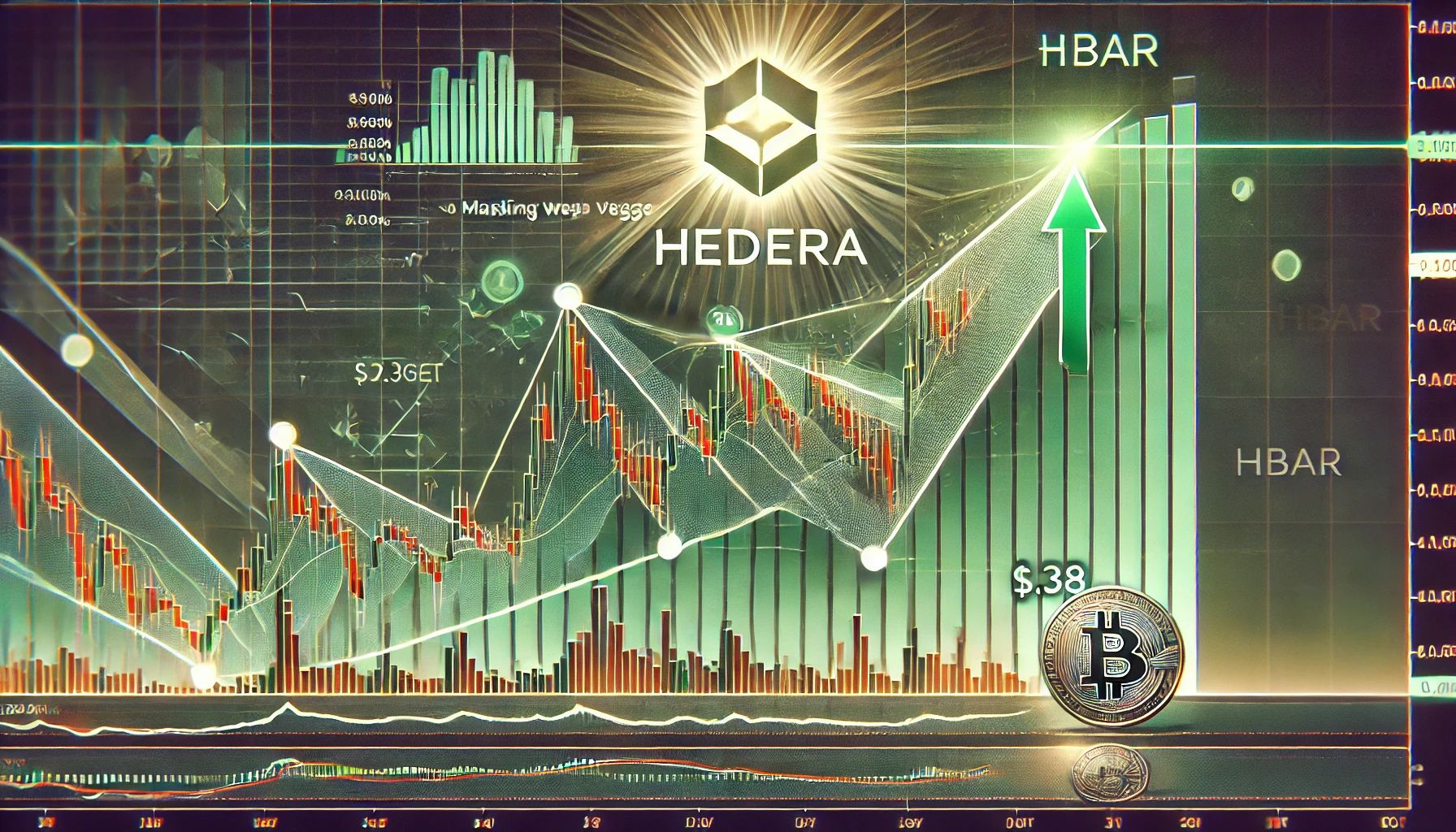

HBAR Breaks Above Massive Falling Wedge – Expert Sets $0.38 Target

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Hedera Hashgraph (HBAR) is showing strong signs of recovery, surging over 20% in the past week as bullish momentum sweeps across the broader crypto market. Despite continued macroeconomic uncertainty…

The “Indexification” of Active Strategies

In an earlier piece, I introduced the concept of the “Shopification of Wealth”, or the idea that on-chain rails can lower the barriers to entry and radically scale operations for financial advisors and wealth managers. Just as Shopify enabled anyone to launch a retail business online, crypto is enabling a new generation of investment professionals to start and scale advisory businesses without the legacy layers of TradFi infrastructure. This democratization of advice foreshadows broader changes in asset management. Because when you zoom out — beyond the advisor and beyond the…

Riot Platforms secures $100M ‘Bitcoin-backed’ loan from Coinbase

Riot Platforms has used its massive Bitcoin stockpile as collateral to secure a $100 million credit facility from Coinbase as the cryptocurrency miner eyes continued expansion. The $100 million loan from Coinbase’s credit arm marks Riot’s “first Bitcoin-backed facility,” CEO Jason Les said in an April 23 statement. Les said the credit line will be used to fund general corporate operations and support the company’s “strategic growth initiatives.” Source: Riot Platforms The credit line is scheduled to mature in one year’s time, but could be extended for an additional year.…

Best Altcoins to Ride the $BTC Bull Run as SoftBank and Tether Back $3B Bitcoin Fund

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Cantor Fitzgerald, a leading global financial services firm, is partnering with SoftBank, Tether, and Bitfinex to build a Bitcoin acquisition vehicle. The new venture will be called 21 Capital and is expected to raise $3B worth…

Riot secures $100M BTC-backed credit via Coinbase.

Key Notes Riot Platforms has secured a $100 million credit line from Coinbase Credit to support its expansion plans. The loan is backed by Riot’s Bitcoin holdings, avoiding share dilution for stakeholders. It comes with a 364-day term and a potential extension, offering flexible financing. Riot Platforms, a North American Bitcoin mining company, has secured a $100 million credit line from Coinbase. The credit facility was arranged by Coinbase’s credit division, with Bitcoin used as collateral. Riot is leveraging 19,223 BTC, valued at over $1.8 billion, to secure the loan.…

Multifaceted Entrepreneur Zuby Reveals Real-Life ‘Cheat Code’: Ditch Fiat, Stack Bitcoin

As bitcoin climbed to levels unseen since March, Nigerian-British polymath Zuby—renowned as a rapper, podcaster, author, and public speaker—told his 1.2 million followers on X to “save in bitcoin,” eschewing reliance on saving in fiat currency. Zuby Discloses a Literal ‘Cheat Code for the Emotionally Stable’ Although equity markets found renewed footing amid U.S. President […] Original

PayPal Floats New Yield Offering to Boost PYUSD Adoption

Key Notes PayPal plans to offer a 3.7% annual yield on PYUSD, paid monthly, starting this summer. PYUSD circulation is $868 million, trailing far behind Tether’s $145 billion market cap. Paypal aims to integrate PYUSD into 20 million businesses in 2025 to further drive adoption. Fintech giant PayPal is taking a new step to deepen its efforts in the digital currency ecosystem. The company plans to offer US users a return of 3.7% on its dollar-backed stablecoin PYUSD. The program is expected to launch this summer, marking another move in…

XRP Targets $33 To $50 By September 2027, Research Firm Says

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Trading-desk watchers received a fresh dose of long-term optimism for X on Tuesday after crypto analytics boutique Sistine Research published a multi-year XRP/US Dollar chart pointing to an eventual…

Blockchain prediction markets offer new hope for scientific validation

Opinion by: Sasha Shilina, PhD, founder of Episteme and researcher at Paradigm Research Institute Decentralized prediction markets are gaining ground in the scientific world, offering an intriguing answer to the field’s ongoing reproducibility crisis. While a notable share of research findings fail to replicate in independent tests, supporters believe market-driven forecasting can speed up identifying robust studies. Detractors remain cautious, worried that introducing financial wagers could compromise the measured, peer-reviewed process that has guided academic inquiry for centuries. The debate hinges on whether blockchain-based forecasting will elevate or destabilize scientific…