US President Donald Trump’s first 90 days in office have been miserable for Bitcoin (BTC) and the broader cryptocurrency industry. Despite positive regulatory developments, culminating in the first-ever White House crypto summit on March 7, digital asset prices have been dragged down by the currents of trade war and fear of recession. However, crypto saw a huge sentiment shift this week amid reports that Trump was backing off on his full-scale tariff war against China. It also didn’t hurt that Trump’s media empire, Trump Media and Technology Group, inked a…

Day: April 25, 2025

Nasdaq urges SEC to treat certain digital assets as ‘stocks by any other name’

Nasdaq has urged the US Securities and Exchange Commission (SEC) to hold digital assets to the same regulatory standards as securities if they constitute “stocks by any other name,” according to an April 25 comment letter. The exchange said the US financial regulator needs to establish a clearer taxonomy for cryptocurrencies, including categorizing a portion of digital assets as “financial securities.” Those tokens, Nasdaq argued, should continue to be regulated “as they are regulated today regardless of tokenized form.” “Whether it takes the form of a paper share, a digital…

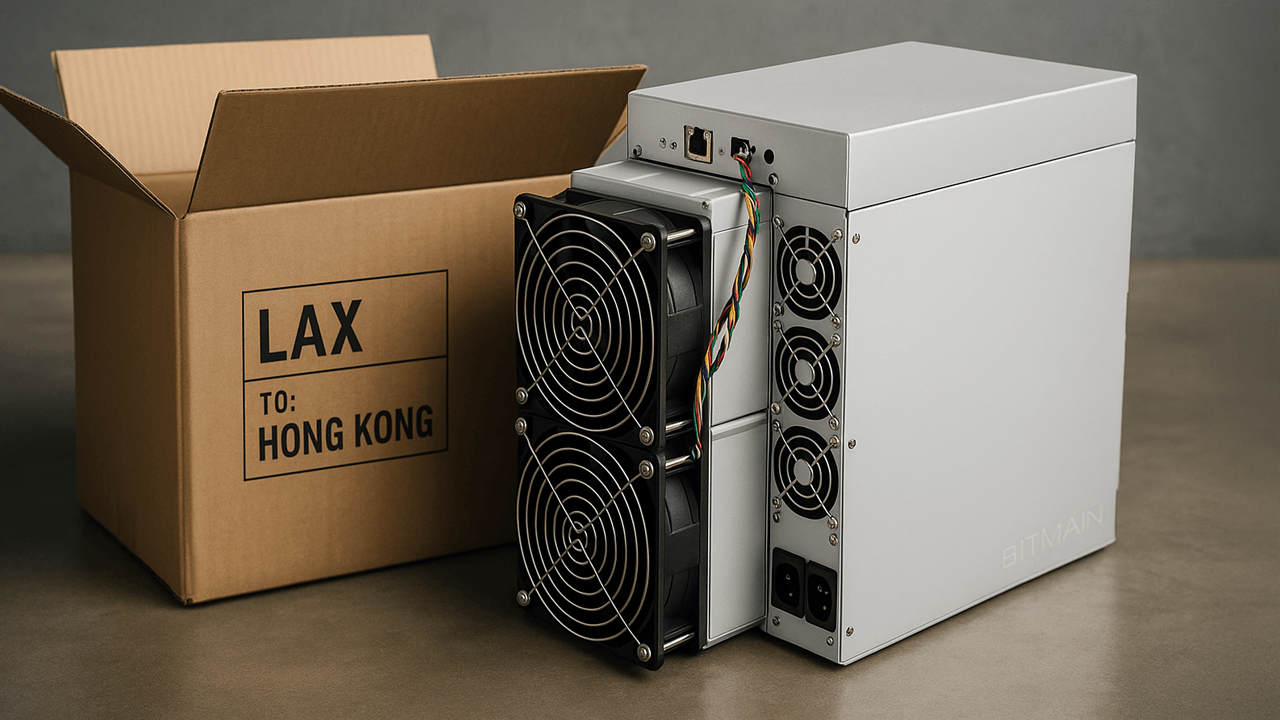

LAX Cargo Theft Unveiled: LAPD Catches Suspects Behind $2.7M in Stolen Bitcoin Miners

A local news outlet reports that two individuals tied to a South American theft ring were apprehended in Los Angeles after allegedly stealing $4 million in goods, including $2.7 million worth of application-specific integrated circuit (ASIC) bitcoin miners. From Tequila to Bitcoin Mining Rigs: LAPD Unravels Multi-Million Dollar Heist The Los Angeles Police Department (LAPD) […] Original

is decoupling here to stay?

In April, many crypto market observers were writing about an ongoing decoupling or divergence of Bitcoin from equities, meaning that the trajectory of Bitcoin’s price took a different direction compared to stocks and equities. Bitcoin and Gold are up, while the American dollar and stocks are down. However, opinions among market experts on whether the Bitcoin and equities markets have truly diverged vary. Some enthusiastically proclaim that Bitcoin has decoupled from risk assets and joined Gold as a safe haven. The reason is not hard to see: lately, Bitcoin and…

BlackRock, five others account for 88% of all tokenized treasury issuance

New data from RWA.xyz, a platform tracking tokenized real-world assets, shows that six entities are responsible for 88% of all tokenized US Treasurys. The data suggests a concentration among a few funds as the market continues to develop. The largest issuer of tokenized treasures continues to be BlackRock. The company’s tokenized US treasury fund, called BUIDL, has a market capitalization of $2.5 billion, 360% higher than its nearest competitor. BlackRock disclosed a total of $11.6 trillion in assets under management in the first quarter of 2025. Rounding out the top…

The Last Leg-Up That Confirms A Resounding Rally To $150,000

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. A new Bitcoin price prediction suggests that the flagship cryptocurrency needs just one more leg up to kickstart a powerful bullish move toward $150,000 and beyond. With Bitcoin getting…

Crypto firms launch Wall Street-style funds: Finance Redefined

Cryptocurrency firms and centralized exchanges are launching more traditional investment offerings, bridging the divide between traditional financial and digital assets. With investors seeking more flexible product offerings under one platform, the “line is blurring” between traditional finance (TradFi) and the cryptocurrency space, as the two financial paradigms signal a “growing synergy,” according to Gracy Chen, CEO of Bitget, the world’s sixth-largest crypto exchange. In the wider crypto space, Securitize partnered with Mantle protocol to launch an institutional fund that will generate yield on a basket of diverse cryptocurrencies, similar to…

Bitcoin Inches up to $95K, but Tariff Uncertainty Persists

The digital asset continued its upward trajectory on Friday, despite worries of how a drop in Chinese imports will impact the economy. Bitcoin Nears $95K Despite Trump Tariff Turbulence Some economists suggest President Donald Trump’s frequent last-minute trade policy reversals may have a more dire impact on the economy than his initial tariff announcements, leaving […] Original

Bitwise Files Delaware Trust Registration for Proposed NEAR Protocol ETF

Crypto asset manager Bitwise has taken a preliminary step toward launching a NEAR Protocol-focused exchange-traded fund (ETF) by filing registration documents for a Delaware statutory trust, public records show. Bitwise Advances NEAR ETF Plans with Delaware Statutory Trust Filing A Bitwise NEAR ETF entity was registered as a Delaware statutory trust on April 24, 2025, […] Source CryptoX Portal

As Bitcoin and altcoin prices rise, should you sell in May and go away?

Bitcoin and altcoin prices continued their recovery, and are on track for their best weekly close since January. The Bitcoin (BTC) price has jumped for three consecutive weeks and is now 28% above its lowest level this month. Most altcoins have also jumped, with the best weekly performers being Official Trump (TRUMP), Sui (SUI), Dogwifhat (WIF), Fartcoin (FARTCOIN), and Stacks (STX). All these tokens have jumped by over 50% in the last seven days. Other risky assets have also bounced back. The S&P 500, Nasdaq 100, and Dow Jones indices…