Smarter Web Company expands its Bitcoin holdings, as more global firms turn to BTC Corporate interest in Bitcoin (BTC) is reaching new highs, as more companies expand their holdings. On Friday, June 13, U.K.-based Smarter Web Company announced an additional purchase of 74,27 Bitcoin. The purchase, worth about $7.7 million, brings the company’s reserves to 242.34 BTC, worth approximately $25 million. The latest transaction was made at an average purchase price of $109,256 per BTC. The overall average purchase price for its reserves stands at $107,002. The purchase is part…

Day: June 13, 2025

Bitcoin Price Watch: Caution Ahead as Momentum Weakens Below Key Levels

Bitcoin continued its volatile path on June 13, 2025, hovering around $104,888 to $105,149 over the past hour as of 9:15 a.m. Eastern time. With a market capitalization of $2.089 trillion and 24-hour trading volume reaching $51.975 billion, the leading cryptocurrency traded within an intraday range of $103,081 to $108,369, reflecting sharp intraday swings and […] Original

Walmart, Amazon Are Coming for Traditional Payments, Mull Dollar-Pegged Stablecoins in the U.S.

Walmart (WMT) and Amazon (AMZN) are considering issuing their own stablecoins in the United States, according to a report by the Wall Street Journal. These corporate digital tokens, pegged to the U.S. dollar or other government-backed currencies, could dramatically reduce merchant fees and speed up payment settlements, disrupting the dominance of traditional financial institutions. The move is contingent on the passage of the Genius Act, a proposed regulatory framework for stablecoins that recently passed a key procedural step in Congress. If passed, it could pave the way for large companies…

Amazon and Walmart Plotting Stablecoin Issuance Moves: Report

Key Notes American multinationals Amazon and Walmart are considering issuing their USD-pegged stablecoins. Taking this route may strain the traditional financial system that relies on these firms. This development signals an increase in mainstream adoption of stablecoins. . The era of stablecoins has successfully reached the doorsteps of top merchandise platforms Amazon.com Inc (NASDAQ: AMZN) and Walmart Inc (NYSE: WMT). According to the Wall Street Journal (WSJ), both firms are considering the possibility of issuing stablecoins backed by the United States dollar. Handing Liquidity from TradFi to DeFi With Stablecoins With…

Bitcoin crashes as Israel launches attack on Iran, but charts saw it coming first

Bitcoin’s sharp sell-off this week has sparked concerns across the market, with many pointing to escalating tensions between Israel and Iran as the primary catalyst. While macro headlines triggered panic selling, the charts had already laid out the roadmap. A bearish shark harmonic pattern, coupled with a breakdown from key volume levels, suggested that a corrective move was highly probable. Notably, Bitcoin (BTC) was consolidating near the value area high earlier this week when tensions in the Middle East began escalating. As news of a military confrontation between Israel and…

Bitcoin’s Most Reliable Signal Just Flashed—Next Stop: $170,000

Reason to trust Strict editorial policy that focuses on accuracy, relevance, and impartiality Created by industry experts and meticulously reviewed The highest standards in reporting and publishing Strict editorial policy that focuses on accuracy, relevance, and impartiality Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio. The Hash Ribbon “buy” trigger – a signal embedded in Bitcoin’s network hashrate dynamics – has flashed again, and technical analyst Astronomer Zero believes it could pave the way to at least $170,000 per coin. A…

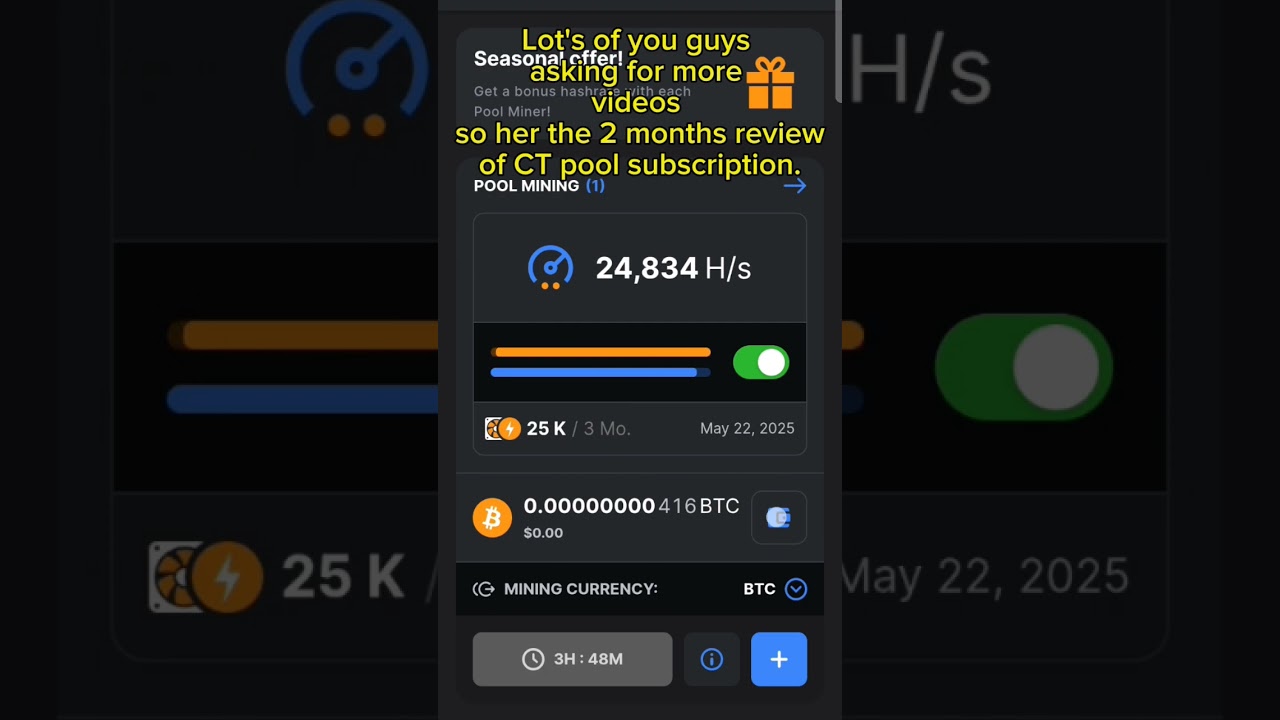

2 months review of CT POOL mining subscription #bitcoin #mining #cryptocurrency #powerpool

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Bitcoin eyes $110k, but this new memecoin could make investors wealthy

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. As Bitcoin edges toward $110k, a new contender, XYZVerse, is drawing attention for its blend of sports fandom and memecoin momentum. As Bitcoin aims for a staggering $110,000, investors are watching closely. Yet, there’s a new meme-inspired token on the horizon that might offer even greater returns. XYZVerse is generating buzz for its immense potential. Could this be the next big thing in cryptocurrency? The following article explores the…

Ether ETFs Set New 19-Day Inflow Record as Blackrock Drives Bitcoin ETF Gains

Bitcoin exchange-traded funds (ETFs) marked a fourth straight day of inflows totaling $86 million, while ether ETFs pushed their historic inflow run to 19 consecutive days, pulling in another impressive $112 million. Crypto ETF Momentum Builds With Bitcoin and Ether Funds Posting Strong Inflows The inflow optimism continued to sweep the crypto ETF markets on […] Original

Is it the time to buy Bitcoin? $170,000 setup looks like “a ticking time bomb”

Is $170,000 still a valid projection when Bitcoin derivatives show concentrated open interest at $140,000, or is the market setting itself up for another correction? Softer CPI data fuels BTC recovery attempt Bitcoin (BTC) climbed to $110,400 on Jun. 11 after fresh U.S. inflation data showed prices rising at a slower pace than expected. The report raised hopes that the Federal Reserve may have more room to lower interest rates in the coming months, a potential tailwind for risk assets including BTC. As of Jun. 12, Bitcoin is trading near $107,000.…