Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others. Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more…

Day: April 26, 2025

Crypto banking rule withdrawal by Fed ‘not real progress’ — Senator Lummis

United States Senator Cynthia Lummis suggests the crypto industry may be celebrating too soon over the US Federal Reserve softening its crypto guidance for banks. “The Fed withdrawing crypto guidance is just noise, not real progress,” Lummis said in an April 25 X post. Lummis called the Fed’s April 24 announcement — withdrawing its 2022 supervisory letter that had discouraged banks from engaging with crypto and stablecoin activities — “just lip service.” Lummis’ tone was different from the rest of the crypto industry Lummis, a pro-crypto advocate known for introducing…

Coinbase sees floor forming not sooner than late Q2, warns of short-term weakness

Despite signs of long-term Bitcoin accumulation, Coinbase warns that near-term market weakness may persist until at least late Q2. Coinbase analysts are taking a more cautious stance on the short-term crypto market, with expectations that the floor may not come into view until late Q2. In a joint research report with blockchain analytics firm Glassnode, Coinbase analysts highlighted that while long-term Bitcoin (BTC) holders are steadily accumulating more coins, the exchange still foresees ongoing weakness before any potential rebound takes shape. “Bitcoins’ liquid supply (coins moved within three months) decreased…

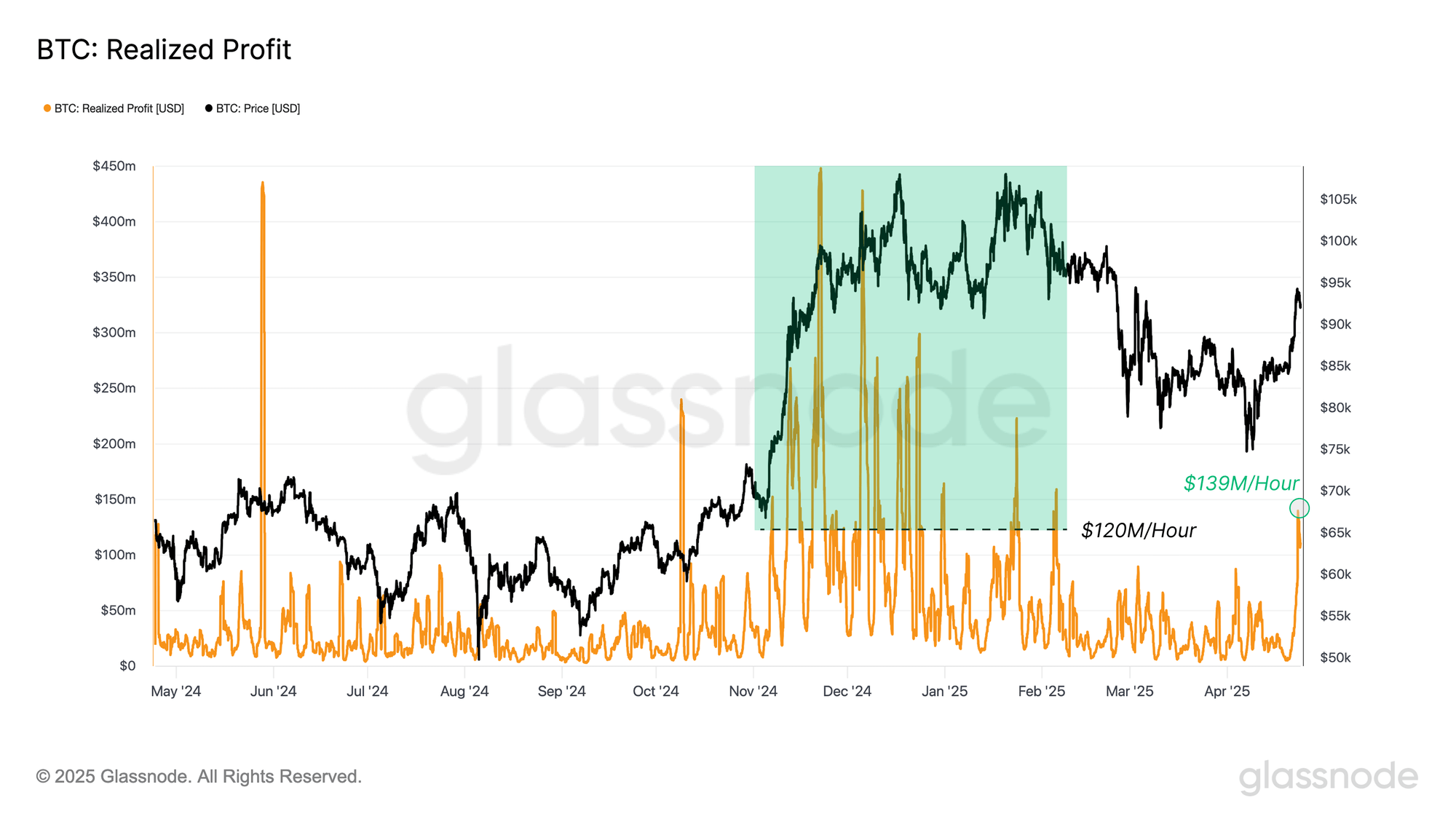

Bitcoin Holders Realizing $139 Million In Profit Per Hour This Rally, Report Says

A report from the on-chain analytics firm Glassnode has revealed how Bitcoin investors have recently been realizing an hourly profit 17% above the baseline. Bitcoin Realized Profit Has Spiked Alongside Recovery Rally In its latest weekly report, Glassnode has talked about the recent trend in the Realized Profit of Bitcoin. The “Realized Profit” here refers to an on-chain indicator that, as its name suggests, measures the total amount of profit that the BTC investors are realizing through their selling. The indicator works by looking at the transaction history of each…

Ethereum Up 12% In a Week, but Derivatives Data Suggests Caution

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. Ethereum is gradually regaining momentum after a recent correction, now trading above $1,700, reflecting a 12.2% increase over the past week. This recovery has drawn attention from analysts, who…

POL breaks out of 5-month downtrend, is a major rally brewing?

On April 25, POL marked its fifth day of gains, breaking a prolonged downtrend as ecosystem momentum and NFT demand picked up. According to crypto.news, Polygon’s native token, POL (formerly MATIC), surged nearly 20% to an intraday high of $0.26, pushing weekly gains to 34% and marking a 70% rebound from its monthly lows. Its market cap has once again crossed the $2 billion mark, standing at around $2.15 billion at the time of writing. A sharp rise in trading activity backed this rally. POL’s 24-hour volume also shot up…

Swiss National Bank Slams Bitcoin Reserve Push as Inflation Storm Brews

Switzerland’s fierce defense of tradition faced a seismic crypto challenge as calls to add bitcoin to national reserves intensify amid global economic turmoil and geopolitical shifts. Swiss National Bank Chairman Warns Bitcoin’s ‘Very High’ Volatility Risks Currency Stability Swiss National Bank (SNB) Chairman Martin Schlegel strongly opposed integrating bitcoin into the institution’s currency reserves during […] Original

Bitcoin ‘Apparent Demand’ Makes Sharp Rebound

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. Este artículo también está disponible en español. As Bitcoin (BTC) edges closer to the psychologically significant $100,000 milestone, several technical and on-chain indicators suggest that a major breakout could be on the horizon. One such metric…

Bitcoin ETFs on $3B ‘bender,’ log first full week of inflows in 5 weeks

Spot Bitcoin exchange-traded funds (ETF) in the United States saw over $3 billion in inflows this week, marking the first full week of consecutive inflows in five weeks. On April 25, the 11 spot Bitcoin (BTC) ETFs saw $380 million in inflows, bringing the total for the week to around $3.06 billion over five consecutive inflow days, according to Farside data. The last time spot Bitcoin ETFs had a full week of inflow days was the week ending March 21. Strong inflow week turns April into positive month ETF analyst…

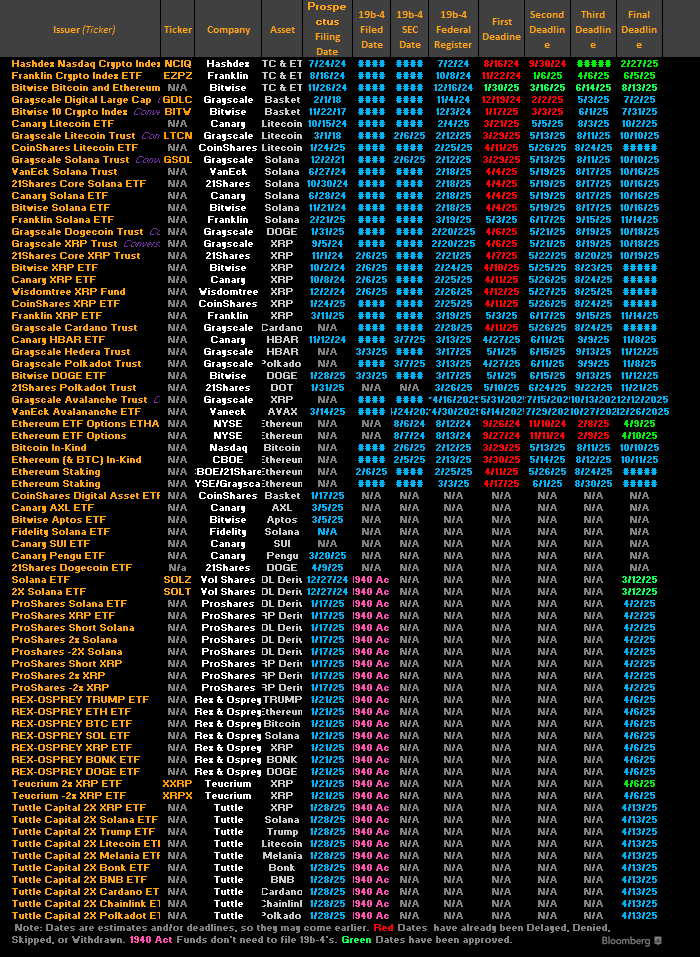

SEC delays multiple crypto ETF decisions amid growing application backlog

The U.S. Securities and Exchange Commission has pushed back decisions on Bitwise’s Bitcoin and Ethereum ETFs as well as Canary Capital’s Hedera ETF, citing the need for more time as it navigates a surge in ETF filings. According to filings dated April 24, the SEC has delayed decisions on Bitwise’s Bitcoin (BTC) and Ethereum (ETH) ETFs as well as well as Canary Capital’s Hedera (HBAR) ETF, with the new deadlines set to June 10 and June 11, respectively. In both filings, the SEC cited the need for additional time to…