Key Notes LSEG has deepened its crypto drive with instant blockchain settlements using commercial bank money. The Settlement House platform supports real-time PvP and DvP across digital and traditional payment networks. Service aims to cut settlement risk and improve liquidity management around the clock. Blockchain settlements moved closer to daily market use as LSEG launched Digital Settlement House. This is a new platform designed to allow instant settlement across payment networks. It will use commercial bank money to move cash and assets across markets at any time. How LSEG Is…

Day: January 15, 2026

London Stock Exchange Group Launches DiSH for 24/7 Onchain Cash Settlement

The London Stock Exchange Group has rolled out a new digital settlement service to bring commercial bank money onto blockchain rails. The service, called Digital Settlement House (DiSH), enables instant settlement across both blockchain-based and traditional payment networks, operating around the clock across multiple currencies and jurisdictions, according to a Thursday announcement. At the core of the platform is DiSH Cash, a ledger-based representation of commercial bank deposits. Rather than relying on stablecoins, the system uses tokenized claims on actual bank deposits, providing what LSEG describes as a “real cash…

Arthur Hayes Bets On MSTR, Metaplanet And Zcash As Bitcoin Turns

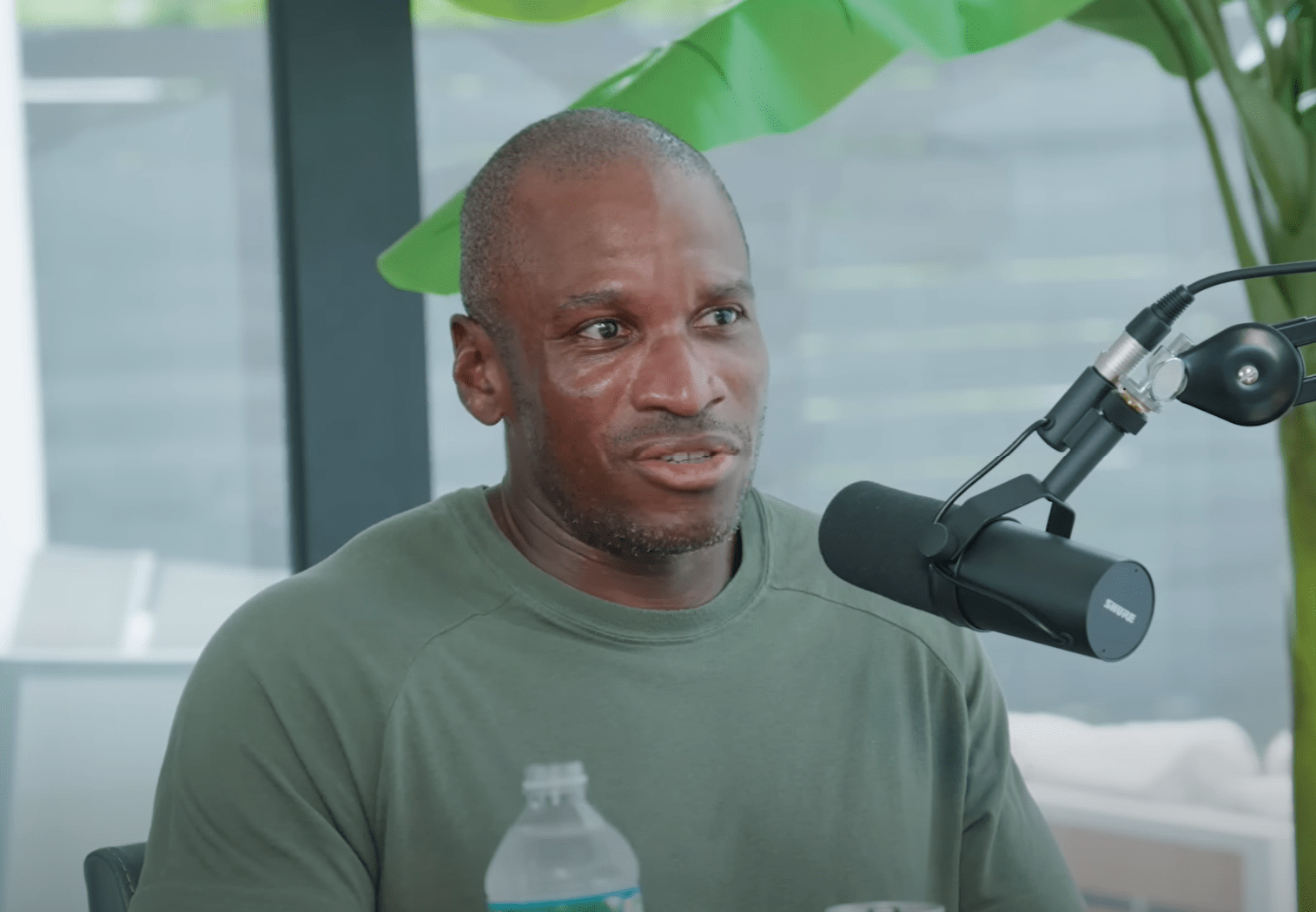

Arthur Hayes is positioning for a 2026 liquidity rebound, arguing that Bitcoin’s weak 2025 wasn’t a referendum on “crypto narratives” so much as a straightforward dollar-credit story. In his latest essay, “Frowny Cloud,” the Maelstrom CIO says he is adding risk via Strategy (MSTR), Japan’s Metaplanet, and Zcash (ZEC) as he expects US dollar liquidity to inflect higher after a year in which Bitcoin lagged both gold and US tech stocks. Hayes frames 2025 as an awkward year for the standard cross-asset shorthand that treats Bitcoin as either digital gold…

Arthur Hayes: Dollar Liquidity Will Drive BTC Higher in 2026

Key Notes Hayes attributes Bitcoin’s 2025 underperformance to tighter dollar liquidity. BTC is trading near $96,200 after breaking above the $94,200 resistance level. Open interest has fallen over 31% from its 2025 peak to around $10 billion. BitMEX co-founder Arthur Hayes claimed that Bitcoin’s weak performance in 2025 was a direct result of tightening dollar liquidity. Notably, Bitcoin BTC $96 756 24h volatility: 1.8% Market cap: $1.93 T Vol. 24h: $67.26 B fell 14.4% last year as liquidity declined. Gold soared 44.4% in the same period. US tech stocks also…

Bitcoin ETFs Post $840M Inflows As BTC Rallies Above $97K

Bitcoin exchange-traded funds (ETFs) have seen strong inflows for three consecutive days, reversing earlier January losses. Spot Bitcoin (BTC) ETF inflows topped $843.6 million on Wednesday, marking the largest single-day inflows of 2026 so far, according to data from crypto research platform SoSoValue. During the three-day streak, spot Bitcoin ETFs have drawn more than $1.7 billion, offsetting earlier outflows of about $1.4 billion on Jan. 6–9. The fresh inflows came amid Bitcoin revisiting two-month highs above $97,000 on Wednesday, pushing investor sentiment higher as the Crypto Fear & Greed Index…

Cat VS Deer. Mining Challenge🥺

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Ethereum Season Loading? Analyst Says It’s Time For Its ‘Big Test’

After its recent price breakout, Ethereum (ETH) is facing its next big test and attempting to turn a crucial area into support. Some analysts have suggested that the altcoin is ready to continue its bullish momentum, arguing that the biggest rotation in years is coming. Related Reading Ethereum Challenges Key Resistance Area On Wednesday, Ethereum broke past a crucial area and retested the $3,400 level for the first time in over a month. The king of altcoins has seen a 6% increase in the daily timeframe, jumping from the $3,100…

Retail Is Bearish, but $1.7B in Institutional Inflows Pushed BTC Above $97K

Key Notes Spot BTC ETFs saw a net inflow of over $1.7 billion in the past three days. Santiment data suggests bearish sentiment from smaller investors. Bitcoin almost reached $98,000 as the CMC fear and greed index broke above 50. The cryptocurrency market has been seeing notable gains as January kicked off, especially in the past three days. The retail sector, however, continues with its mixed reactions, mostly bearish. The total crypto market cap grew by over $300 billion over the past two weeks, according to CoinMarketCap. Its value reached…

DeFi Protocols Move Away From Discord as Scam Risks Rise

Decentralized finance (DeFi) protocols are abandoning public Discord servers, arguing that the platform has become more of a liability than a community hub. The shift drew attention on Wednesday after DeFi lending protocol Morpho said it had moved its public Discord server into read-only mode, directing users instead to alternative support channels. The move reflects growing concern that Discord has become a favored hunting ground for scammers targeting crypto users. The concern is not limited to Morpho. DeFi data platform DefiLlama’s pseudonymous founder 0xngmi said they have been quietly reducing…

Bitcoin. El mercado puede reactivarse mañana con la apertura de las bolsas o el lunes día 5.

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io LINK del libro de aventuras: LINK DE BINANCE : (20% de descuento en comisiones de compra-venta) (Hasta 300 $ gratis para comisiones, cumpliendo unas tareas) LINK de BackPack: LINK campaña de BYBIT: LINK DE BITGET: (15% de descuento en comisiones de compra-venta) LINK DE KUCOIN: (15% de descuento en comisiones de compra-venta) LINK DE NordVPN: Link del libro “Memorias de un operador de Bolsa” : LINK DE NEXO : Canal de Instagram: Canal de mercados tradicionales: ADVERTENCIA: No tengo ningún canal de…