Bakkt, a regulated platform for crypto asset custody and trading owned by Intercontinental Exchange, has reported record daily trading volumes for its physically-settled Bitcoin (BTC) futures contracts.

On September 16, Bakkt announced that more than $200 million worth of BTC contracts had been traded over a single day — breaking its previous record by 36%.

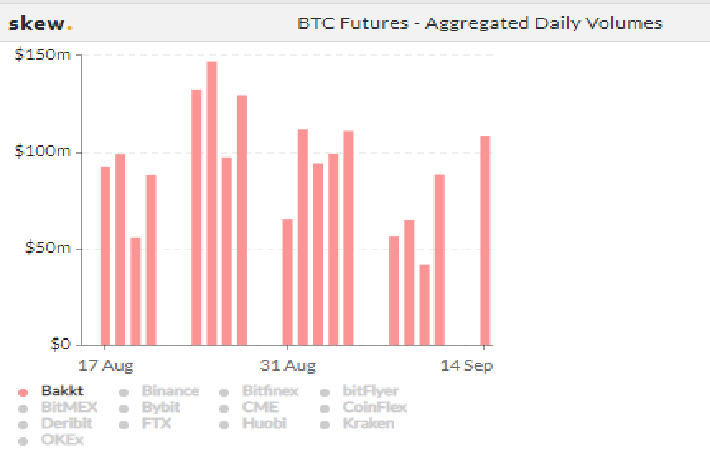

According to crypto market data aggregator Skew, the record figure is roughly double the average daily volumes posted throughout September so far.

Despite being touted as the likely catalyst for an institutional-led bull market, Bakkt’s Bitcoin derivatives failed to meet the expected impact — seeing sustained periods of complete inactivity during January of this year. However, the steady increase in volume recently enjoyed by the platform suggests that institutions are now warming to it.

A point of difference for Bakkt’s contracts is they are supposedly ‘physically settled’ in Bitcoin rather than cash. However, analysts have highlighted that most contracts traded on Bakkt are rolled over — with only a minority of traders opting to receive Bitcoin when the contracts expire.

Despite the new all-time high, Bakkt’s volumes pale in comparison to the trade activity on the largest cryptocurrency exchanges. Over the past 24 hours, Binance’s BTC-USDT perpetual contract — a futures contracts with no expiry or settlement date — drove $2.65 billion in trade, while the exchange’s 74 futures pairings pushed $5.96 billion collectively.

Huobi’s 103 futures pairings generated $5.48 billion in trade over the past 24 hours, including $1.28 billion from the platform’s BTC-USD perpetual contract. OKEx’s BTC-USD perpetual contracts saw $516 million worth of trading today, with the exchange’s 466 futures pairings driving $2.72 billion in total.

However, Bakkt beat out Derebit today, with Derebit’s BTC-USD contract generating $168 in 24-hour volume.