Bitcoin (BTC) bear markets come in many shapes and sizes, but this one has given many reason to panic.

BTC has been described as facing “a bear of historic proportions” in 2022, but just one year ago, a similar feeling of doom swept crypto markets as Bitcoin saw a 50% drawdown in weeks.

Beyond price, however, 2022 on-chain data looks wildly different. Cointelegraph takes a look at three key metrics demonstrating how this Bitcoin bear market is not like the last.

Hash rate

Everyone remembers the Bitcoin miner exodus from China, which effectively banned the practice in one of its most prolific areas.

While the extent of the ban has since come under suspicion, the move at the time saw huge numbers of network participants relocate — mostly to the United States — in a matter of weeks.

As a result, Bitcoin’s network hash rate — the computing power dedicated to mining — roughly halved. At the time, this was unprecedented, while miners felt that they had no choice but at least temporarily to cease operations.

This time around, it is not red tape but simple math threatening miners. The BTC price dip to 19-month lows has put mounting pressure on the profitability of mining operations.

As Cointelegraph reported, however, a mass capitulation event may not necessarily occur, even at current levels, amid suggestions that miners who needed to sell BTC inventory have already done so.

Hash rate supports that thesis, having dipped by a maximum of around 20% from all-time highs before rebounding, according to estimates from data resource MiningPoolStats.

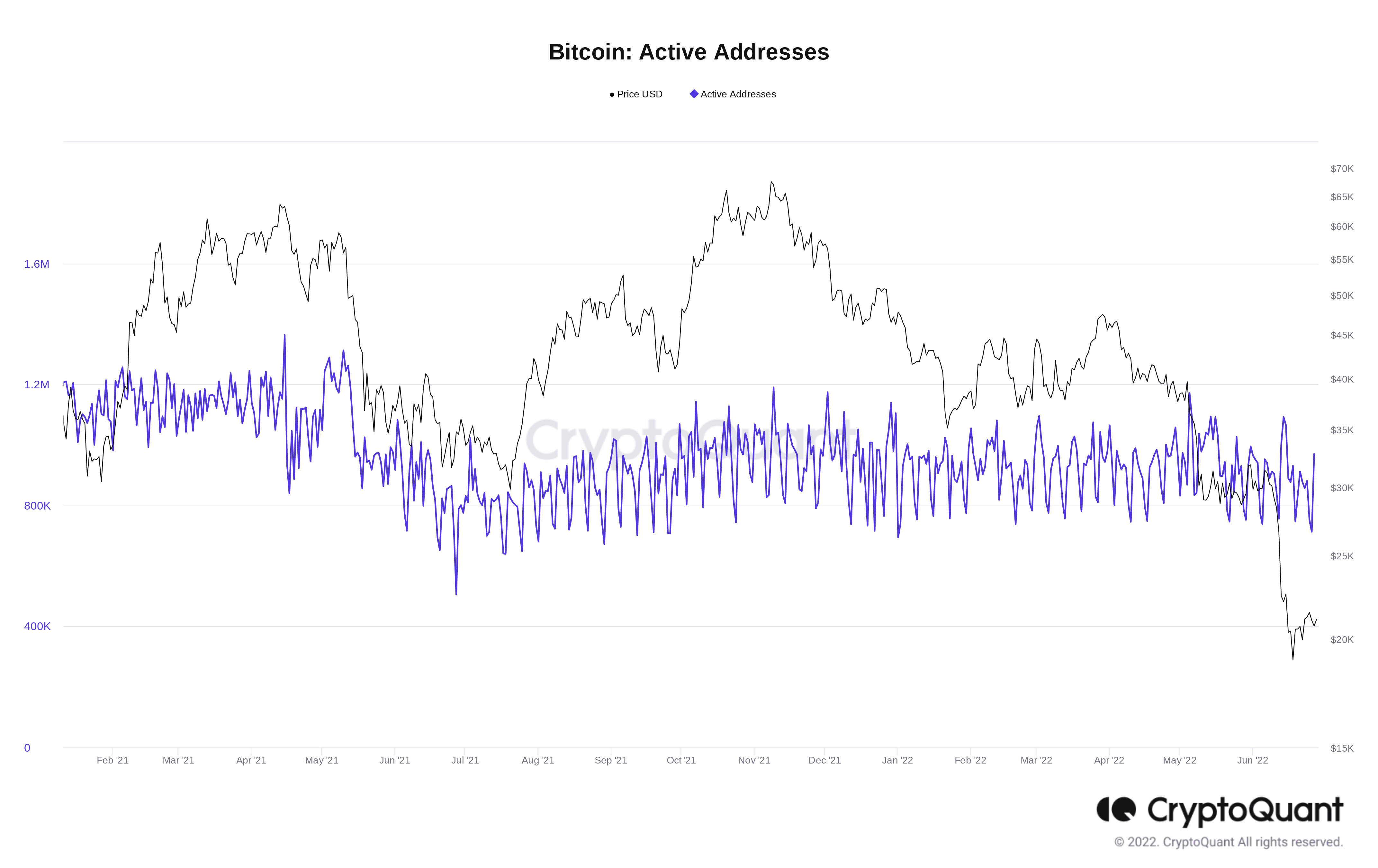

Active addresses

The July 2021 drawdown was accompanied by a slowdown in Bitcoin network activity.

Active addresses, as measured by on-chain analytics platform CryptoQuant, saw a noticeable drop through June last year before rebounding in line with price in Q3.

This time, no such dip has taken place, indicating that the market is more occupied in moving their BTC. This has a number of implications — hodlers may have become sellers due to low prices; traders may be seeking to profit from volatility; others may be looking to “buy the dip.”

It is worth noting, however, that overall on-chain volume remains low, and that means that buy-side support is likely insufficient to end the downward price trend, analysts argue.

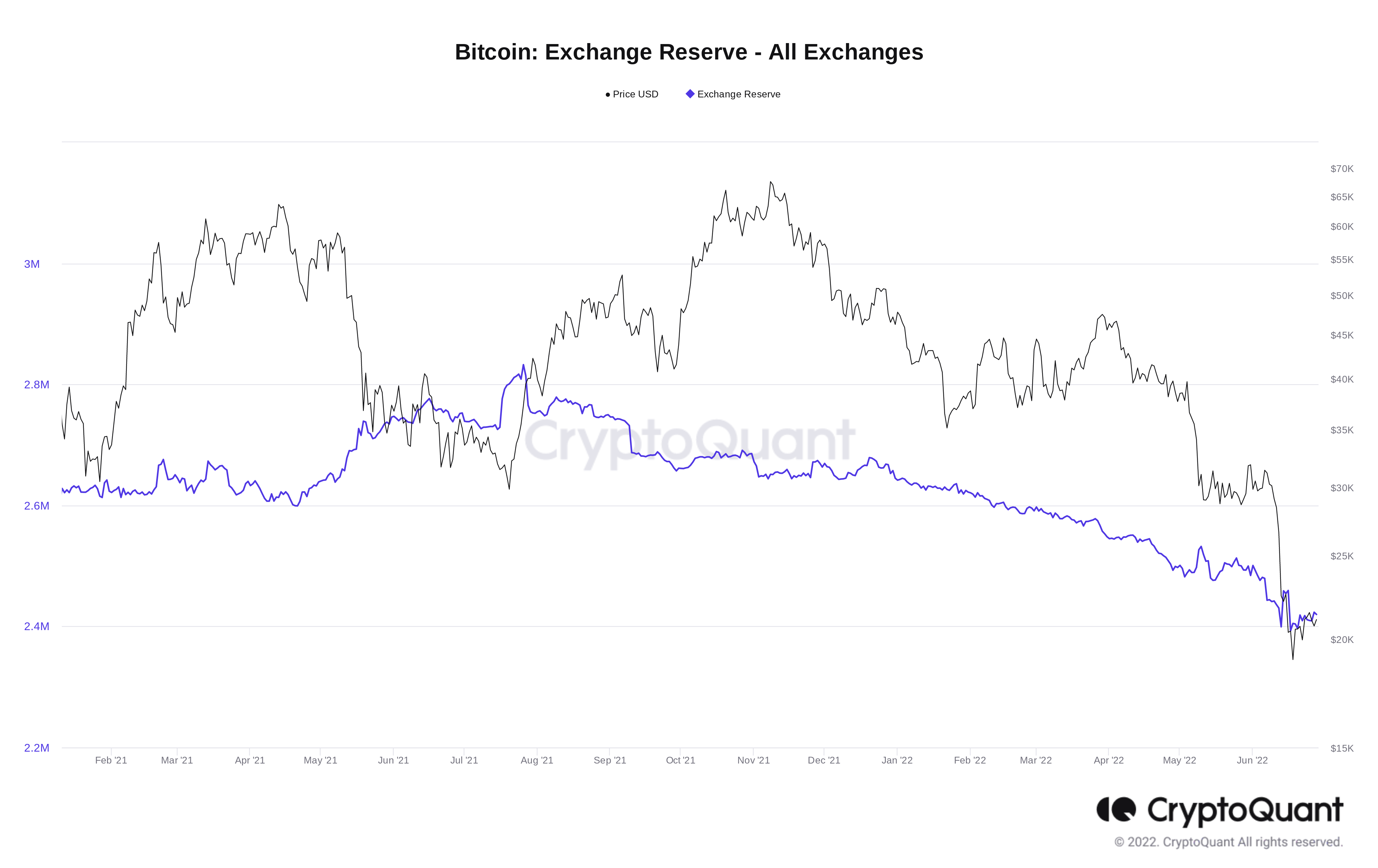

Exchange reserves

Finally, and despite the broadly lower volumes mentioned above, Bitcoin exchanges are losing coins around $20,000 — and fast.

Related: These 3 metrics suggest the Bitcoin price crash is not over

Normally, price collapses trigger inflows to exchanges as panicking traders prepare to sell or short. This time, it would appear, really is different in that respect, as exchange users are removing coins from accounts, not loading up.

21 major exchanges tracked by CryptoQuant currently have a balance of 2.419 million BTC, down from 2.544 million at the start of Q2.

Exchange reserves last year conversely rose throughout the Q2 downtrend, only resuming their own drop as BTC/USD recovered.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.