Key Notes CoinShares reported digital asset weekly outflows of $1.94 billion in the past week. Bitcoin, Ethereum, and Solana Records outflows of $1.27 billion, $589 million, and $156.2 million, respectively. XRP recorded inflows worth approximately $89.3 million to change the trend. XRP XRP $2.08 24h volatility: 1.3% Market cap: $125.44 B Vol. 24h: $4.61 B has surprised crypto enthusiasts by going in a different direction, while most cryptocurrencies struggled this past week. It recorded inflows of $89.3 million, while other digital asset investment products saw $1.94 billion of outflows last…

Day: November 24, 2025

How Low Can Zcash Price Go After ZEC’s 30% Drop From November’s Peak?

Key takeaways: ZEC charts mirror BNB’s pre-crash parabola, hinting at a potential correction to the $220–$280 range next. Analysts warn of “pump-and-dump” dynamics amid paid promotions, although some crypto veterans remain bullish long term. Zcash (ZEC) has dropped about 30% from its November peak of $750, raising fears of deeper losses ahead, with some analysts warning of a potential “pump-and-dump.” ZEC/USDT four-hour chart. Source: TradingView Symmetrical triangle hints at 50% ZEC price drop As of Monday, Zcash traded within a symmetrical triangle pattern on the four-hour chart, reflecting indecision among…

#Bitcoin Analiz – Bitcoin’de Düşüşler Devam Edecek Mi? Btc Teknik Analiz Forex

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin analiz – Bitcoin teknik analiz – altcoin sepeti – btc – kripto para – al sat – yukselecek mi? dusecek mi? kazanma – alinir mi – nasil alinir – alma – fiyati – yorumu – yorum son durum nedir? simdi ne olacak? btc yorum destek ve direncler neler? btc ayi sezonu basladi mi? boga sezonu devam mi ediyor? kripto para – crypto currenty technical analysis forex 06.11.2025 Ramço Okuluna Sizde Üye Olun! Hafta İci Hergün Altcoin Analizleri icin, Anlık Bilgiler İçin,…

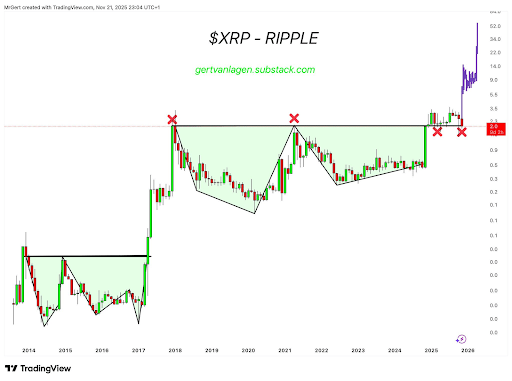

Why XRP Price Crash Below $2 Is Not A Problem

XRP has endured a difficult stretch in recent days, falling below the $2 level after a sequence of heavy selling. Price volatility across Bitcoin and other major assets added fuel to the drop, dragging XRP to lows around $1.92 and shaking the short-term sentiment of many traders. However, several XRP supporters are still of the notion that this move is far from a cause for concern. One of the most vocal is an analyst operating under the name @WillyWonkaXRP on the social media platform X, who insisted that the dip…

Bitcoin ETF outflows on track for worst month in history

November is set to be the worst month for crypto ETFs in their history, with Bitcoin ETFs seeing $3.5 billion in outflows. Summary So far in November, investors have pulled $3.5 billion from Bitcoin ETFs This figure is close to the previous record of $3.6 in February 2025 BlackRock’s IBIT fund leads with $2.2 billion in outflows in November Since launching nearly two years ago, Bitcoin exchange-traded funds are on track for their worst month in history, according to Bloomberg. From the start of the month up to Monday, November…

Did Bitcoin bottom? Arthur Hayes Thinks $80,000 Will Hold

Key points: Bitcoin should have bottomed out at $80,000 last week, according to former BitMEX CEO Arthur Hayes. Liquidity conditions are poised to turn in the crypto bulls’ favor, with the US Federal Reserve set to end QT. The buzz around future Fed rate-cut moves remains highly volatile. Bitcoin (BTC) should retain $80,000 support as US liquidity conditions change to boost crypto bulls. In his latest X content, Arthur Hayes, former CEO of crypto exchange BitMEX, predicted an inbound BTC price recovery. Hayes on BTC price: “I think $80,000 holds”…

Long-Term Demand Is Intact, Traders Look to $HYPER for Outsized Gains

What to Know: Bitcoin’s latest drawdown is being driven by reversing ETF flows, weaker treasury demand, and shrinking stablecoin supply, signaling real capital flight. Despite near-term volatility, the long-term structural story for Bitcoin, notably institutional adoption, sovereign interest, and neutral-collateral status, remains intact. Bitcoin Hyper aims to extend Bitcoin into high-speed DeFi through a Solana-style Layer-2, a canonical BTC bridge, and zk-secured settlement. The $HYPER presale has raised over $28M, offering staking rewards and clear tokenomics that position it as a leveraged bet on Bitcoin utility. Bitcoin just reminded everyone…

I-On Digital Corp. Retains Craft Capital to Advance Capital Strategy and Prepare for National Exchange Uplisting

November 24th, 2025 – Chicago, USA I-ON Digital Corp. (OTCQB:IONI), a U.S.-based digital asset infrastructure company specializing in real-world-asset (RWA) tokenization and regulated digital asset banking, today announced a strategic engagement with Craft Capital Management, LLC (“Craft Capital”) to strengthen its capital markets strategy, support upcoming financing initiatives, and guide the Company’s preparations for a potential national exchange uplisting. Craft Capital, headquartered in Garden City, New York, is a full-service broker-dealer and investment bank providing institutional and retail brokerage, private and public capital advisory, uplisting expertise, and comprehensive corporate finance…

Can This Tiny Miner Mine Bitcoin Solo?!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io A look at an affordable crypto gadget from JingleMining. The BTC Solo Lite 1.2T Miner lets you solo mine Bitcoin with a chance to hit a full block reward. Great for hobbyists and crypto beginners. Use code “chris” for a discount! Jingle Mining Website: Jingle Mining X: Jingle Mining Facebook: Jingle Mining Instagram: Jingle Mining LinkedIn: Jingle Mining YouTube: Jingle Mining TikTok: Blockchain Bay Website: Looking for a Discount on Crypto Projects, Hardware Wallets, Seed Phrase Wallets and More? Check out the…

$80K Bitcoin Becomes the Most Popular Bet

Key Notes The $80,000 put is now the most popular BTC options contract. Spot bitcoin ETFs saw over $40 billion in weekly trading volume. Analysts warn of potential dips toward $80k-$82k liquidity zones. . Bitcoin’s BTC $86 040 24h volatility: 1.0% Market cap: $1.72 T Vol. 24h: $66.62 B options market is swinging heavily toward bears, with the $80,000 put now emerging as the most popular contract on Deribit. The put option holds over $2 billion in open interest, surpassing the $85,000 put at $1.97 billion. The once-dominant $140,000 call…