▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 💡Daftar sesi konsultasi 1-on-1 eksklusif untuk membantu kamu ubah arah keuangan dan capai kebebasan finansial. Hubungi di di +62 821‑1827‑0890 (admin), atau pelajari lebih lanjut di Garansi 100% uang kembali jika kamu tidak puas! 💡Mau belajar ETF & kerja di luar negeri bareng? Gabung komunitas saya GRATIS di sini ► GRATIS Template Kuangan Pribadi Saya, buat atur Uangmu dari sekarang sampai hari pensiun. ► Mulai investasi Saham AS di XTB (pake kode referral “PANDEKAETF”). Download di sini: ► Link daftar GO trade.…

Day: December 1, 2025

Does GENIUS Make Stablecoin Issuers Stealth Buyers of US Debt?

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, signed into law on July 18, is billed as the statute that finally drags dollar‑pegged tokens out of the regulatory gray zone into a supervised, payments‑first framework. Supporters say it offers legal clarity, consumer protections and a path for programmable money. Critics say it raises a deeper question: If issuers are tightly steered into holding cash and short‑term Treasurys, does that make them structural buyers of US debt? That’s the case laid out by author and ideologist Shanaka Anslem…

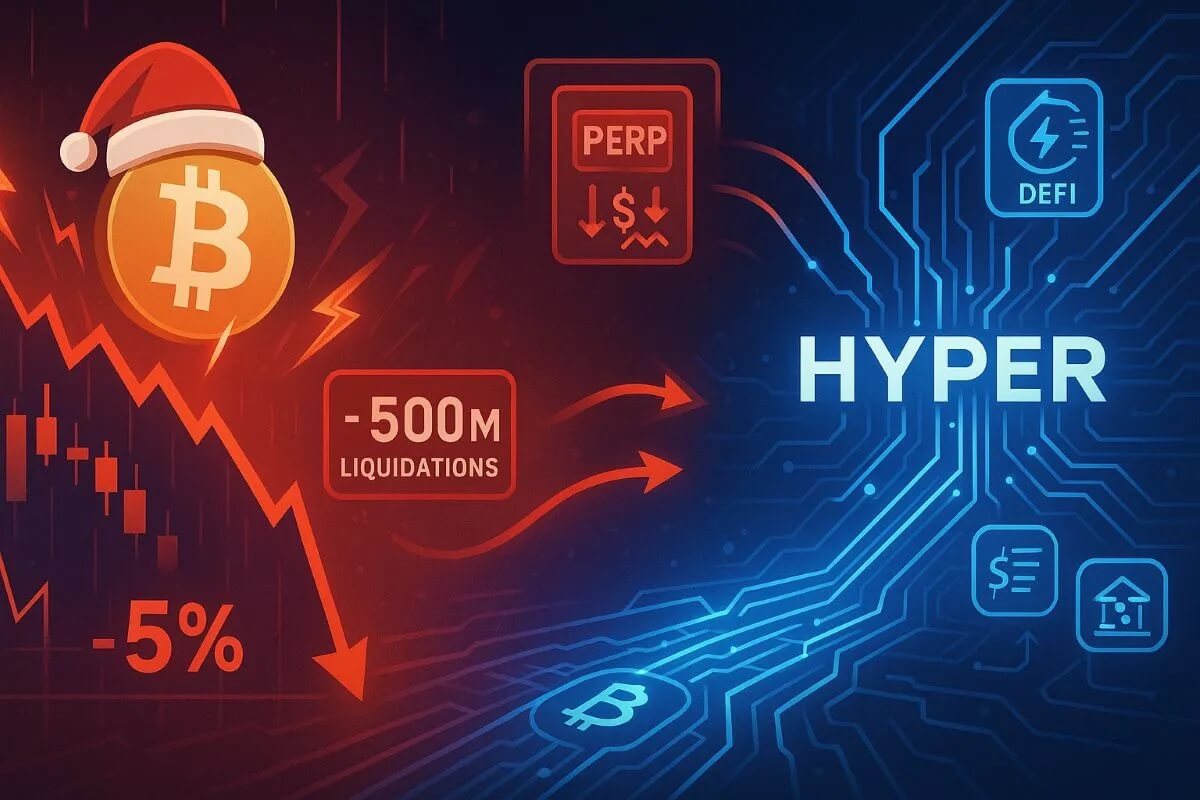

Bitcoin Dips 5% in ‘Sunday Slam’ as Liquidations Surge, Sparking Bitcoin Hyper Interest

What to Know: A 5% Bitcoin pullback and more than $500M in liquidations show how quickly overleveraged long positions unwind when volatility returns. Volatility spikes often drive traders out of crowded perpetual futures trades and into emerging Bitcoin-adjacent themes such as Layer-2 infrastructure and smart contract ecosystems. Bitcoin Hyper ($HYPER) is designed to close Bitcoin’s throughput and programmability gaps with an SVM-backed Layer-2 offering sub-second execution anchored to the Bitcoin base layer. Rising interest in Bitcoin-native DeFi and high-speed payment rails indicates that Bitcoin Layer-2 narratives may become increasingly influential…

BlackRock-linked wallet shifts $186m in Bitcoin to Coinbase Prime

A BlackRock-linked wallet moved 2,156 BTC (~$2186) to Coinbase Prime, with analysts viewing it as routine ETF liquidity and settlement flow rather than sell pressure. Summary On-chain data shows 2,156 BTC sent from a wallet tied to BlackRock to Coinbase Prime, worth about $200M at current prices. Analysts say such transfers usually support ETF share creation/redemption, OTC settlement, custodial rebalancing, and treasury operations, not speculative selling. Until coins hit hot wallets or fragment into smaller outputs, observers see no clear signs of imminent market selling from this move. A wallet…

Ether ETFs Lead Weekly Gains as Bitcoin and Solana Stay Green

Ether ETFs roared back to life with their strongest week in a month, while bitcoin funds ended a four-week outflow streak and solana funds extended their multi-week surge. Across all three sectors, the tone shifted decisively toward accumulation. ETF Revival Week: Ether Dominates, Bitcoin Edges Up A calmer macro backdrop and renewed appetite across digital […] Original

Yearn Finance Suffers $9M Breach As Attacker Creates Endless yETH Tokens

Yearn Finance reported that a legacy yETH product was hit by an exploit that allowed an attacker to mint a massive amount of fake tokens and swap them for real assets. According to on-chain alerts and protocol statements, the attacker created a near-infinite supply of yETH in a single transaction, then used those tokens to pull ETH and liquid-staking derivatives from liquidity pools. The incident was first flagged on November 30, 2025, and the total impact has been reported at roughly $9 million. #PeckShieldAlert Yearn Finance @yearnfi suffered an attack…

Bitcoin Wasn’t Dumped, It Was Executed: Best DCA Opportunity Is Here?

Key Notes Spot Bitcoin ETFs just recorded their worst month since February, with $3.48B in outflows. Massive whale accumulation formed one of the densest cost-basis support zones near $80K. Analysts say Bitcoin’s dip under the DCA stress line historically signals the best long-term buy zones. Bitcoin BTC $85 931 24h volatility: 6.1% Market cap: $1.71 T Vol. 24h: $72.03 B entered December after ending the previous month with the worst performance for spot BTC ETFs since February, as heavy outflows met a sudden collapse in market liquidity. SoSoValue data shows…

Altcoin liquidity vanishes as capital crowds into Bitcoin

Altcoin liquidity is drying up as capital consolidates into Bitcoin-focused ETFs and DAT-style treasuries, leaving most non-blue-chip tokens exposed to thinner books and harsher speculative boom–bust cycles. Summary CryptoQuant’s CEO says months of falling volume and shallow order books show structural liquidity exhaustion across the altcoin sector, while Bitcoin dominance climbs with macro uncertainty. Regulated Bitcoin ETFs and DAT companies accumulating BTC act as primary inflow channels, attracting institutional money that bypasses long-tail tokens entirely. Only a handful of assets like Bitcoin, Ethereum, and Solana retain deep liquidity, while altcoins…

This Crypto Expert PREDICTED This Crash – Here’s What Comes NEXT! (Warning)

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io He successfully predicted the crash when everyone else was calling for new all-time highs. Now, he explains why the worst might not be over yet and the specific conditions we need to see before Bitcoin and Altcoins can recover. We also discuss the state of Altcoins – are they dead, or is this the buying opportunity of a lifetime? Check out Fefe here: Private Community – Get Started For Free💎 CoinW – Register & Earn Up to $1000 Bonus💰 Bitunix – Earn…

Bear Trap or $4K? Ethereum Data Mixed on ETH Price Recovery

Ether (ETH) fell to $2,800 on Monday, failing to hold $3,000 as surging expectations of a Bank of Japan rate hike unnerved the market. Meanwhile, technicals and onchain data sent mixed signals on Ether’s ability to buck the downtrend. Key points: Ethereum price fell 5.5% on Monday, dropping below $3,000 again amid Bank of Japan rate-hike fears. Bulls need a sustained break above $3,200 for a strong recovery, while breaching $2,800 would invalidate the macro bullish trend. Ether’s MVRV Z-Score approaches the accumulation zone, signaling a local bottom forming. Ether’s…