Jupiter, a decentralized trading platform on Solana, has announced plans to launch its stablecoin in partnership with Ethena Labs. The new token, called JupUSD, is scheduled to go live in mid–Q4 2025. According to an X post on Wednesday, JupUSD will be integrated across all Jupiter products, serving as collateral on its perpetual futures exchange, a liquidity asset in Jupiter’s lending pools and a trading pair. According to Jupiter, the stablecoin will be 100% collateralized by Ethena Labs’ USDtb, a dollar-pegged token backed by short-term US Treasury assets. Over time,…

Day: October 8, 2025

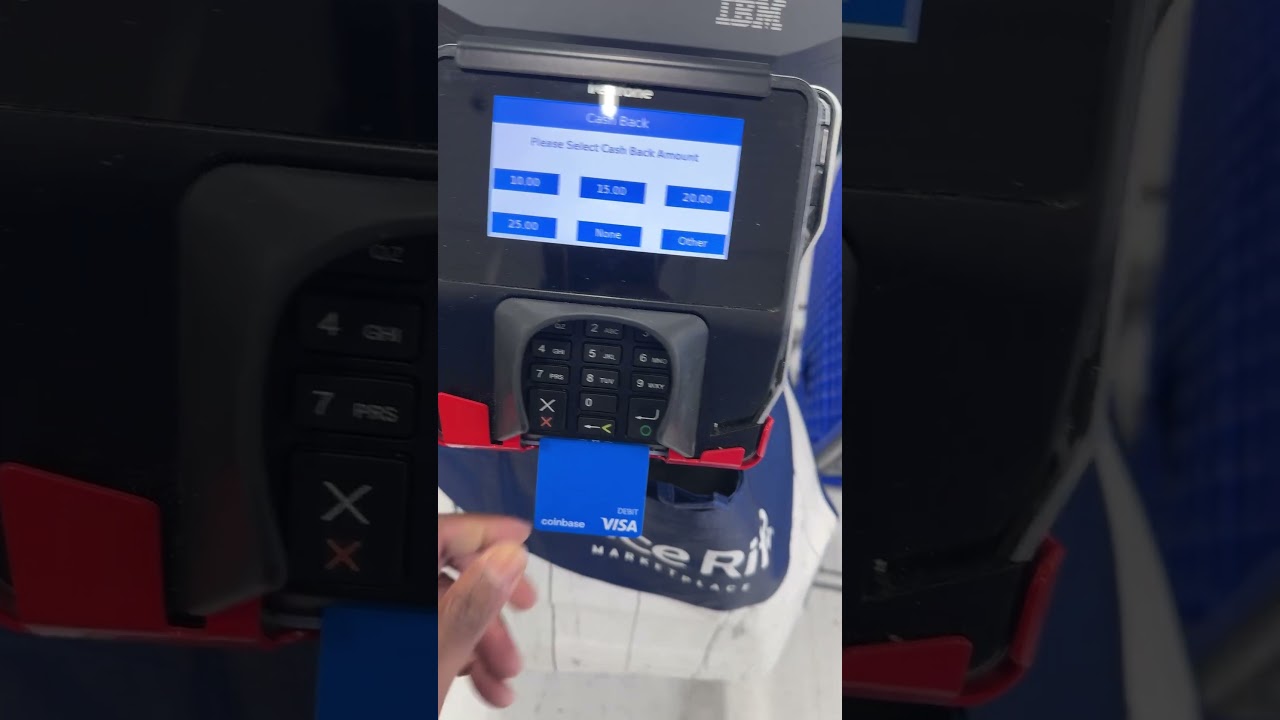

How I Paid for Groceries with Shiba Inu Using My Coinbase Card!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io In this video, I take you along as I use my Coinbase Card to pay for groceries with Shiba Inu (SHIB) – yes, you heard that right, crypto at the checkout! Watch me show how easy it is to spend your crypto in real life. If you’re into cryptocurrency, Shiba Inu, or just curious about using a Coinbase Card, this is for you. Don’t forget to like, subscribe, and hit that notification bell for more crypto adventures! #ShibaInu #CoinbaseCard #CryptoSpending #Cryptocurrency #PayWithCrypto…

Analyst Urges All XRP Investors To Pay Attention To This Connection No One Has Made Before

The XRP community has been called to attention after a new analysis linked the cryptocurrency’s trajectory to a powerful market force that many have overlooked. A recent breakdown by crypto analyst Austin Hilton has spotlighted a direct connection between XRP and Bitcoin that could shape how investors position themselves ahead of what could be one of the most explosive altcoin runs in years. How Bitcoin’s Performance Could Dictate XRP’s Next Move Hilton shared a video analysis on X social media, discussing a simple yet powerful correlation that shows the Bitcoin…

Crypto Exchange Gemini Expands Offering in Australia

US crypto exchange Gemini is set to expand its offerings in Australia with the launch of a new locally registered entity, and is taking a wait-and-see approach to recent draft laws expected to broaden oversight of the crypto sector. Gemini’s head of Asia Pacific, Saad Ahmed, told Cointelegraph that Australia’s crypto penetration is “quite significant, somewhere in the range of 23 to 25%” which leaves the exchange with “headroom for growth.” On Thursday, the exchange said it created a local entity registered with the Australian Transaction Reports and Analysis Centre…

MetaMask to Let Users Bet With Polymarket Integration

Crypto wallet MetaMask will tap Polymarket later this year to expand its offerings to prediction markets, aiming to get in on the booming sector that has caught Wall Street’s attention. The integration will make Polymarket directly available through MetaMask’s wallet, enabling users to buy and sell “shares” to bet on real-world events from elections and sports to a company’s earnings results. MetaMask’s global product lead, Gal Eldar, told Cointelegraph that the partnership is part of the firm’s goal to evolve from a crypto wallet into a gateway to global, democratized…

North Dakota to Launch Roughrider Coin: First US State-Backed Stablecoin on Fiserv Platform

Key Notes The dollar-backed stablecoin will serve North Dakota banks and credit unions through Fiserv’s digital asset platform. Named after Theodore Roosevelt’s Rough Riders, it aims to enhance interbank transactions and global payments. Fiserv processes 90 billion transactions annually across 10,000 financial institutions, providing the blockchain infrastructure. Bank of North Dakota, in collaboration with financial technology giant Fiserv, has announced plans to launch Roughrider Coin, the first state-backed stablecoin in the US. According to official reports, Roughrider Coin will launch on the Fiserv digital asset platform, fully backed by US…

Solana Crypto Price Prediction 📈

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Coinbase Premium Gap Signals Strongest Bitcoin Accumulation Since ETF Launch – Details

Bitcoin faced a swift correction below the $125,000 level after reaching a new all-time high of $126,200 on Monday, triggering widespread volatility across the market. The price retraced over 4% to around $120,000, liquidating millions in leveraged positions as traders anticipated further upside. The move caught many off guard, especially after days of strong momentum and renewed optimism that Bitcoin was preparing to enter another price discovery phase. Related Reading Despite the pullback, key on-chain data reveals a contrasting trend beneath the surface — a massive accumulation by US investors.…

Bitcoin Breaks $124K as Fed Minutes Reveal Strong Expectation for More Rate Cuts

The U.S. Federal Reserve published official minutes from its September meeting showing that half of the committee members expect two more rate cuts by year-end. Bitcoin Hits $124K After Fed Minutes Hint at Accelerated Easing U.S. President Donald Trump is probably somewhere smiling after reading the official minutes from the Federal Reserve’s September meeting, published […] Original

US Senate Confirms Treasury Official as Government Shutdown Continues

A majority of lawmakers in the US Senate voted to confirm Jonathan McKernan as Under Secretary for Domestic Finance at the Department of the Treasury. In a Tuesday vote of 51 to 47, the Senate confirmed McKernan to the US Treasury, serving under Secretary Scott Bessent. Though the US government has been shut down since lawmakers failed to pass a bill extending funding beyond Sept. 30, Congress can essentially continue to operate. McKernan, nominated to the Treasury by US President Donald Trump in June, has previously suggested opposition to debanking…