No one can blame Bitcoin (BTC) bulls for placing bets at $20,000 and higher for the $600 million weekly options expiry on Nov. 18. After all, this level had provided a solid resistance since Oct. 25 and held for almost two weeks.

However, the base scenario changed abruptly on Nov. 8 after a liquidity crisis halted withdrawals on the FTX exchange. The movement surprised traders and over a 48-hour timespan, over $290 million in leverage buyers were liquidated.

The market quickly adjusted to the news, ranging from $15,800 to $17,800 for the past seven days. At the moment, investors are afraid that contagion risks might force other key players to sell their cryptocurrency positions.

FTX held significant deposits from key industry players, so its demise meant other participants would also face substantial losses. For example, BlockFi held a $400 million credit line with FTX US. On Nov. 15, collateralized yield platform SALT disclosed significant losses from the FTX collapse and subsequently halted withdrawals.

Similar events happened at the Japanese cryptocurrency exchange Liquid, increasing the uncertainty level in the entire market.

The Nov. 18 options expiry is especially relevant because Bitcoin bears can secure a $120 million profit by suppressing BTC below $16,500.

Bulls placed their bets at $20,000 and higher

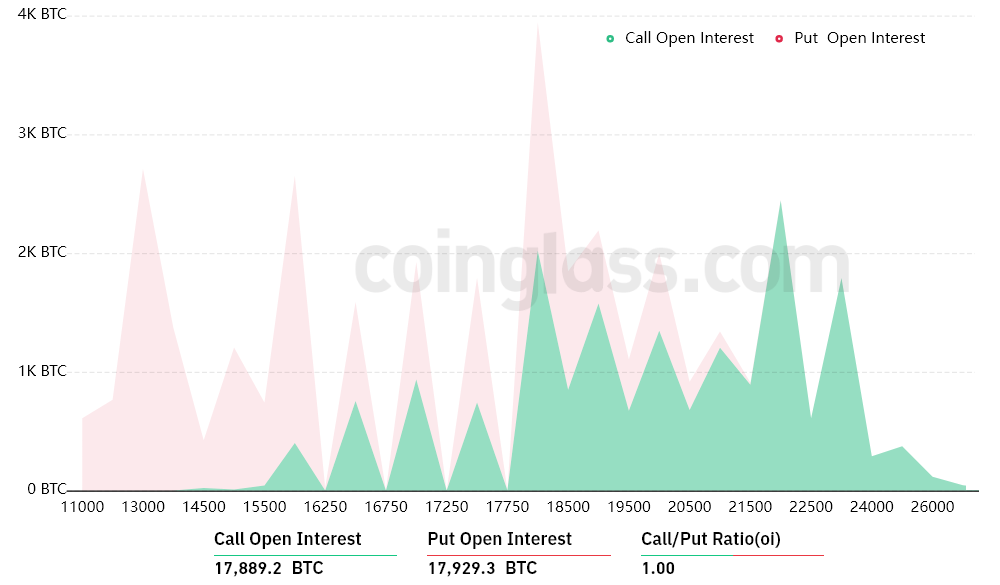

The open interest for the Nov. 18 weekly options expiry is $600 million, but the actual figure will be lower since bulls were overly-optimistic. These traders missed the mark, placing bearish bets at $18,000 and higher, while BTC was dumped following the FTX insolvency.

The 1.00 call-to-put ratio shows the perfect balance between the $300 million put (sell) open interest and the $300 million call (buy) options. Nevertheless, as Bitcoin stands near $16,500, most bullish bets will become worthless.

If Bitcoin’s price remains below $17,500 at 8:00 am UTC on Oct. 21, only 10% of these call (buy) options will be available. This difference happens because a right to buy Bitcoin at $18,000 or $19,000 is worthless if BTC trades below the expiry price.

Bulls need a pump above $18,000 to come out ahead

Below are the four most likely scenarios based on the current price action. The number of Bitcoin options contracts available on Nov. 18 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $15,500 and $16,500: 400 calls vs. 7,900 puts. The net result favors the put (bear) instruments by $120 million.

- Between $16,500 and $17,500: 1,700 calls vs. 6,100 puts. The net result favors the put (bear) instruments by $75 million.

- Between $17,500 and $18,000: 2,500 calls vs. 5,000 puts. The net result favors the put (bear) instruments by $45 million.

- Between $18,000 and $18,500: 4,500 calls vs. 3,100 puts. The net result favors the call (bull) instruments by $25 million.

This crude estimate considers the put options used in bearish bets and the call options exclusively in neutral-to-bullish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price, but unfortunately, there’s no easy way to estimate this effect.

Related: Bitcoin price dips to $16.4K over Genesis woes as execs defend GBTC

BTC price dips below $16,000 should not be surprising

Bitcoin bears need to push the price below $16,500 to secure a $120 million profit. The bulls’ best-case scenario requires a 10% pump above $18,000 to flip the tables and score a $25 million gain.

Considering that Bitcoin margin and options instruments show low confidence in regaining the $18,500 support, the most likely outcome for Friday’s expiry favors bears. Bulls might be better served by throwing in the towel and concentrating on the Nov. 25 monthly options expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.