The cryptocurrency market continued its recovery in the past week as the total crypto market capitalization breached the $3 trillion mark for the first time since the beginning of March. Bitcoin (BTC) rose to an over two-month high of $97,300 last seen at the end of February, before the “Liberation Day” tariffs announcement in the US, bolstering analyst predictions for a rally driven by “structural” institutional and exchange-traded fund (ETF) inflows into the world’s first cryptocurrency. Risk appetite continued rising among crypto investors, as Chinese state-linked news outlets indicated that…

Day: May 2, 2025

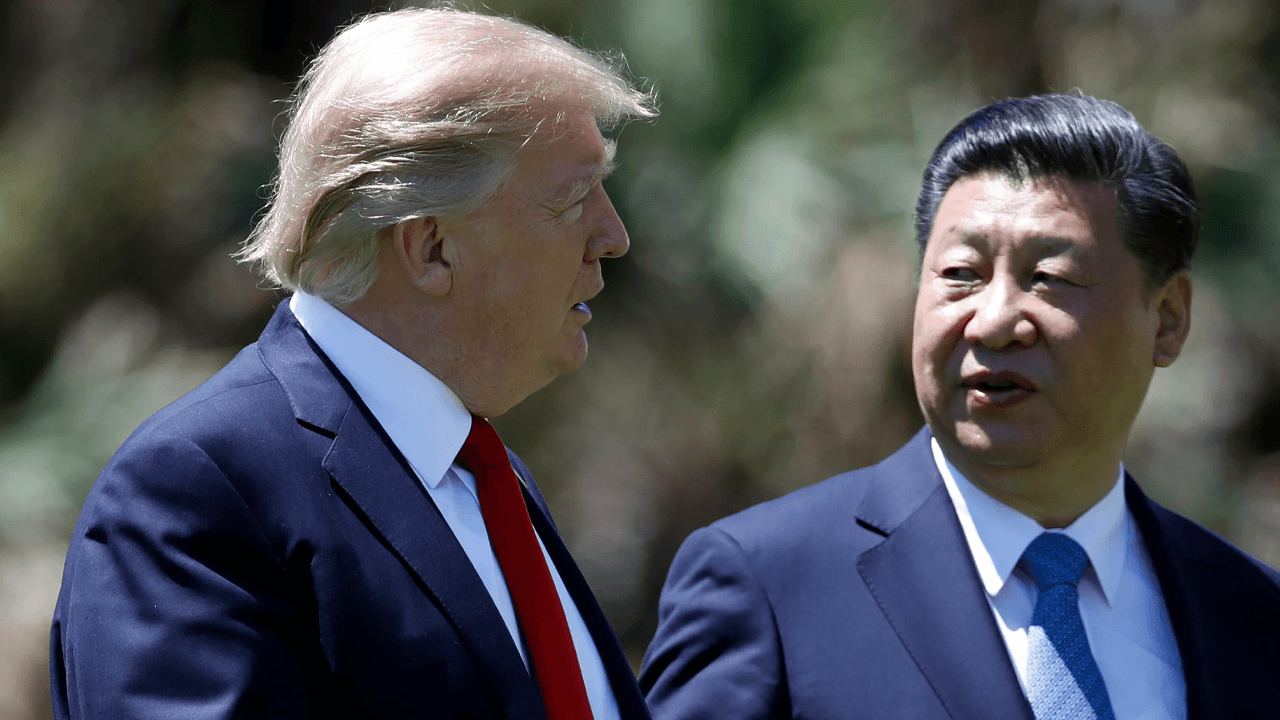

Trump adviser hints China tariffs could drop ‘within weeks’ as Bitcoin rallies

The U.S. could reduce its current 145% tariff rate on China “within a few weeks,” White House Council of Economic Advisers Chair Stephen Miran said in an interview. Speaking to Bloomberg TV on Friday, Miran said that while he is not directly involved in negotiations, he believes President Donald Trump is committed to reaching a deal and has a strong track record in doing so. Miran referred to the 2019 “phase one” deal as evidence of the president’s ability to strike agreements despite widespread skepticism. “The president has been very…

Bitcoin Taps $97.9K as US-China Trade Chill Ignites Crypto and Stock Market Frenzy

Digital assets edged higher Friday in step with U.S. equities, buoyed by hints that Washington and Beijing are dialing back their trade spat. The sector’s total capitalization has touched $3.03 trillion, and bitcoin is fetching $97,938 per coin. Fed in Trump’s Crosshairs Again—Markets Surge on Job Data and Trade Hopes Wall Street is on a […] Original

The SEC Can Learn From the IRS in Making Regulation Simpler for Crypto

In February, the Department of Government Efficiency (DOGE) began soliciting public input pertaining to the U.S. Securities and Exchange Commission (SEC) — a move suggesting reform at the agency is imminent. Since then, the SEC, in line with President Trump, has taken a far less adversarial stance towards the cryptocurrency industry, as evidenced by the appointment of crypto-friendly personnel and the abandonment of numerous lawsuits and investigations into crypto companies. But DOGE has the potential to implement further change, and interest in the SEC signals growing pressure towards regulators to…

CoinDesk Recap: Movement’s Very Bad Week

This week, bitcoin climbed steadily to reach nearly $100K, amid hopes for a China-U.S. trade and better macroeconomic conditions ahead. Institutions like Mastercard and BlackRock made important digital asset announcements. An historic stablecoin bill neared completion in the U.S. Congress. (A former prime-mover in the House said to expect a “wicked hot summer” of legislation.) And the Trump Family continued to dominate the crypto news cycle, raising serious conflict-of-interest questions. At CoinDesk, however, the biggest story concerned Movement, a once-hot startup that now seems deeply troubled. Deputy managing editor Sam…

Why Grayscale’s Bitcoin Trust still dominates ETF revenue in 2025

In the annals of financial history, few institutions have faced the tempests of competition with the steadfast resolve of Grayscale Bitcoin Trust (GBTC). Born in 2013 as a private placement, GBTC pioneered regulated Bitcoin investment, granting investors access to Bitcoin’s (BTC) meteoric rise without the perils of digital wallets or unregulated exchanges. On Jan. 11, 2024, it transitioned into a spot Bitcoin ETF following a landmark victory against the SEC. This marked a pivotal moment with the SEC’s view that ETFs can offer lower expense ratios and enhanced tax efficiency…

Bitcoin Dominance Hits 4-Year High on U.S. Jobs Shift

Key Notes Bitcoin dominance has jumped to 64.89%, marking a four-year high. Stronger-than-expected US job data has delayed hopes for rate cuts, with key implications for BTC. Market focus has shifted to Bitcoin amid sustained institutional inflows. Current market data shows that Bitcoin dominance in the digital asset market has reached its highest level in four years. This increase comes as the latest U.S. job data has given investors reason to reassess their economic expectations, affecting Bitcoin’s breakout potential. US Job Data Exceeds Expectations According to recent reports, the U.S.…

Bitcoin is a matter of national security — Deputy CIA director

The US Central Intelligence Agency is increasingly incorporating Bitcoin (BTC) as a tool in its operations, and working with the cryptocurrency is a matter of national security, Michael Ellis, the agency’s deputy director, told podcast host Anthony Pompliano. In an appearance on the market analyst and investor’s show, Ellis told Pompliano that the intelligence agency works with law enforcement to track BTC, and it is a point of data collection in counter-intelligence operations. Ellis added: “Bitcoin is here to stay — cryptocurrency is here to stay. As you know, more…

Strategy’s agressive Bitcoin purchases get green light from Wall Street analysts

Michael Saylor’s Strategy has announced aggressive plans to up its Bitcoin acquisitions, and two Wall Street firms are on board. Michael Saylor’s risky bet on Bitcoin (BTC) received a green light from top Wall Street analysts. According to a Friday, May 2 report by Coinbase, analysts from Wall Street research firms Benchmark and TD Cowen endorsed Strategy’s aggressive Bitcoin acquisitions. Mark Palmer, analyst at the research and investment banking firm Benchmark, noted Strategy’s first-mover advantage. He explained that the firm has managed to grow its Bitcoin holdings substantially, projecting a…

Brown University invests $4.9m in BlackRock’s Bitcoin ETF

Brown University has revealed a new $4.9 million investment in BlackRock’s iShares Bitcoin Trust. This investment stems from a 13F filing, which reveals that 105,000 shares were purchased, marking the university’s initial reported investment in a spot Bitcoin ETF. The position, acquired sometime in the first quarter of 2025, underscores growing institutional interest in Bitcoin (BTC) through regulated financial instruments. Brown’s total disclosed equity holdings in the filing stood at $216 million across 14 positions, placing the IBIT stake at roughly 2.3% of the portfolio’s value. BlackRock’s IBIT has been…