Opinion by: Dima Saksonov, founder and CEO of Atleta Network The sports industry has become the distribution channel for blockchain’s mainstream moment. Leagues, teams and venues are running verifiable ticketing, identity and rights-management systems as mission-critical infrastructure that operates at stadium scale. This shift has positioned sports organizations as decisive buyers that carry blockchain into everyday fan experiences. In the earlier cycles, crypto chased shortcuts to make a name in the mainstream, and the sports industry (eagerly looking for a fresh revenue stream) has become the first to embrace this…

Day: November 2, 2025

Provide granite marble mining solutions:2025 Latest Stone Mining Technology Solution #stonemachine

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Bitcoin Price Watch: Bulls Tease Breakout as Resistance Holds the Line

On Sunday, Nov. 2, bitcoin is coasting along at $110,896 to $111,087 over the past 60 minutes, securing a market cap of $2.21 trillion and churning out a 24-hour trading volume of $32.63 billion. The intraday price range flirted between $109,713 and $111,129, teasing breakout watchers but ultimately keeping its cards close to the vest. […] Original

November Could Be the New October for U.S. After Shutdown Delays SEC Decisions

October was supposed to be the month when long-awaited crypto exchange-traded funds (ETFs) finally hit U.S. markets. Deadlines for the Securities and Exchange Commission (SEC) to approve or deny several spot crypto ETF applications were lined up throughout the month. But when the U.S. government shut down, the process froze — and deadlines stopped mattering. Now November could take October’s place. Several issuers are using a procedural route that doesn’t require an active SEC sign-off. It’s the same approach that allowed four crypto ETFs — two from Canary Capital, one…

Dogecoin RSI Returns To Pre-Launch Levels, Analyst Says Next Major Surge Is Close

Dogecoin’s latest two-week chart analysis suggests the cryptocurrency could be gearing up for a new explosive rally. According to trader and market analyst Trader Tardigrade, the Relative Strength Index (RSI) for Dogecoin has settled at levels similar to those seen before price rallies in the past two years or so. This technical observation is based on Dogecoin’s steady uptrend along a long-standing support line since 2023 and points to its price action currently being in a possible early stage of accumulation before another leg upward. Related Reading Dogecoin RSI Now…

Bitwise’s Solana ETF Dominates 2025 Launches, Bitcoin Dips After Powell Comments, and More — Week in Review

Bitwise’s Solana ETF dominance, bitcoin’s dip after Powell comments, x402 token surge, Western Union’s crypto push, and Trump’s attack on Powell in this Week in Review. Week in Review Bitwise’s Solana ETF dominated 2025 ETF launches with a blockbuster debut and even stronger day-two trading, bitcoin dipped after Powell warned a December rate cut isn’t […] Original

Bitcoin: ACHTUNG! In __ Tagen ist ALLES VORBEI!😳

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Hier kaufen wir unsere Kryptos: 🔥Bitvavo, einer der günstigsten Börsen weltweit! ✅10€ Gratis für ALLE NEUKUNDEN! (Nur für kurze Zeit!) ✅ 10.000€ Gebührenfrei! ➡️ * Hier Trade ich Bitcoin: (Nur für erfahrene Trader!) ✅Sichere dir 10.500$ Trading-Bonus gratis:🤯(Nur für kurze Zeit) ✅10% Gebühren-Rabatt Lebenslang! ➡ 🔥20.000$ Trading Wettbewerb: ➡ 🔥Bitpanda – Krypto Broker aus Österreich, reguliert in ganz Europa! 600 Altcoins, Bitcoin-Sparplan, Trading, Aktien uvm.: ➡️ ✅30€ in BTC Gratis für ALLE NEUKUNDEN! (NUR für kurze ZEIT) ➡️ ✅DU möchtest TRADEN lernen?…

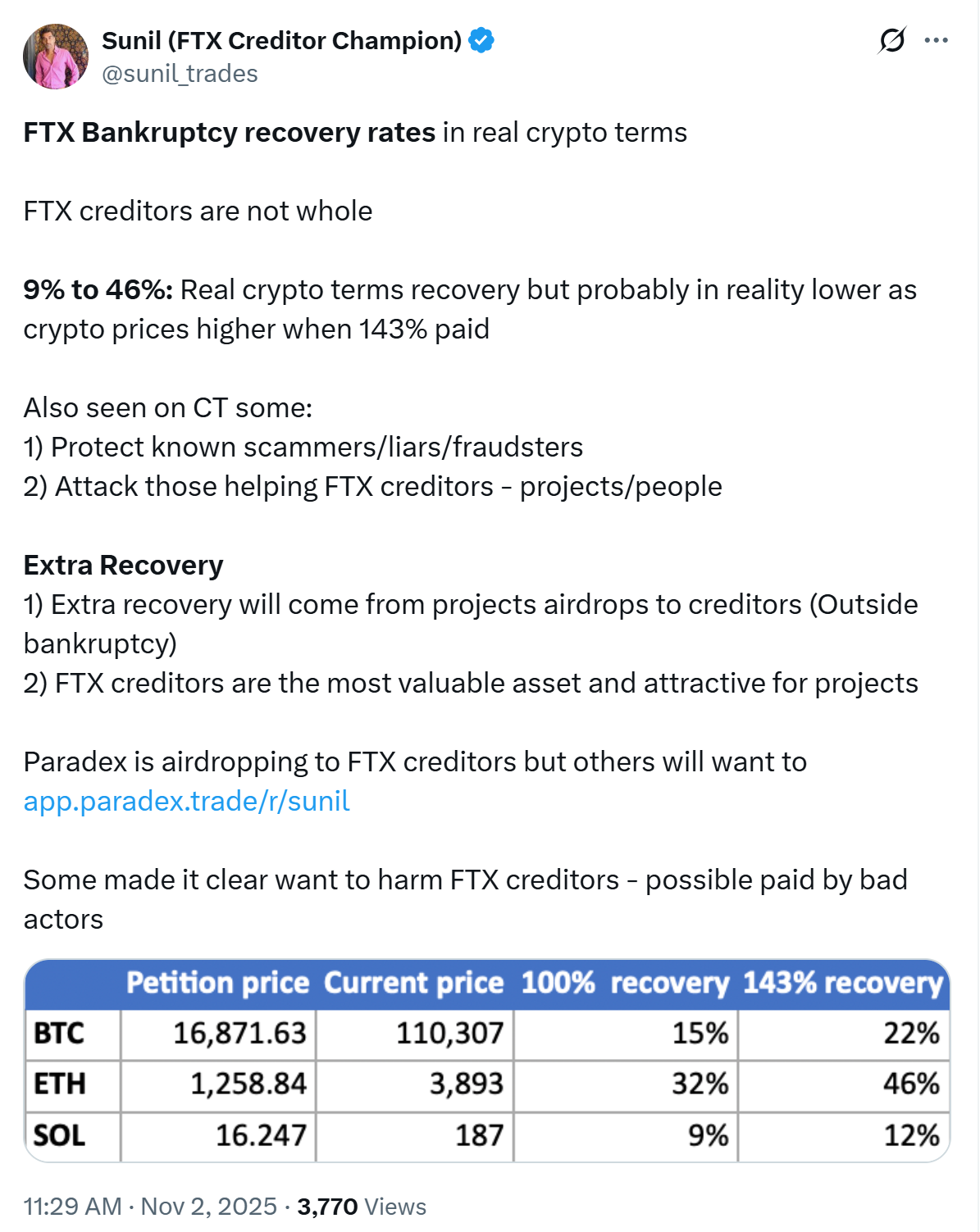

FTX Creditors May Recover as Little as 9% After Adjusting for Crypto Prices

FTX creditors may receive far less than initially believed once payouts are adjusted for today’s inflated crypto valuations, according to Sunil, a prominent FTX creditor representative. In a Sunday post on X, Sunil estimated that the real crypto recovery rate for FTX creditors ranges between 9% and 46%, noting that the actual value could be even lower as Bitcoin (BTC), Ether (ETH) and Solana (SOL) prices have surged since the exchange’s collapse in 2022. “FTX creditors are not whole,” he wrote, adding that the exchange’s planned 143% fiat repayment doesn’t…

The ‘Uptober’ That Wasn’t: Bitcoin Ends Seven‑Year Winning Streak

While many were expecting bitcoin prices to blow up during October, as they had during the previous seven years, BTC failed to follow through. Although the leading cryptocurrency reached record highs, it also fell as low as $104K, enduring one of its harshest liquidation events. ‘Uptober’ Trend Demolished: Bitcoin Closes October With Losses The Facts […] Original

Hedera Price Prediction: Falling Wedge Pattern Hints 150% Upside Amid $44M HBAR ETF Inflows

Key Notes HBAR gains 3% in 24 hours, hitting $0.20 after ETF inflows surge. Canary’s HBAR ETF records $44 million in net inflows, leading altcoin peers. Falling wedge breakout pattern projects up to $0.50 if bullish momentum holds. After closing October with a 13% loss, Hedera (HBAR) price dipped by another 3% in the last 24 hours, hitting $0.19 on November 2. As macro headwinds taper off, Hedera appears to be benefiting from $44 million ETF inflows, as institutional investors take on a bullish outlook on HBAR’s enterprise solution prospects.…