Ether’s price has been locked within a tight trading range spanning from $1,800 to $1,900 since July 21. This remarkable lack of volatility has instilled a sense of uncertainty and skepticism among investors, despite recent positive developments, which include the launch of PayPal’s Ethereum-based stablecoin and a surge in requests for Ether-based exchange-traded funds (ETFs).

PayPal’s entrance into the world of cryptocurrencies could signify a major step toward mainstream adoption for Ethereum. However, this move also raises concerns about centralization and the potential loss of control over personal assets.

At the same time, the United States Securities and Exchange Commission has recently witnessed a surge in applications for Ether (ETH) ETFs, which mirrors a trend of major asset management firms seeking to establish spot Bitcoin (BTC) ETFs.

ETH’s drop in DApp deposits and active users is concerning

The Ethereum network is having problems because of high gas fees, which are the costs for transactions, including those done with smart contracts. For the past two months, the average transaction fee has been more than $4, which limited the demand for its decentralized apps (DApps).

There has been a noticeable decline in the total value locked (TVL) of deposits on the Ethereum network. This decrease marked the lowest TVL level observed over the past three years, as reported by DefiLlama.

While there may have been some shifts in this trend over the past week, the current scenario still reflects a substantial reduction in Ether deposits, specifically around 12.9 million, in contrast to the 14.75 million recorded three months ago.

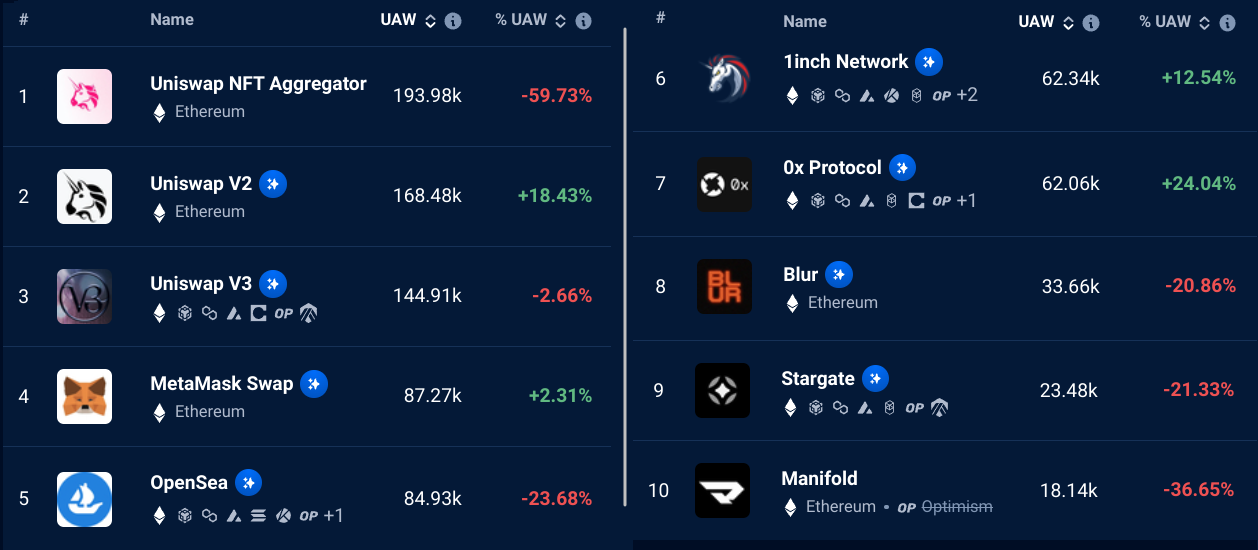

To ascertain whether the decline in Ethereum’s TVL correlates with a decline in its user base, investors should monitor the utilization of DApps. It’s important to note that certain DApps, such as gaming platforms and marketplaces, do not require substantial deposits.

The number of active addresses using DApps is down, which is concerning. In the last 30 days, the main DApps on Ethereum had 25% fewer active users. This might reflect that investors aren’t satisfied with how much it costs to transact on the network.

Examining Ether derivatives can help to figure out whether the $1,800 level could actually prove a reliable support level based on how ETH investors are positioned.

Derivatives metrics show balanced demand between bulls and bears

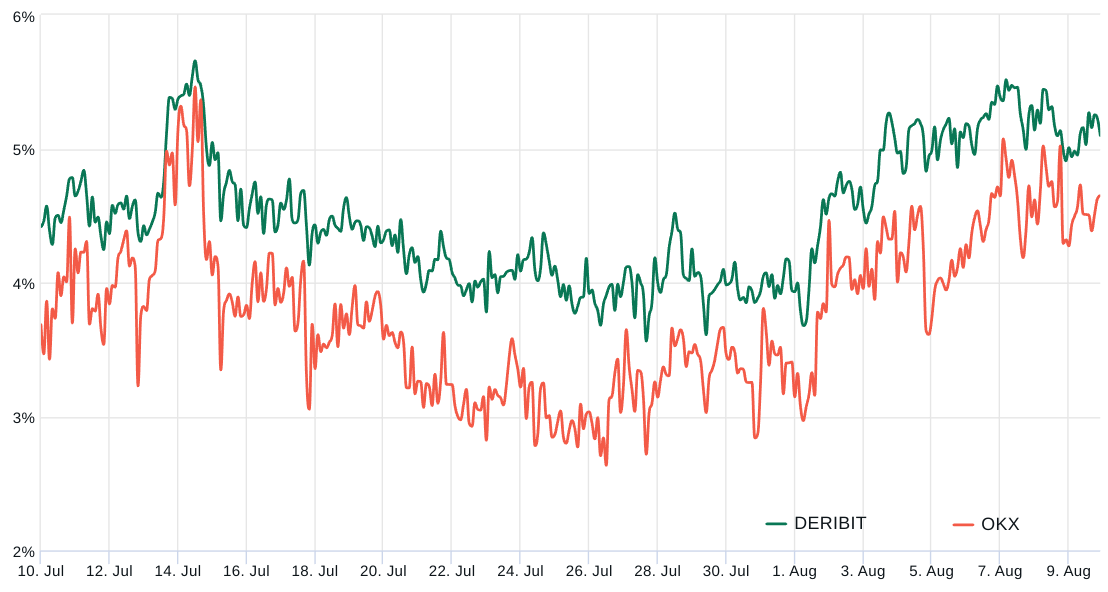

Ether quarterly futures are popular among whales and arbitrage desks. However, these fixed-month contracts typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement. As a result, ETH futures contracts in healthy markets should trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

As per the futures premium, also referred to as the basis indicator, professional traders in the Ether market have remained unable to adopt a bullish stance since July 16. The current level of 5% hovers on the brink of a neutral-to-bearish threshold, indicating a state of equilibrium in demand between leveraged long and short positions.

Related: NFT project y00ts to return $3M grant as it ditches Polygon for Ethereum

The unveiling of Coinbase’s Base network on Aug. 9 could contribute to Ether’s challenge of surpassing the $1,900 mark. Several development teams within the ecosystem have announced their offerings for the Base network, which presently incorporates a version of the decentralized exchange Uniswap.

While Ether’s bullish prospects are fueled by the potential approval of an ETF and the substantial user base facilitated by PayPal’s stablecoin, the network finds itself confronted by competition from existing smart contract platforms and challengers with ample resources. Such a scenario introduces an element of uncertainty surrounding the resilience of the $1,800 support level.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.