Bitcoin miners make an invaluable contribution to the security of the hardest money known to man, but it’s a risky and challenging way to make a buck.

Between 5,000 and 10,000 Bitcoin miners operate across the world, ranging from solo miners to massive corporations. It takes an average of 12 years for a solo miner to find a block — meaning they do it for love and the lottery-like chance of striking big.

Some organizations operate hundreds of thousands of Antminers.

To earn a living wage from Bitcoin mining, you’ll need to operate “between 200 and 1,000 machines depending on your electricity costs,” according to analyst General Kenobi from Demand Pool. The world’s largest miner, Marathon Digital, operates 385,000 machines and has a hashrate of 57 exahash per second.

Bit Digital was a smaller operation, running a fleet of miners that peaked at 2.43 EH/s in September last year. But in June, the company decided to shut down mining operations entirely. Now, it’s the fourth-largest corporate holder of Ethereum.

CEO Sam Tabar tells Magazine there were many reasons it decided to move on from Bitcoin mining:

“This is a business where your profits are guaranteed to be cut in half every four years, the hashrate difficulty will continue to go up as more and more people are mining, and you cannot predict where the Bitcoin mining [return] is going to be, so you can’t take debt responsibly, and you have to obliterate all your equity shareholders just to raise capital to buy the latest generation of machines,” he says.

“That is a remarkably shitty business.”

Bitcoiners might be tempted to write Tabar’s comments off as the salty tears of an unsuccessful miner. But Bit Digital has had plenty of success. The firm started up an AI infrastructure business called WhiteFiber in 2023, shortly after the launch of ChatGPT. It now has $100 million in annual revenue; it raised $183.3 million when it was spun out of Bit Digital to list on the Nasdaq in August.

Also read: Bitcoin mining industry ‘going to be dead in 2 years’ — Bit Digital CEO

Bitcoin mining problem No. 1: Jurisdiction

The search for cheap power led Bit Digital to establish its entire fleet in the Chinese province of Sichuan. With 1,400 rivers, the region has an abundance of hydroelectric power. Costs fall to just a cent per kWh during the wetter months.

But Tabar believed that a ban on Bitcoin mining in China was a looming “existential threat,” and so he undertook the “logistical nightmare” of moving tens of thousands of machines to North America during the COVID-19 pandemic.

“Everybody thought we were crazy, and we were very unpopular doing that, and (that) it was really stupid. Everybody said, ‘Oh, you’re going to lose so much money getting these machines offline and migrating into North America and paying higher electricity.’”

Six months later, China banned Bitcoin mining entirely. Tabar rushed the remaining one-third of the machines to the nearest port and got them out of the country, too.

“All our friends who had their machines in China were fucked,” Tabar notes.

The EU considered (but voted against) banning Bitcoin mining in 2022. In June this year, the government of Norway announced it would temporarily ban proof-of-work mining from Autumn onward. The country accounts for 1.6% of the global hashrate, making it the largest mining hub in Europe.

Bitcoin mining problem No.2: Constant, expensive upgrades

To keep up with the ever-increasing hashrate and mining difficulty (which recently hit an all-time high of 134.7 trillion), miners must constantly upgrade to more efficient machines.

“The machines have to be updated every few months because each generation of machine is more efficient and because the hashrate continues to go up if you don’t have that efficiency, you can’t mine Bitcoin profitably,” he says.

This is extraordinarily expensive. It costs “multiple millions and millions of dollars,” Tabar says. But failing to do so is not an option; older equipment quickly becomes “very expensive paperweights.”

Bitcoin mining problem No. 3: Debt kills miners

Normally, a business would borrow for large capital expenditure such as the purchase of new mining equipment, and then pay it back over time from the expected profits. But due to Bitcoin’s price volatility, Tabar says it’s impossible to work out how to service the debt responsibly.

“You cannot predict your future cash flows in Bitcoin mining because you don’t know where Bitcoin is going to be,” he says.

“So a lot of people who borrowed […] that ended in tears. They went poof, a lot of them.”

Read also

Bitcoin mining problem No. 4: The halving halves profits

In theory, miners seeing their profits halve every four years shouldn’t be a problem as long as the Bitcoin price doubles, right?

That doesn’t take into account surviving the lag before that happens — or the risk that it won’t double this time around.

Kenobi explains that each halving event sees the exit of less profitable miners, while those who stick with it are often driven by “religious faith that Bitcoin will provide.”

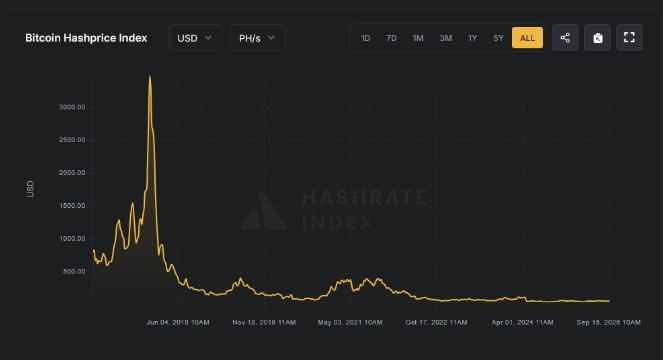

But he also points out that “dollars per day per terahash” is trending down over time due to increasing hashrate and mining efficiency. That means smaller miners are being forced out, leading to increasing centralization among big players.

Tabar says the economics no longer stack up.

“Okay, sure, the Bitcoin mining price goes up. But what a lot of people didn’t understand was that… the difficulty to mine Bitcoin was harder and harder. And the price did not compensate for the hashrate difficulty.”

Bitcoin mining problem No. 5: Diluting shareholders

Bit Digital’s policy was to avoid borrowing money. As a publicly listed miner, the only other route to finance the acquisition of new equipment was to raise capital by issuing more shares.

“We have to basically dilute our existing shareholders….and buy new machines. And you have to do this constantly,” he says. “Basically, obliterating all the shareholders because you’re just diluting them to oblivion.”

Bitcoin mining problem No. 6: Nobody can get an edge

Tabar argues there’s no way for Bitcoin miners to really differentiate themselves and gain an edge over other miners. That means there’s no way to mine smarter or more efficiently outside of buying better equipment, and there’s no barrier to entry for newcomers.

“Anybody overnight can build a Bitcoin mining company. It just requires capital. That’s not a business you really differentiate yourself in.”

Read also

Bitcoin mining problem No. 7: Pools take up to 10% of the profits

Bitcoin mining pools began to emerge in late 2010. The system gradually evolved into FPPS (Full Pay Per Share), the most common way to run a pool today.

Under FPPS, the pools pay miners for the amount of hashpower they contribute, regardless of how many blocks the pool finds. While this delivers Bitcoin miners consistent and dependable cash flow, it requires pools to front miners the money, meaning they need to either keep large reserves or borrow money to pay miners during periods when the pool finds fewer blocks than usual.

Kenobi says that pools claim to have low fees of 0.5 to 2% but hidden fees and bad exchange rates push the rate closer to 10%.

Kenobi is the head of business development for Demand Pool, which aims to be the “first Stratum v2 only Bitcoin mining pool.” Created by Alejandro De La Torre, who also founded BTC.com and Poolin, it simply pays miners a share of the actual profits, which cuts down on costs.

Kenobi argues that the pool’s efficiency gains and lower fees enable miners to make up to “15% more” profits than with a big centralized pool.

The future of Bitcoin mining

In part one of this series, Tabar argued that the commercial mining industry would not be able to survivethe combination of the next halving and nation-states moving in to mine Bitcoin with free power.

Kenobi, meanwhile, believes that commercial mining companies face a big threat from electricity companies mining Bitcoin with surplus power, and to help them stabilise the grid.

Neither prediction is guaranteed, but with profit margins growing tighter, even Bitcoin’s most ardent supporters can see increased risks of mining centralization.

The ongoing health and decentralization of the Bitcoin network are extremely important because, as Kenobi points out, Bitcoiners are attempting to create a new monetary system for the next century.

“Miners are being paid to participate in a revolution, you know, in a peaceful revolution,” he says.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with more than 25 years experience, who has been covering cryptocurrency since 2018. He spent a decade working for News Corp Australia, first as a film journalist with The Advertiser in Adelaide, then as Deputy Editor and entertainment writer in Melbourne for the nationally syndicated entertainment lift-outs Hit and Switched on, published in the Herald-Sun, Daily Telegraph and Courier Mail.

His work saw him cover the Oscars and Golden Globes and interview some of the world’s biggest stars including Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Prior to that he worked as a journalist with Melbourne Weekly Magazine and The Melbourne Times where he won FCN Best Feature Story twice. His freelance work has been published by CNN International, Independent Reserve, Escape and Adventure.com.

He holds a degree in Journalism from RMIT and a Bachelor of Letters from the University of Melbourne. His portfolio includes ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.